How to Invest in Mutual Funds through YONO SBI App | Simple & Fast - Yono

Mutual Funds On YONO SBI — We Make Digital Investment Simpler, Faster, And Better

18 Apr, 2024

investments

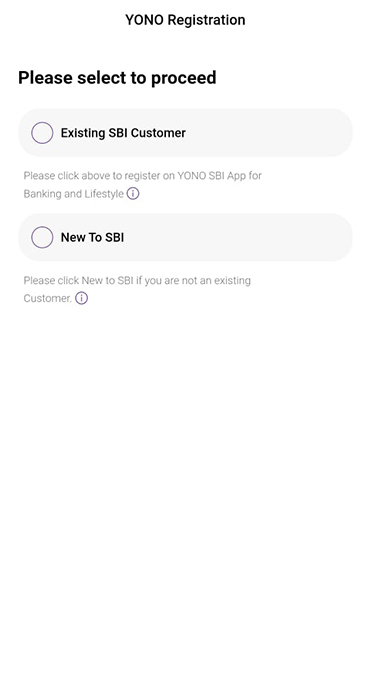

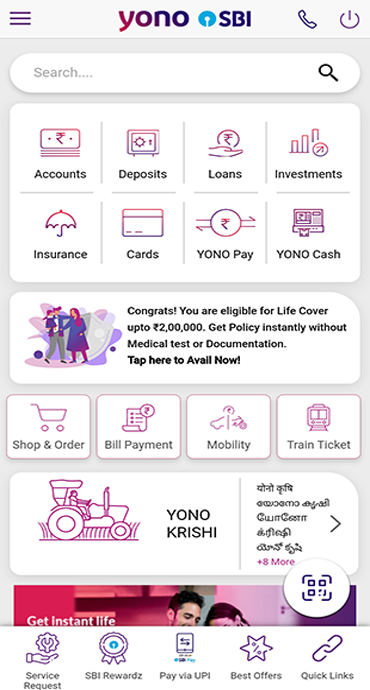

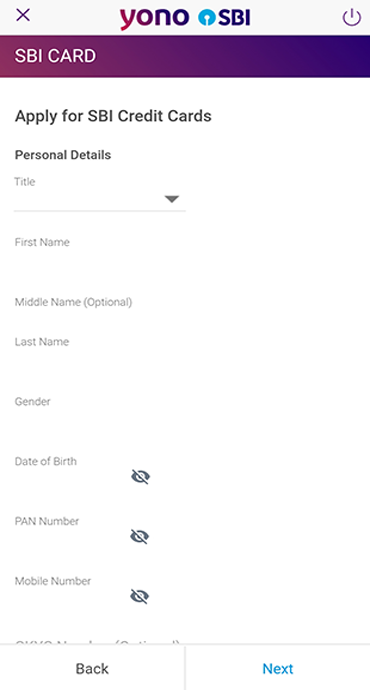

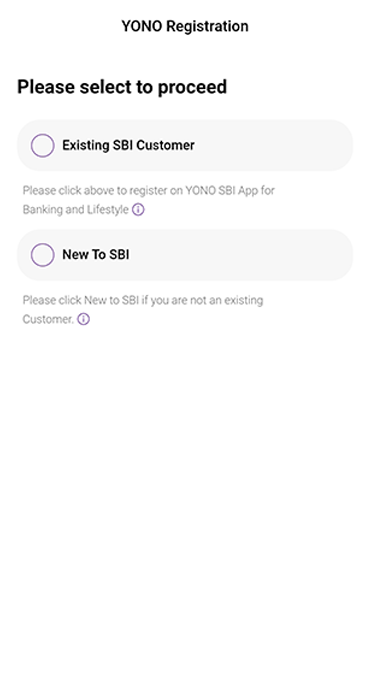

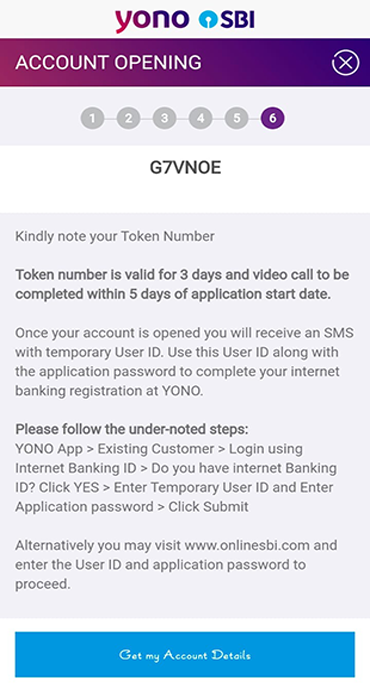

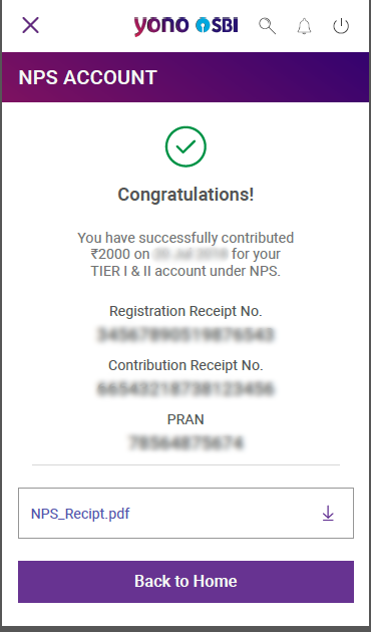

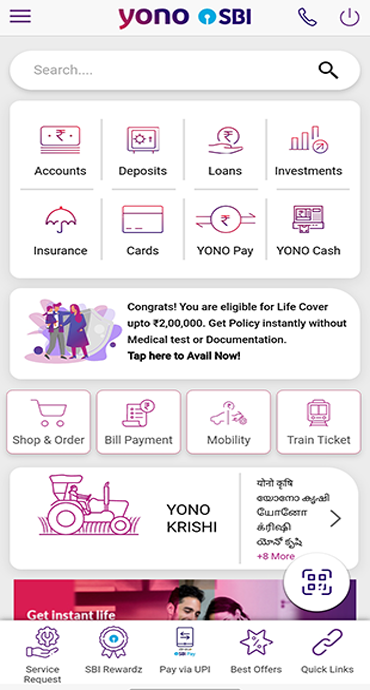

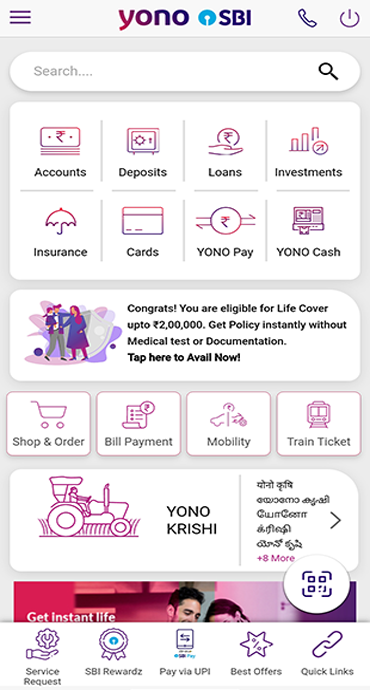

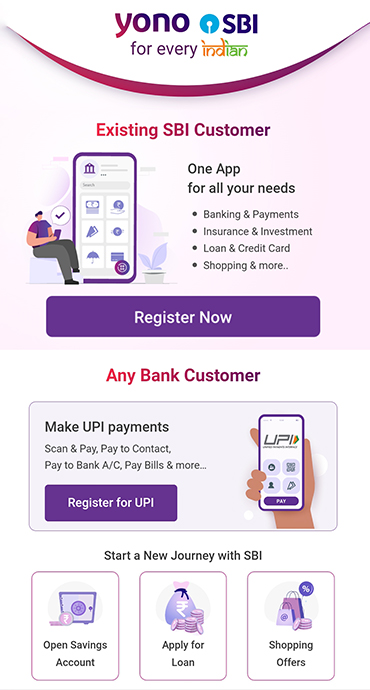

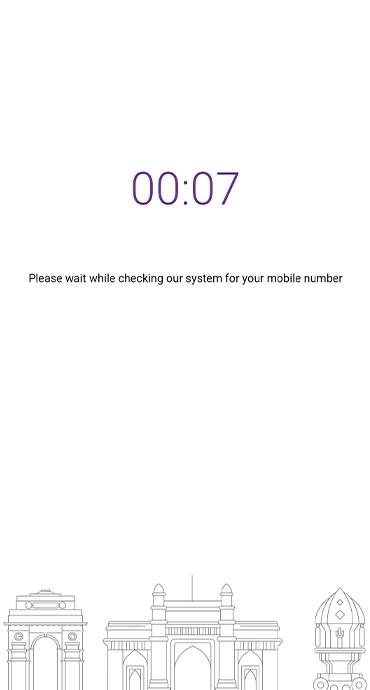

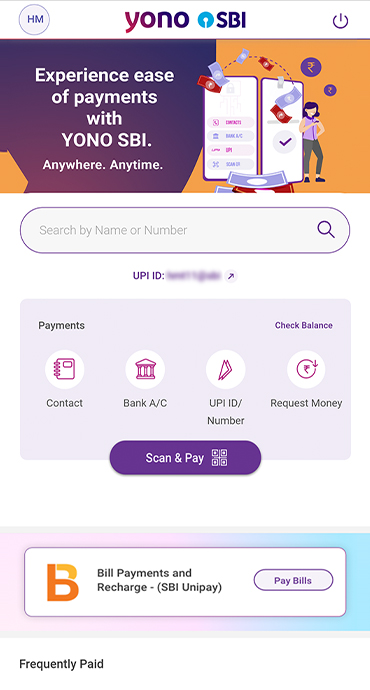

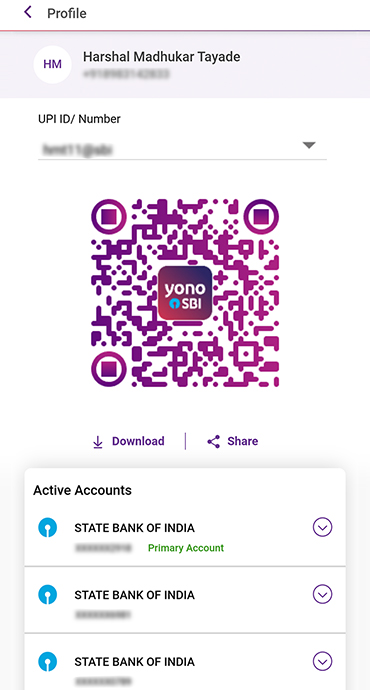

