SBICB Hyderabad - Strategic Training Unit

स्टेट बैंक स्टाफ कॉलेज

STATE BANK STAFF COLLEGE, HYDERABAD

About Us

Training in State Bank of India traces its origins to 1961 at State Bank Staff College in Hyderabad. For more than half a century, this Apex Training Institute has been the starting point for a stellar career for numerous batches of officers. This Institute has evolved with the changing trends in the industry and the training needs of generations of State Bankers, who have raised the bar for SBI and the banking industry.

The Banking and Finance industry is changing rapidly, bringing in its wake, new challenges in a customer-centric domain, altering the traditional approaches to bank marketing and client relationships. It is no longer the products that define customer stickiness, as the process of banking itself has seen an upheaval, resulting in a paradigm shift in customer interactions.

The significant changes in the ‘customer era’ of the banking industry have impacted the traditional classroom training, transforming it into an immersive and learning experience, leveraged on the platform of new methodologies enabled by technological innovation.

SBSC has been a pioneer in adapting itself to current market trends and management thought, by refining training content and delivery towards a more meaningful learning experience, especially in the domain of consumer banking, in addition to customizing programs to suit the needs of participating institutions in diverse areas of banking.

The cherished belief of the Institute which is ISO 21001:2018 compliant, continues to be ‘learn-teach-learn’, where the faculty learn as much as the participants during a program interaction. SBSC boasts of a team of qualified, accomplished, and experienced Faculty, fully competent to lead participants into the ‘Consumer Era’ of banking.

Shri Satyabrata Mohapatra, (CGM & Director, State Bank Staff College)

Shri Satyabrata Mohapatra is a distinguished banking professional with 33 years long career in various assignments. He currently holds the esteemed position of General Manager & Director at the State Bank Staff College in Hyderabad. With a robust academic background and extensive expertise in Retail Business, Subisdiary Business, Research and Training system, Shri Mohapatra has excelled in diverse leadership roles at State Bank Of India. His strategic acumen and unwavering commitment to excellence make him a highly valuable asset not only to the bank but also to the entire banking industry.

Management Team - The Director, SBSC is supported by a Management Team comprising of DGMs :

Shri Rajiv Seraphim, joined SBI as a Probationary Officer in 1997. In his 28 years of service in the Bank, Shri Seraphim has worked in various capacities including Branch Manager and Regional Manager. He has rich experience in areas like Credit, IT and Forex. He has also worked in two assignments overseas, as AVP in Hong Kong and as VP & Manager in SBI (California). Shri Seraphim has also headed SBILD, Bengaluru as Director. Shri Seraphim is a graduate in Geology and has done CAIIB. He is a Moody’s CICC (Certification in Commercial Credit) professional. His other interests are reading fiction and listening to music. Shri Seraphim worked as AGM & Faculty in SBIL Kolkata and is currently posted at State Bank Staff College as DGM (Research & Admin)

M. Joseph Christy, a postgraduate in Commerce and MBA Finance., ICWAI (Inter) and CAIIB. Joined the bank in 1994 and was promoted as Trainee Officer in 2001. He worked in various branches in different capacities. He was a faculty at SBLD Nungambakkam, Chennai Circle and gained expertise in handling behavioral science sessions. Before joining SBSC he was a Regional Manager for the past 5 years. He has excelled in creating good teams wherever he worked and ensured excellent performance. His area of interest are listening to music and reading

Ms. Lalitha Rudrabhatla, DGM & Senior Faculty. With an illustrious career spanning 36 years in the banking sector, Ms Lalitha Rudrabhatla has established a reputation as a seasoned expert in General Banking, NRI Services, Forex Business, Medium and High Value Credit and Stressed Asset Recovery. Her diverse career spans roles across branch operations, regional leadership, corporate administration, and institutional marketing, blending operational expertise with strategic vision.

During her career, Ms Lalitha Rudrabhatla has served in diverse branch environments including high profile and specialized branches such as Air Force Academy, Dindigul, HITECH City Branch Madhapur, NRI Branch Hyderabad. These roles have honed her expertise in handling complex financial transactions and catering to the unique needs of niche clientele, such as Airforce, NRIs and high-net-worth individuals.

Her leadership as Regional Manager at Warangal was particularly impactful, overseeing a broad portfolio that encompassed agricultural, retail, SME banking. In this role, she demonstrated exceptional oversight of multiple branches, driving business growth and ensuring operational excellence.

At the corporate level as DGM (Branch Redesign and Network Management), she played a pivotal role in branch expansion and infrastructure development initiatives across the country. She contributed to the bank’s nationwide growth ensuring alignment with evolving industry trends and customer expectations.

She also undertook overseas assignment at Antwerp, Belgium that provided invaluable exposure to international banking, particularly in diamond exports, cross-border trade finance, and foreign exchange management.

Further enhancing her career, Ms Lalitha Rudrabhatla served as Deputy General Manager (Marketing) at SBIRD, Hyderabad, where she excelled in marketing, brand building, and capacity development. She curated and designed bespoke training programs tailored to the needs of private, cooperative, and public sector banks.

As a Senior Faculty member, Ms Lalitha Rudrabhatla brings a unique blend of practical banking experience and strategic marketing acumen.

Faculty at SBSC

Surya Prakasam, a Science graduate, joined the banking industry in 1988. He has a long experience of working in Branch operations, Retail & Corporate credit and specialization in SME business. He is an Associate Member of Indian Institute of Banking and Finance. His areas of expertise are MSME credit and Audit.

Parimal Kumar Jha joined SBI in 1998. He is an Economics (Honors) Graduate and a Postgraduate in Labour and Social Welfare, and CAIIB. He has exposure of working in major centers like Delhi & Bengaluru. He is an expert in Retail Credit.

Deepak Kumar Choudhary has joined the bank as Probationary Officer in the year 2007. He holds Bachelor of Science (Chemistry) honours Degree. He has also completed various professional courses viz. MBA (Banking & Finance), CAIIB, Certified Documentary Credit Specialist, FRM Part I, Certified Anti Money Laundering Specialist, Certificate in Trade Advance, etc. His parent Circle is Chennai.

Apart from Chennai Circle, he has worked in Patna Circle, North East Circle and foreign Office (RBB Bahrain).

Under Credit Assignment, he has worked as CSO, Relationship Manager (Medium Enterprises), CM ( SME & Business Development), Chief Manager (SME intensive Branch) and AGM (CPC) handling high value SME Advances (Exposure greater than Rs. 10.00 Cr.).

Ms N V N M Kiranmayi, Chief Manager& Faculty joined in Bank as CRA in 2008 and has been promoted as Trainee Officer in 2011. She has done her graduation in Arts and completed CAIIB. She has done various courses from IIBF. She has worked in various capacities as RMPB, Branch Manager and CM RACC. Her hobbies include singing, dancing and listening to music.

Mukti Prakash Behera has completed his Executive PGPM from Xavier Institute of Management, Bhubaneswar and has to his credit an MBA degree from Pondicherry University. He is UGC – NET qualified and has completed his MPhil in Management from Ravenshaw University. He has to his credit 9 years of industry experience in the domain of Training & Service Delivery and has worked for companies of repute such as IBM, Reliance Telecom, FirstSource and STel Pvt Ltd.

Continuing his academic career, for the last 6 years, he has worked as Assistant Professor (Marketing Domain) in Srusti Academy of Management, CV Raman Group of Institutions and ICFAI Business School, delivering interactive sessions on Advanced Marketing Management, Consumer Behavior and Services Marketing to management graduates. His academic credentials also include publication of research articles, case studies and book chapters in prominent Journals. His forte is designing and delivering impactful marketing related course programs for bank officials.

Sunil Kumar, a Commerce graduate and also holding PGDBM (Finance), joined the Bank in 2007 as a Probationary Officer in Ahmedabad circle.