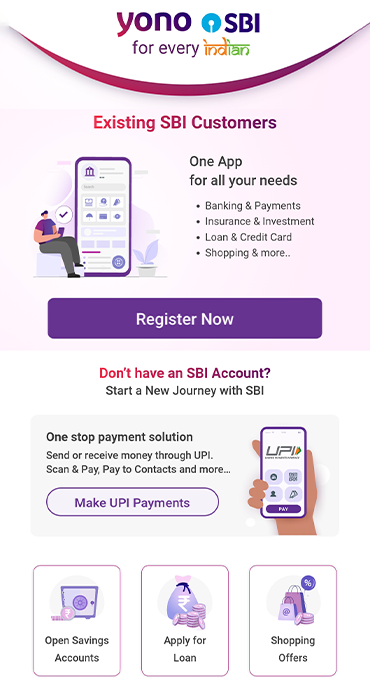

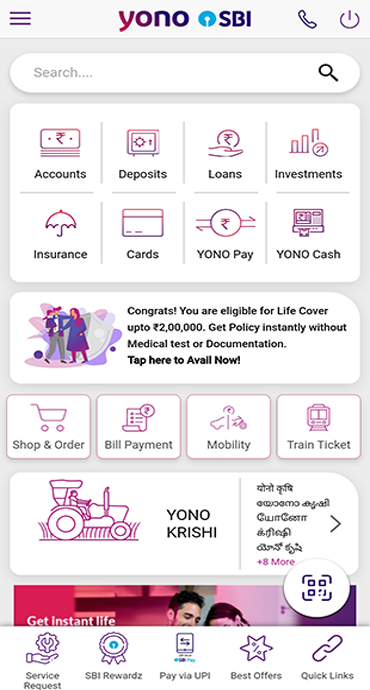

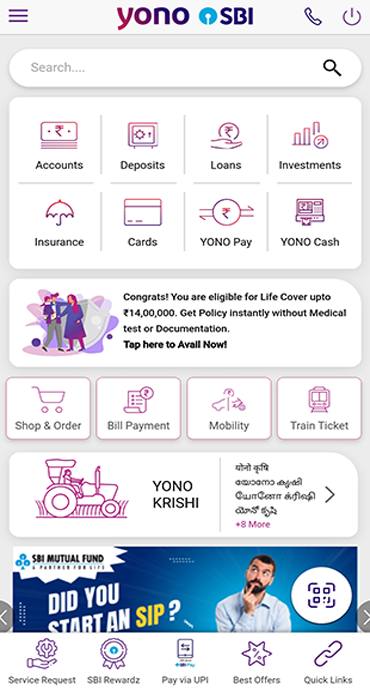

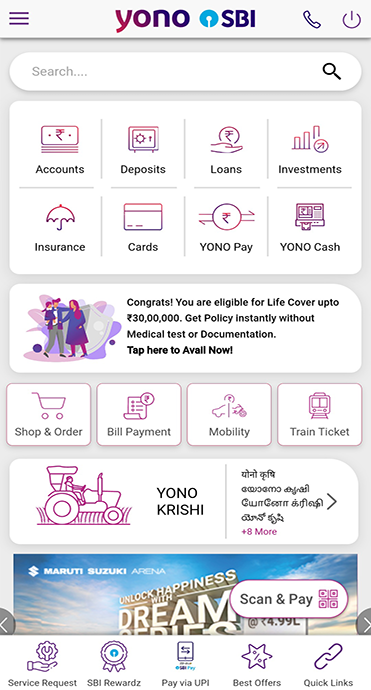

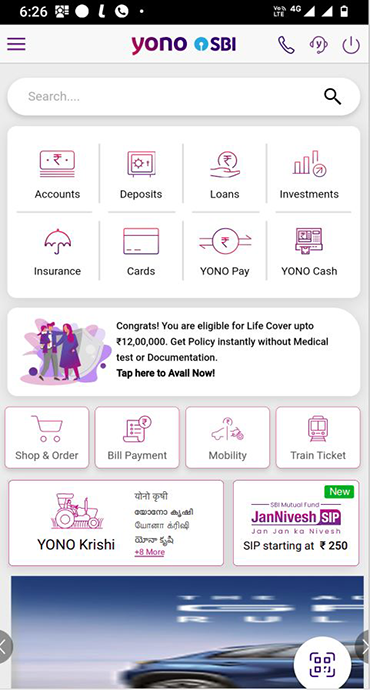

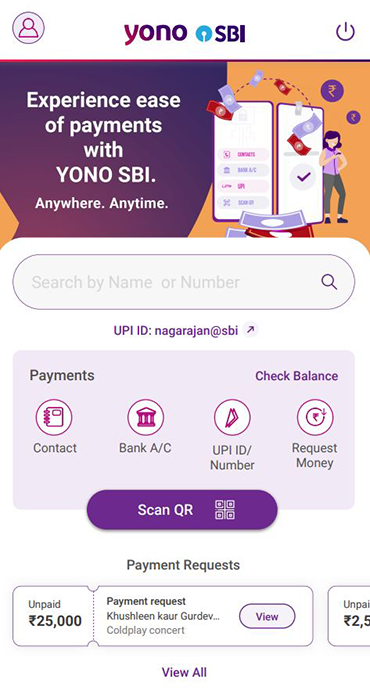

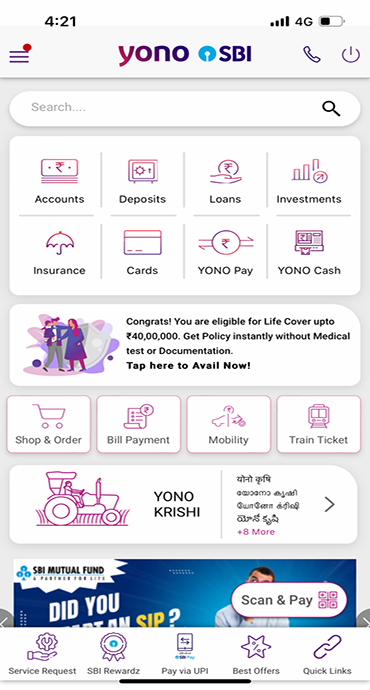

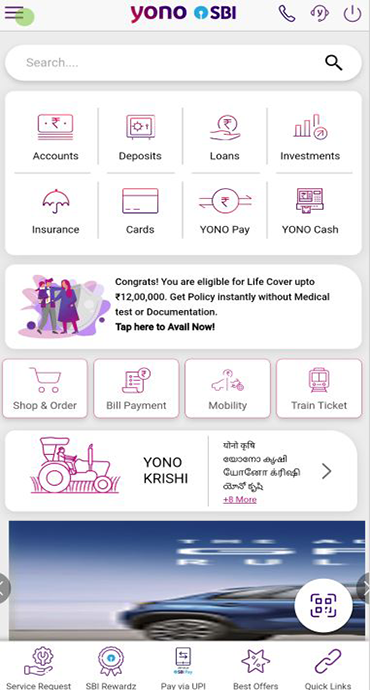

The YONO SBI App is a revolutionary platform for all those seeking a unified place to invest their surplus funds. From sleek interface to convenient navigation, YONO SBI has everything to make your digital mutual fund investment experience smoother than ever. So, start your systematic investment plan (SIP) and take your first step towards digital investment only on the YONO SBI app.

Be a Part of The Rapid Digitalization by Going Full ‘Digital’ On Your Mutual Funds Investments

Today’s fast-paced world is witnessing a revolutionary change in the financial landscape. More and more people now understand the importance of long-term savings, and mutual funds investment is the best roadmap to accomplish that.

When done systematically with prestigious institutions like ours, risk-taking does not become a concern for your investment plans. SBI Mutual Fund has emerged as a go-to option for millions of Indians planning to take that risk and take that one big step toward a financially stable future. Moreover, we make things simpler than ever with our digital investments.