He has worked as CM Relationship Manager Real Estate (CM RMRE) handling residential builder Finance Portfolio for 3 years and Branch Manager for 3 years in a NON-BPR Semi Urban Branch handling, P, SME, Agri advances, Government Business & Currency Chest.

He has also worked in Global Markets, CC Mumbai for 4 years handling PMS desk handling investment banking activity in Debt Market securities on behalf of Retirement funds like EPFO, and SBI Pension, Provident & Gratuity Funds etc.

Krishnan Divakaran joined the bank as Probationary Officer on 08th May 2000. His educational qualification is B. Tech in Civil Engineering. The various assignments undertaken by him in the stint of past 22 years at various levels are Demat Operations, Dealer & Operations head in Doha-Qatar, and Branch Manager, SARC Officer, Crédit Officer at SME Branch. During his stint as CM & AGM, he had handled NPA Management at the LHO. Before Joining as faculty, he was working as AGM in RASMEC. His hobbies include listening to music & playing cricket

Dattatri V, a commerce graduate, joined the Bank in 1996 as cashier-cum-clerk and was promoted to the officer cadre in 2004 in Bangalore Circle. He has mainly worked in Operations. He was a Branch Head for 9 years in various branches handling PER, SME, Agri Advance, Government Business & Currency Chest at both BPR and NON-BPR Branches. He has worked more than four years in Currency Chest and Government Business Branches in two different branches. He has also worked in I S Security Department for three years and as Programmer cum Audit Processing Officer in CAO Chennai.

Rahul Sah has joined the bank as Probationary Officer in the year 2003. He is an Arts graduate. He has completed various professional courses viz. CAIIB, Certified Anti Money Laundering Specialist, Certificate Course in Foreign Exchange. His parent Circle is Bhopal Circle where he has performed in various roles viz Credit, Forex. He has also worked in Foreign Office at Retail Branch, Bahrain as Credit Analyst.

He has almost 10 years of experience working in the IB domain both in the administrative setup as CM (IB-Circle) as well as an operational functionary in branches dealing in NRI banking, B category Trade & Forex branch. Further, during his last tenure, he was handling high value SME and REH advances in an SME Intensive branch.

Shri Himanshu Gaur Chief Manager (Faculty) joined as Probationary Officer in 2009 in Lucknow Circle, he is Bachelor in Science and also did MBA in Marketing from NIILM,CMS New Delhi . He has been Branch Manager for Last 5 years and has been in operational domain for 12 years . He has worked and has rich knowledge in Retail Credit and Branch Management . He has completed CAIIB and has done Certifications in BM Advanced ,Retail Credit and Customer Service .

Anurag Tiwari is an Arts Graduate, joined the Bank (e-SBP) as Clerk-cum-Typist in 1994 and became a Trainee Officer in 2001. He has worked in different capacities as Field Officer, Branch Manager (6 years), Chief Manager (Sanctions) at Retail Assets and Credit Processing Centre, and Chief Manager (Sales & Business Development). His area of interest is RE & Retail credit. His hobbies are watching cricket and comedy shows.

Ms, Deepa Balakrishnan is a Chief Manager (Faculty) joined the Bank as Probationary Officer in the year 2007. She is a Post graduate in Commerce, completed her CAIIB and also complete multiple certifications from IIBF. She has experience in banking operations, Retail Credit, SME Credit and Foreign Exchange and also worked as Branch Manager. Her Hobbies includes Reading, Writing, Gardening and Painting.

Shri Vishnu Venkata Shivaraju joined the Bank in the year 1998. His qualifications include B.Com, and CAIIB. He has done certifications offered by IIBF in Forex and Financial Risk. During his tenure, he has handled leadership roles in Marketing, Retail Credit, and Corporate Credit apart from handling branches and after that, he joined SBSC in the role of Faculty in Retail /SME Credit. He has a rich flair for facilitating Customer Orientation in executives at the front line. His experience in MSME domain gives him expertise in dealing with Credit portfolios, and an ability to impart marketing skills and help in credit risk identification to the executives. His hobbies include reading and gardening.