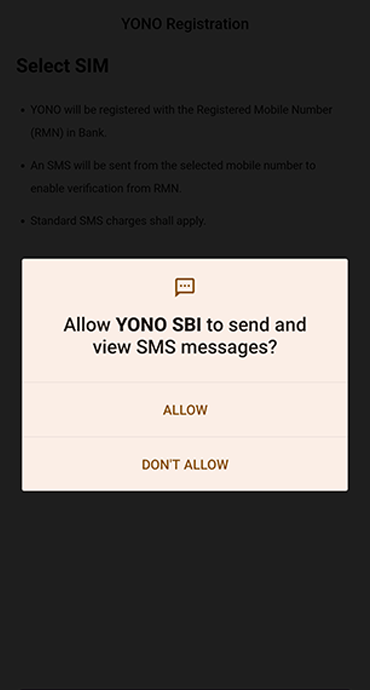

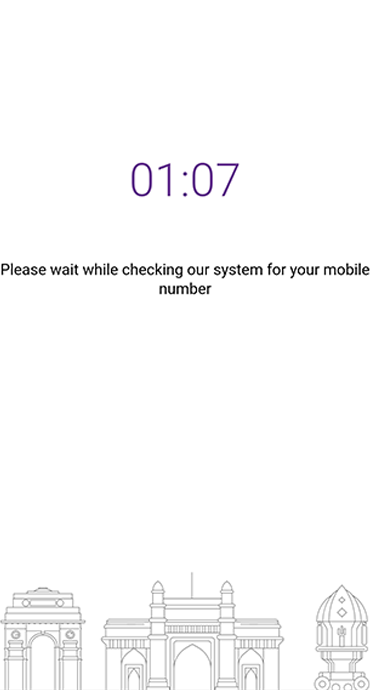

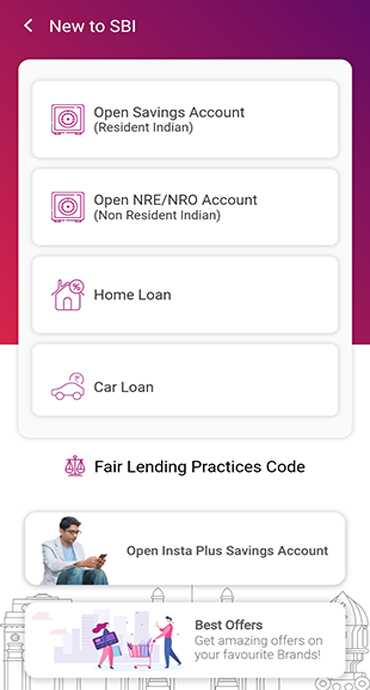

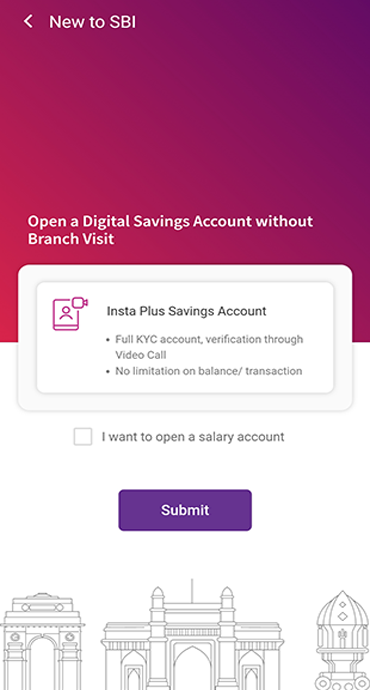

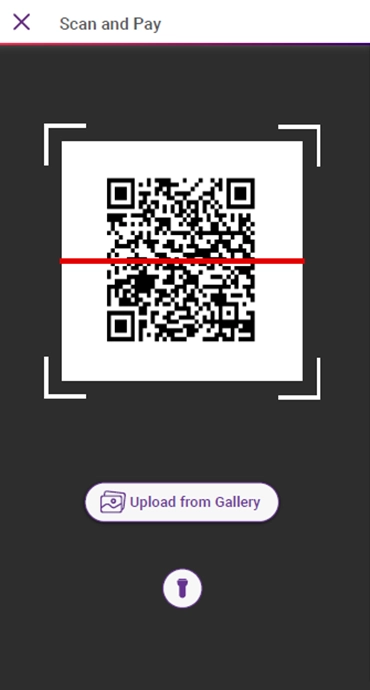

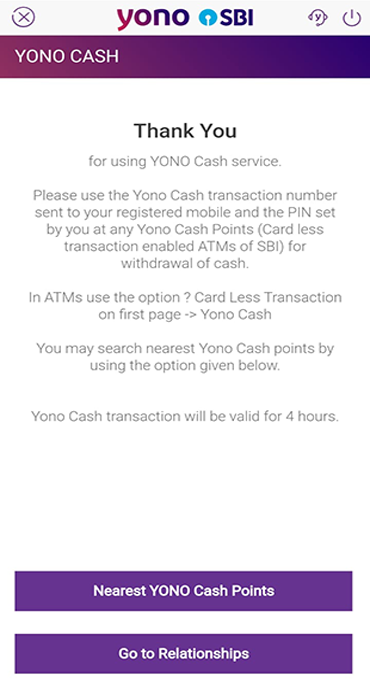

No more physical transactions as we strive to contribute to ‘Digital India’ and want our customers to go full ‘digital.’ Be a part of the rapid digitalization with SBI and invest your surplus funds across capital markets from the comfort of your home, office, or anywhere else. Simply download the YONO SBI app, select the mutual fund option, and start investing!

Our Mutual Fund Investment Services

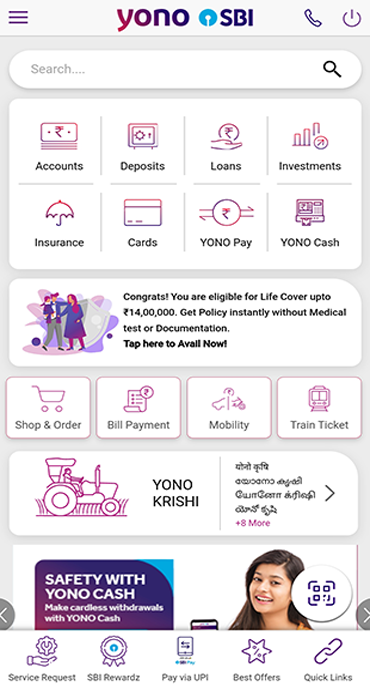

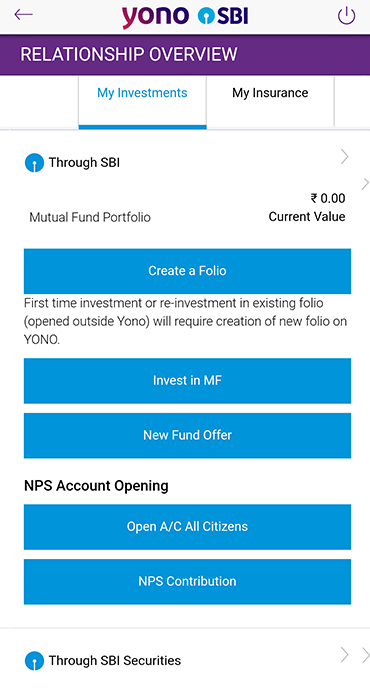

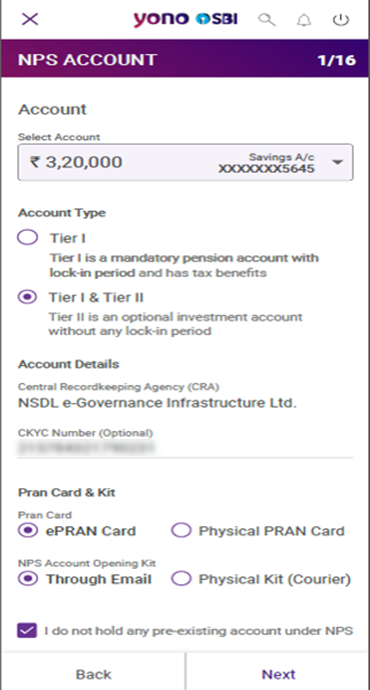

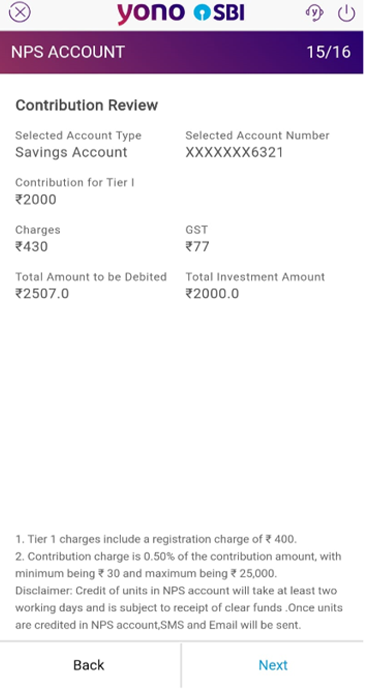

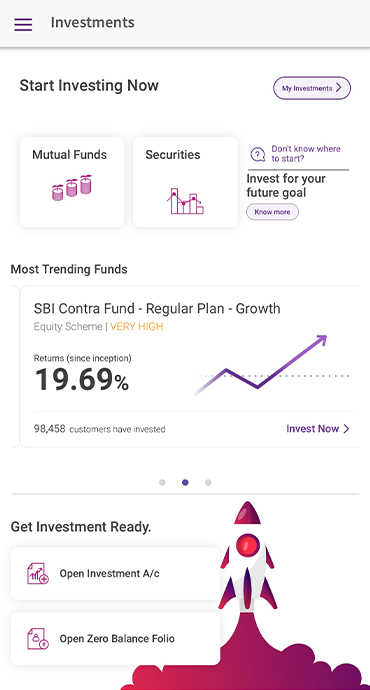

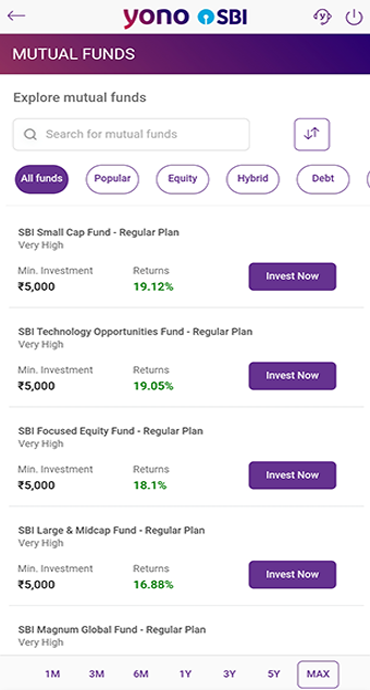

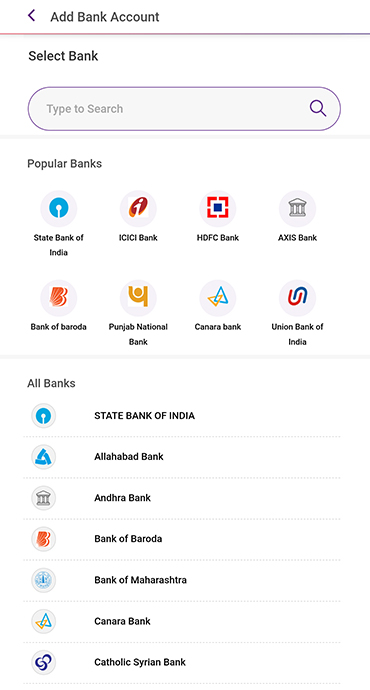

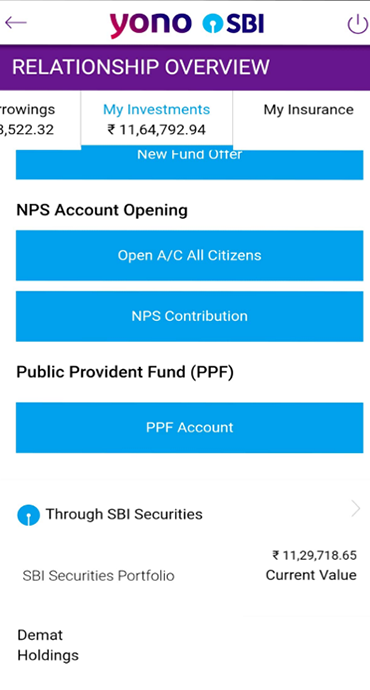

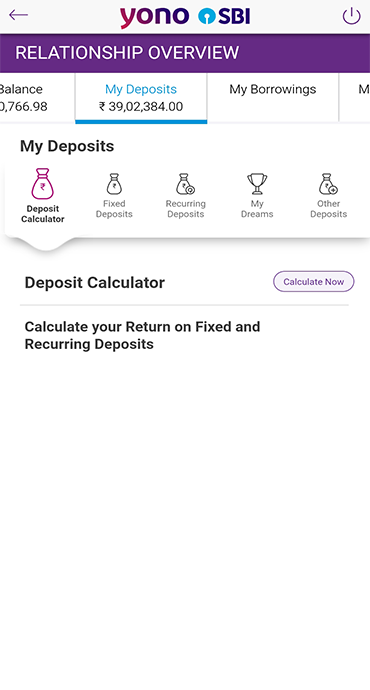

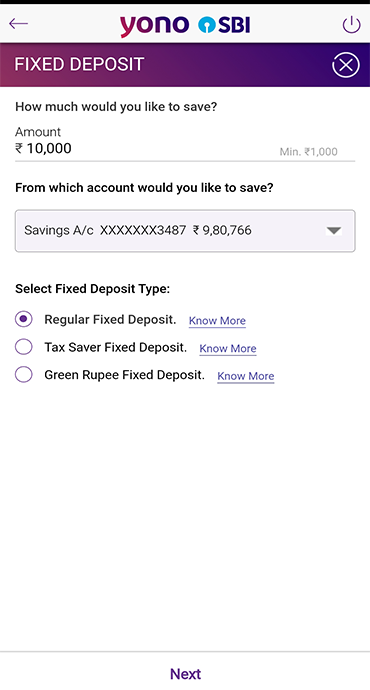

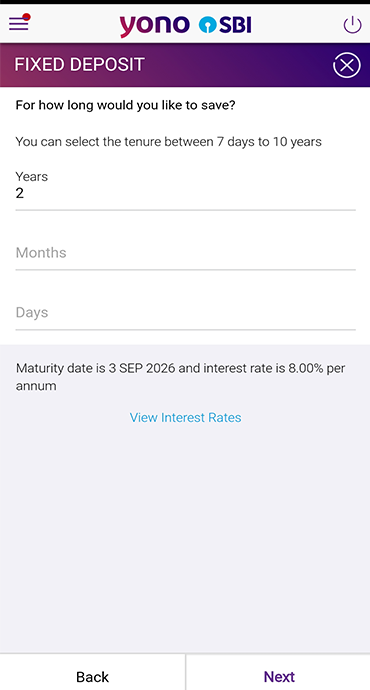

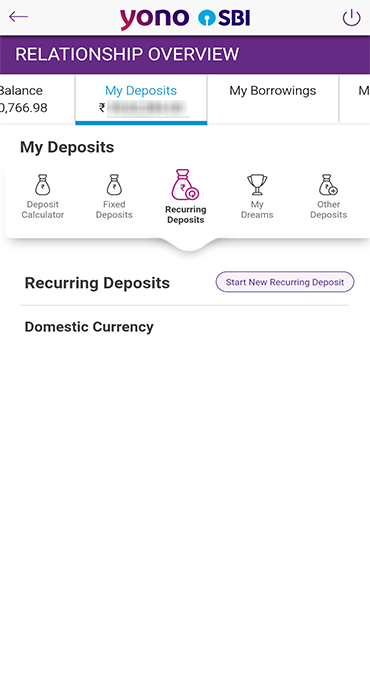

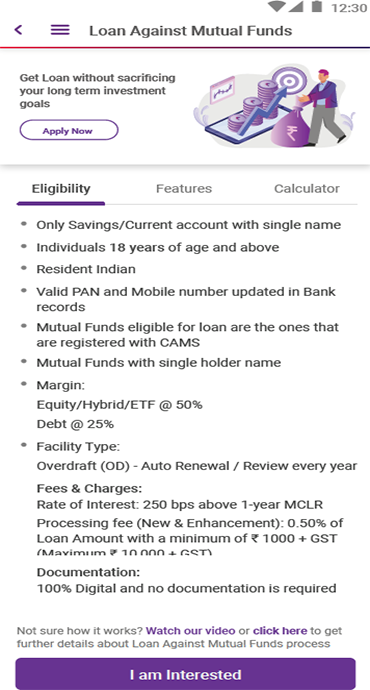

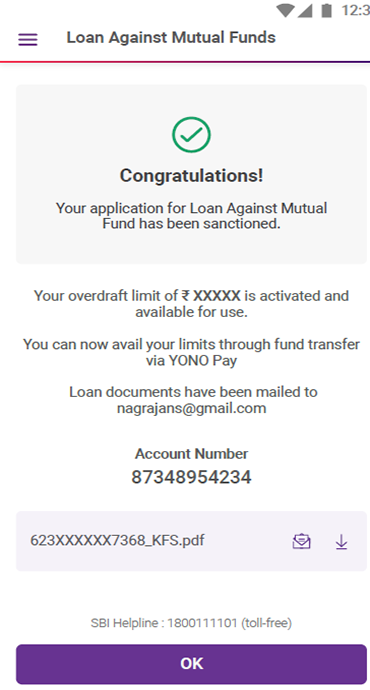

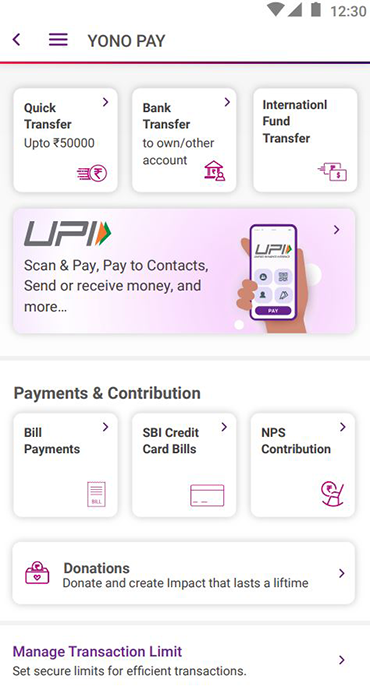

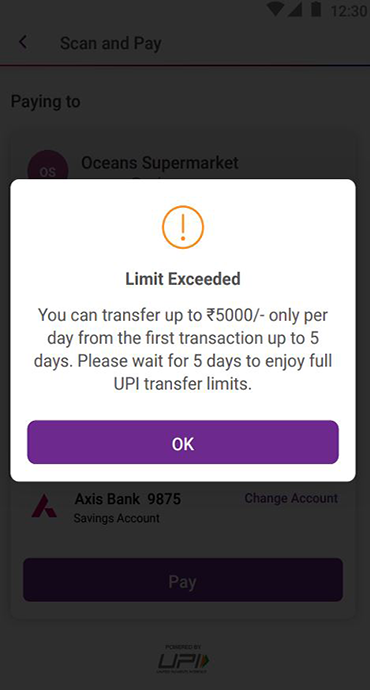