Shri Abhinav Agrawal, CM (Faculty), joined the Bank in the year 2010 and has a Degree in Master of Computer Application. He has rich experience in Branch Management and has headed the Rural and Semi-Urban branches of SBI in Ahemdabad and Delhi Circle. His interest and expertise are in the areas of Branch Management and Audit. His hobbies are playing cricket and writing poems.

Ms Jyotsana Sharma, Chief Manager and faculty, joined the bank as Probationary officer in 2011.She has been graduated in Bachelor of Engineering (Instrumentations and controls) from Pune university. She has completed CAIIB from IIBF. She has worked in different capacities in operations uptil now as field officer in non BPR branch and Branch Manager for 6 years in Mumbai metro. she has been appreciated and awarded for outstanding performance in exceptional growth in CASA, excellent growth in advances and PBBU business, TBU campaigns, customer value enhancement business by GM and CGM of Mumbai metro circle. She has also been honored by MD (SBI Mutual fund) for outstanding performance in Mutual fund business growth. Her flair for reading and writing has given her an opportunity in staff college.

Amit Singh joined the Bank as a Probationary Officer.

His professional qualification includes Master of Arts in English Literature and he has to his credit CAIIB along with further certifications in MSME, Trade Finance, Foreign Exchange, AML & KYC by IIBF and Moody’s Certification in Commercial Credit (CICC).

Has rich experience of about 14 years in banking operations and credit. His assignments include RACC Head, Branch Head and Manager RCC &CC, LPC, FO/Credit Officer (SME)

RSG. Prakash, Chief Manager & Faculty, at State Bank Staff College, Hyderabad, holds a master’s degree in Business Administration (MBA) in Finance from Osmania University, Hyderabad. He has gained 25 years of experience having worked in various roles holding diverse assignments as Branch Manager in Personal and SME focussed branches, government business and Home Loan processing centres. He has good exposure in Retail loan. Mr Prakash has worked and has significant understanding about government business and is experienced hand in government related transactions. To his resume adds another successful role as HR Manager of a module.

Debasish Joshi, a commerce graduate and also a degree in Master in Business Administration (MBA), has joined the bank as probationary officer in the year 2006. Besides, he has completed various professional courses like CAIIB, Certify Treasury Professional and Risk Management and various NISM certification programs. He has a long experience as a branch head and dealer in treasury. He has also worked in Global markets, CC Mumbai as a Forex dealer. His area of expertise is retails credit, Marketing & Treasury.

Research Officers

Mr. Bahadur Singh has joined SBI in 2011 as Probationary Officer in Lucknow Circle. He is a postgraduate in Business Economics. He has rich experience of more than 5 years as Branch Head. He also has exposure in the Retail Credit, MSME and Audit & Compliance function.

Rupinder Kaur Sodhi joined SBI in 2009 and has specialization in Mathematics. She completed her Masters in business administration in Finance and marketing with operational experience in Retail credit and NRI business.

Amit Kumar joined bank as a probationer in 2012. He completed his schooling at Catholic Mission School and earned an engineering degree from Institute of Information Technology & Management, Gwalior. To strengthen his professional expertise, he completed several certifications such as a CAIIB, Certified Treasury Professional (IIBF), Commercial Credit

(Moody's), Credit Risk, Operational Risk, Mid and Large Corporate Lending, MSME & Working Capital Lending from CRISIL and Risk in Financial services (CISI London & IIBF). He has extensive experience in banking operations, SME, and Corporate credit and has good understanding of Risk Management.

Dr. Suja Sekhar C is an FPM (equivalent to PhD) in Finance and Accounting from Indian Institute of Management, Tiruchirappalli. She is a Gold Medalist in MSc. Physics and has completed CAIIB, PG Diploma in Wealth Management and Diploma in International Banking and Finance from IIBF. Her academic interests are in Banking, Corporate Finance, Emerging Economies and Sustainability. Her email id is suja.sekhar@sbi.co.in.