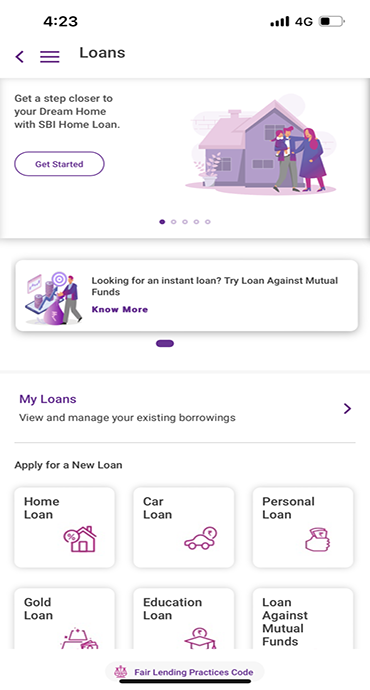

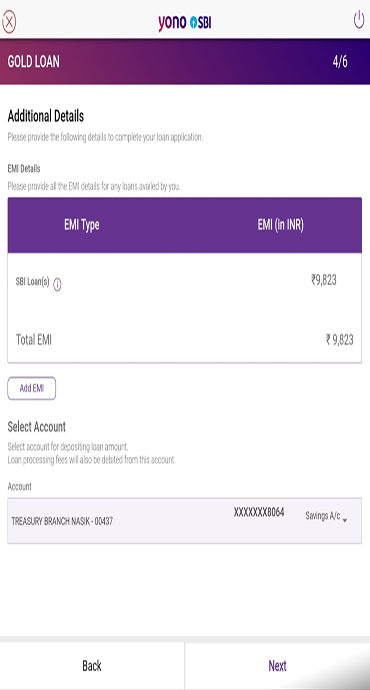

On YONO SBI, customers can leverage the power of digitalization to its fullest by making mutual fund investments with just a phone and an internet connection. YONO SBI simply takes the concept of ‘investment’ to a whole new level with services like this:

- Start investing in Mutual Funds within seconds with 'Zero Folio'

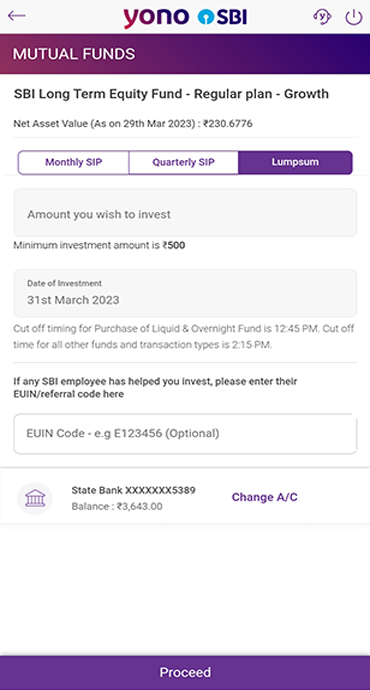

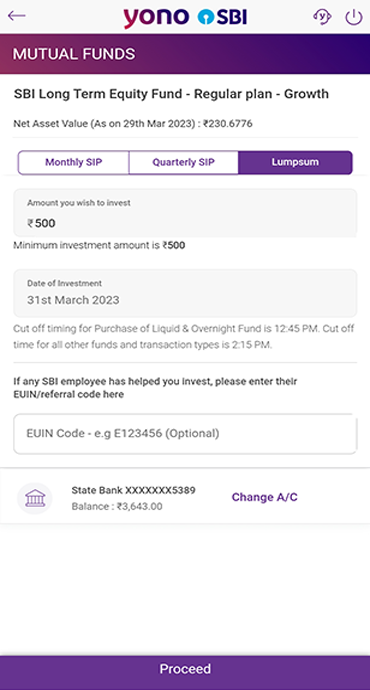

- Make your investment either in Lumpsum or in the form of SIP (Systematic Investment Plan)

- Withdrawal becomes simpler: Activate SWP (Systematic Withdrawal Plan) or simply make a redemption

- Activate STP (Systematic Transfer Plan) or switch to another scheme anytime you want

- Cannot continue SIP? Cancel the ongoing one with a few simple taps

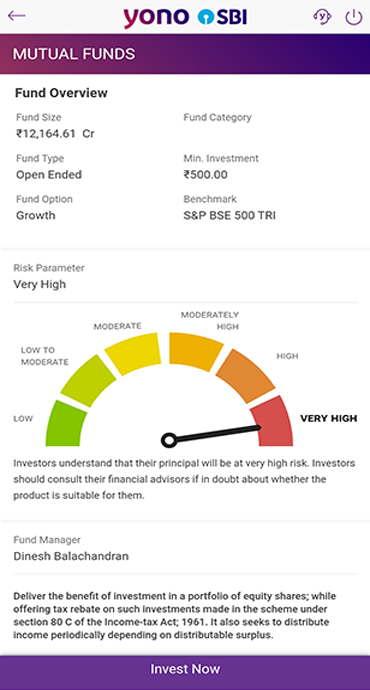

- Maximize investment opportunities: Give answers according to your risk tolerance and determine your Mutual Fund investment objective.

- Tracking and monitoring your Mutual Fund Portfolio becomes easier with YONO SBI.

- No matter the time, track your folio details, NAV value, investment category, scheme name, and current investment value.

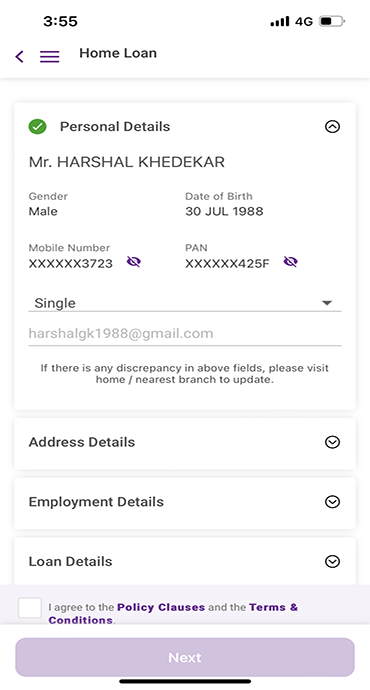

- YONO SBI also facilitates quick and simple KYC status checks as well as updates.