Programmes Offered

Webinar Courses Offered Through MS Teams

| Who should attend : |

|---|

| Employees of all organisations |

| Programme Overview : |

| COVID-19 initially put a pause on activities and slowly forced activity to come to a standstill. There is a plethora of information circulating on Social Media. There is increasing uncertainty amongst people and employees on what to believe and what not to believe.

- Designed with a view to educate participants on various aspects, DOs & DON’Ts and precautions to be followed - Provides inputs on how to deal with the Mental Stress arising out of prolonged anxiety in an uncertain situation and be Emotionally stable |

| Programme Objectives : |

|

- To acquaint participants with information on COVID-19 - To give inputs on Mental preparedness to live and work in this pandemic situation - To help participants work on Emotional Stability to ensure against attrition / drop in productivity - To help improve preparedness of employees in calamitous situations |

| Learning Methodology : |

|

- One day programme, 3 hours - Interactive Webinar – PPT led instruction, Activity, Video, Quiz |

Online Webseries Offered Through MS Teams

“There is only one Boss – The Customer”

| Who should attend : |

|---|

|

- Relationship Managers - Officers handling retail business |

| Programme Overview : |

|

- More than half the loan portfolio of all banking institutions is geared towards the retail customer - The programme intends to guide participants through an individual’s life journey and his banking needs - Participants are introduced to core marketing concepts, customer onboarding, due diligence and managing customer relationships |

| Programme Objectives : |

|

- To provide practical insights into branch banking products - To acquaint/ reacquaint participants with marketing concepts - To provide and understanding of the difference between product marketing and service marketing - To enable an insight into how to leverage on marketing capabilities for enhancing business potential |

| Learning Methodology : |

|

- 4-day programme - 8 Interactive webinars of 60 minutes each - PPT led instruction, Caselets, Activity, Video, Quiz, Assignments |

Online Webseries Offered Through MS Teams

“Marketing is about building relationships”

| Who should attend : |

|---|

|

- Relationship Managers - Officers handling Corporate / SME clients |

| Programme Overview : |

|

- Starts with providing an understanding of the unique perspective of Corporate Clients and value proposition thereof for creating a value-based relationship - Delves into the environmental factors, i.e., the macro and micro variables that affect the client’s business and how analysing the Need, Want and Demand of corporate clients is crucial in terms of value proposition vis-à-vis banking products - Discusses how to achieve a Client Centric Culture to leverage corporate banking products for a mutually valued outcome - Deliberates on techniques to achieve sustainable client relationship marketing and re-orienting relevant skills of Selling, Negotiation and Persuasion for successful client management |

| Programme Objectives : |

|

- To provide inputs for Acquisition of new customers - To enable relationship managers to realise value in relevant marketing concepts and practices - To provide skills on how services and solutions can be delivered in alignment with the client’s objectives and key strategies |

| Learning Methodology : |

|

- 4-day programme - 8 Interactive webinars of 60 minutes each - PPT led instruction, Caselets, Activity, Video, Quiz, Assignments |

Online Webseries Offered Through MS Teams

“Understanding the Gold Mine”

| Who should attend : |

|---|

|

- Field Officers, Branch Managers, Retail Credit Officers |

| Programme Overview : |

|

- The programme aims at providing an understanding of the borrowing needs of retail clients. - Goes beyond the traditional retail asset products like housing, education and personal loans by also enabling participants to learn how to help customers choose the most appropriate financial solution - Will guide participants to understand not only the Customer Life Cycle but also to develop sensitivity towards anticipating the family needs of a customer - Will provide insights on how to generate leads and convert them into business - The regulatory environment and safeguards for complying with institutional policies are discussed in-depth using a series of inter-connected caselets and situational analyses |

| Programme Objectives : |

|

- Specific focus on borrowing requirements of individuals - How to leverage on marketing capabilities for enhancing business potential - Strategic planning and skill development |

| Learning Methodology : |

|

- 4-day programme - 8 Interactive webinar sessions of 60 minutes each - PPT led instruction, Caselets, Videos, Quiz and Assignments |