The best part about YONO SBI is the constant improvisation it strives to accomplish to boost the engagement of customers on its interface. The YONO SBI Mutual Fund app focuses on streamlining the entire mutual fund investment process for its users, from selecting the funds to tracking the portfolio.

Our Systematic Investment Plans Cater To Your Financial Objectives For A Stable Future!

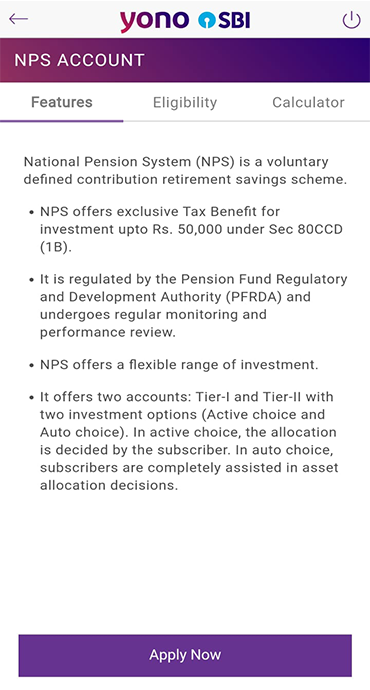

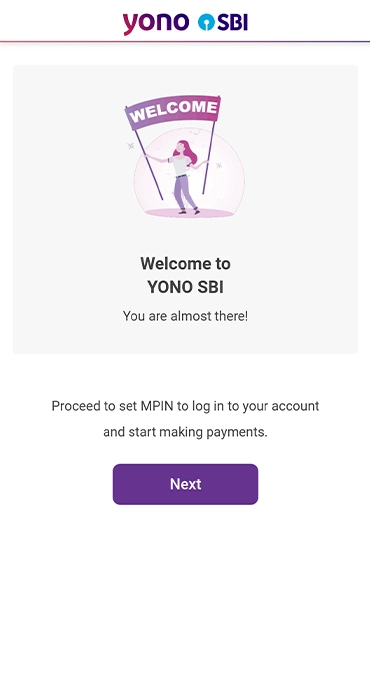

The financial landscape has a new investment trend, and you already know it — SIP! Systematic Investment Plans, or SIPs, have emerged as a simpler, effective, and profitable way for all income groups to generate long-term wealth for their future. Today, SIP has become more of a habit than a choice, especially for middle-class people planning to save big for their future.

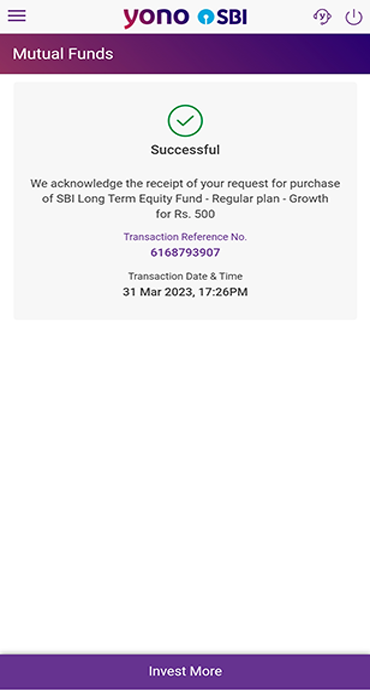

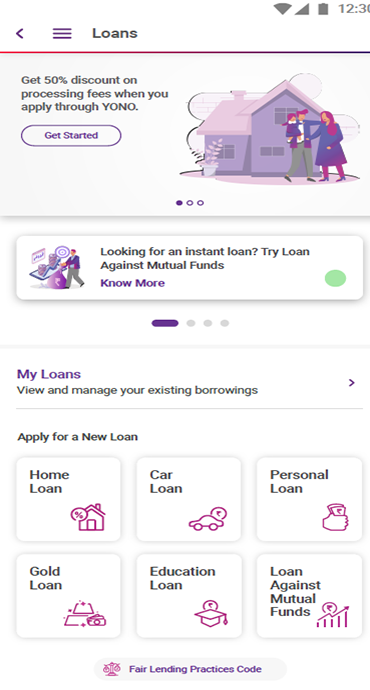

With the YONO SBI app, SIP investment now becomes simpler for all, as everyone can make investments starting from INR 500 anytime, anywhere. Now, you and your family can walk the road of disciplined investment for future savings with YONO’s SIP services accessible right at your fingertips. From savings for your child’s education to healthcare expenses, you can do it all with mutual fund investment via SIP.

Leverage The Power of SIP To Secure Your Financial Goals

Leverage the power of SIPs’ flexibility regarding investment amount and timeline to reach your financial goals without hassle. They are among the most powerful financial instruments to multiply your savings into a huge sum for your future financial objectives.

By allowing investors to see the progress their investments make toward each goal over time and receiving a clear understanding of the regular commitment required for each objective, SIPs also facilitate efficient planning of many financial goals simultaneously.

Sustaining investments in SIPs for debt, equity, and other schemes has benefited investors by allowing them to benefit from rupee cost averaging and stay engaged for an extended time, regardless of market fluctuations.

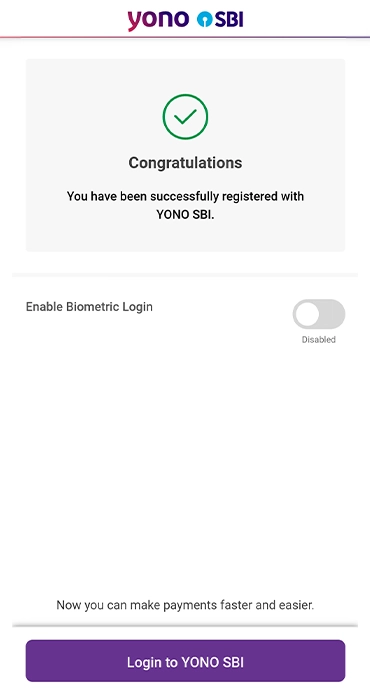

Download YONO SBI and Invest In SBI Mutual Funds To Let Your Surplus Funds Grow Over The Years!

Now that you know how SIPs help achieve financial goals, it’s time to make the most of this investment tool for your financial security in the future. Download the YONO SBI app and start investing in SBI mutual funds in the form of SIP, with every penning compounding into your financial objective.

Disclaimer: Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.

आपकी रुचि से संबंधित ब्लॉग