Online Webseries Offered Through MS Teams

“Give your Customers more than they expect”

| Who should attend : |

|---|

|

- Officers interacting with Customers |

| Programme Overview : |

|

- There is a paradigm shift in doing business from focusing on customer satisfaction, delight and ecstasy, to simply designing the entire company around the customer. - Competition is shifting from the institution’s perspective to the customer’s perspective, thereby making a meaningful contribution to meet customer needs and requirements. - The Customer Life Journey needs to be the focus of institutional goals for the institution to become truly customer-centric business. - With discussions on physical ambience to emotional connect, the programme moves from customer service through experience to co-creating customer lifetime value. - The programme commences with the challenges & opportunities in retail banking and how understanding the customer Life Cycle helps in enriching the customer journey. - The programme also provides perspectives on how to actualise Customer-Centricity in an organisation, by deliberating upon the need of a customer-centric approach vis-à-vis Customer-Centric Banking model. |

| Programme Objectives : |

|

- Understanding customer journey to evolve strategy, keeping the customer centre-stage - Importance of exceptional customer service – applying techniques for better customer engagement |

| Learning Methodology : |

|

- 3-day programme - 6 Interactive webinars of 60 minutes each - PPT led instruction, Caselets, Activity, Video, Quiz, Assignments |

Online Webseries Offered Through MS Teams

“Understanding the Corporate Customer Journey”

| Who should attend : |

|---|

|

- Relationship Managers / Marketing Managers dealing with Corporate Clients - Officers handling Corporate Accounts |

| Programme Overview : |

|

Evolution of companies to meet changing business demands has brought about a paradigm shift in the way companies are managing their finance planning and operations. This has led to a drastic change in the corporate customer’s expectations from the bank : - The programme endeavours to develop a customer-centric way of doing business that provides a positive client experience to drive repeat business, enhance client loyalty and improve business growth. - The programme commences with a discussion on re-aligning core capabilities of corporate banking with corporate client needs and demands - Focus is on the necessity for adapting to a client-centric culture and the communication process for value proposition & delivery - Deliberations on the need for customer centricity in corporate banking by enabling client-centric banking culture |

| Programme Objectives : |

|

- Understanding customer journey to evolve strategy, keeping the customer centre-stage - Understanding customer expectations - Developing a customer-centric mindset - Providing positive client experience, facilitating retention, Acquisition and Growth of Corporate customer |

| Learning Methodology : |

|

- 3-day programme - 6 Interactive webinars of 60 minutes each - PPT led instruction, Caselets, Activity, Video, Quiz, Assignments |

Online Webseries Offered Through MS Teams

“Abundant Precaution”

| Who should attend : |

|---|

|

- Field Officers, Branch Managers, Retail Credit Officers. - Middle Management officials of Banks and NBFCs involved in Retail lending |

| Programme Overview : |

|

Dealing with stressed assets is an area of concern for Financial Institutions. Documentation and creation of Security is vital in case legal recourse is to be resorted to. - The programme evaluates the steps involved in creation of security and the precautions to be ensured - Modalities involved in creation of security will be discussed threadbare to enable participants to apply in their workplace |

| Programme Objectives : |

|

- To equip banking executives about modes of creating charge on various securities that banks / financial institutions undertake while sanctioning Retail Loans - To equip the participants with the precautions to be taken while creating securities to avoid risk |

| Learning Methodology : |

|

- 2-day programme - 4 Interactive webinar sessions of 60 minutes each - PPT led instruction, Caselets, Videos, Quiz and Assignments |

Online Webseries Offered Through MS Teams

“Connecting the Dots and Dashes”

| Who should attend : |

|---|

|

- Officials dealing in Retail / SME loans. |

| Programme Overview : |

|

- Retail and SME lending is a critical area of business for Financial Institutions and the country due to its ability to spur consumption and create employment opportunities - Diligence in scrutiny and monitoring of the account, post lending, acquires increased importance due to multitude of lenders and the large number of small borrowers The programme delves into the challenges involved in finance to Retail and SME and also the risk mitigation efforts. Programme facilitates putting into action the maxim ‘Prevention is better than cure’ |

| Programme Objectives : |

|

- To help participants to hone their skills in pre / post sanction process - To enable participants to comprehend various concepts under retail loans - To reiterate the importance of effective follow-up, supervision and monitoring of advances |

| Learning Methodology : |

|

- 4-day programme - 8 Interactive webinar sessions of 60 minutes each - PPT led instruction, Caselets, Videos, Quiz and Assignments |

Nomination form

Please send enclosed nomination form by email to srfaculty1.sbsc@sbi.co.in or srfaculty2.sbsc@sbi.co.in by program enrolment due date.

Modes of Payment

- Through SBI Collect using the link :

https://www.onlinesbi.com/sbicollect - Through NEFT / RTGS :

Beneficiary : SBI Staff College Drawing Account

Account No. : 41225638523

Bank / Branch : State Bank of India, PBB Hyderabad Public School Branch, Hyderabad

IFSC Code: SBIN0002728 - Through SBI YONO :

Account no. : 41225638523

Bank / Branch : State Bank of India, PBB Hyderabad Public School Branch, Hyderabad

Tax Details :

- PAN No. : AAACS8577K

- GSTIN : 36AAACS8577K1ZQ

Discount :

- 10% for nominations of 5 or more per institution

Contact Us

DGM & Senior Faculty

Mob : 7094153001

Email : srfaculty1.sbsc@sbi.co.in

Location Map

6-3-1188, Begumpet Road, Hyderabad - 500 016. India.

Nearest landmark: ITC Kakatiya Hotel / Greenlands Guest House / Chief Minister's Camp Office

Contact Numbers :

Ph : +91 - 40 - 23423776 / 23406725

Contact by E-Mail : agmadmin.sbsc@sbi.co.in

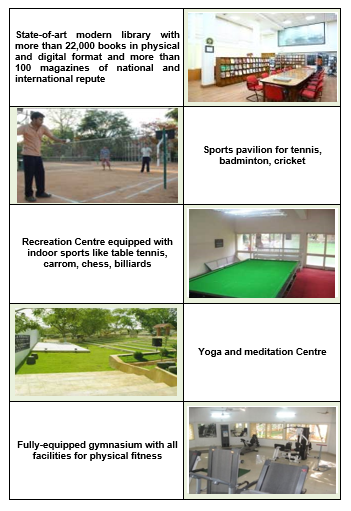

Infrastructure Facilities

Executive Block

Regular Block

Other Amenities

Participants' Voice

- "The campus environment is so welcoming, and the courses are well-designed and a real eye opener for an executive to handle the situations faced back home, in a structured manner."

- Senior Officer, PSB - "The quality, clarity and command over subject of each faculty is excellent. Many HR tools used to asses an individual is useful. Being a big brother of the Indian banking industry, it shows SBI is on top of the rest."

- Senior Officer, PSB - "The learning experience has been very good, and the back-home utility is achieved to a large extent."

- Senior Government Official - "Subject coverage is very relevant, and faculties are having very good subject knowledge. Sessions are very interactive. It is a very good learning experience for all of us."

- Senior Officer, PSB - "The program was very informative. It helped a lot in gaining a wide insight of the activities carried out by a commercial bank and would broaden our understanding of the same."

- Senior Officer, Apex Financial Institution - "It was an overwhelming experience. Learnt a lot over the past few weeks. This will let me take an informed decision of choosing banking."

- Senior Management Student

Interest Rates

6.00% p.a.

for loan amount up to Rs. 2 lacs

8.15% p.a.

for loan amount > Rs. 2 lacs up to Rs. 6 lacs

STU-Other-Product-Slider

Criteria

- Features

- Eligibility

- Terms and Conditions

Interest Rates

6.00% p.a.

for loan amount up to Rs. 2 lacs

8.15% p.a.

for loan amount > Rs. 2 lacs up to Rs. 6 lacs