Investment Products - Wealth Management

Investment Products (ISA)

SBI Wealth brings unbiased open architecture to its customers in order to help them take best suited decision for their investment needs. Our well-researched vast product suite is cautiously hand-picked by the qualified research team in such a way that it caters to the investment objectives of the customers with varied risk-taking appetite

Investment Products

- Mutual Funds

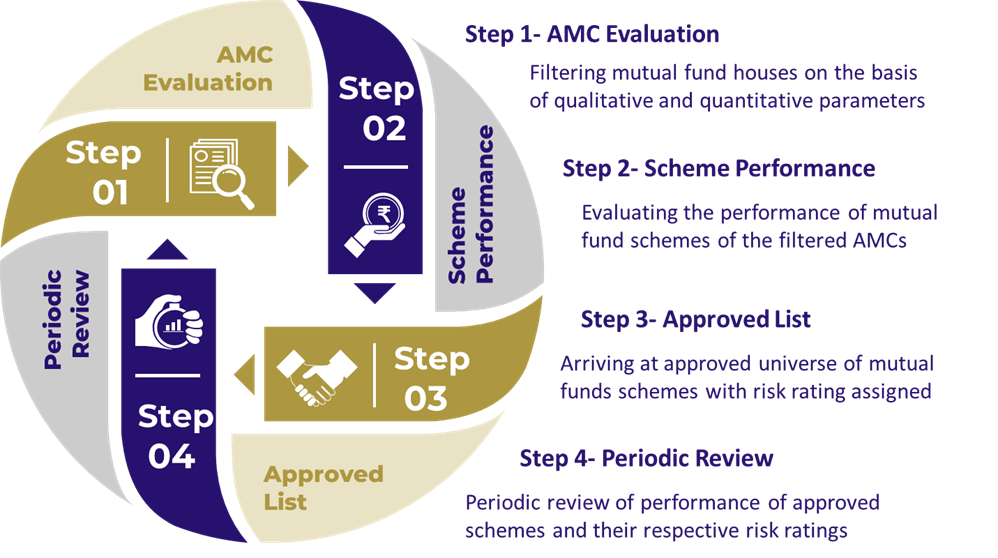

These are one of the most widely accepted means for investments that caters to other distinctive objectives too such as tax-saving, retirement planning and children’s education. We, at SBI Wealth, bring to your access the top-of-the-pyramid mutual fund schemes of more than 20 AMCs which are periodically reviewed and monitored by a team of specialists

-

Our Mutual Fund Research Framework-

-

- Portfolio Management Services/Alternative Investment Funds

We have a tie up with reputed Portfolio managers who offer Portfolio Management Services (PMS) and Alternative Investment Funds (AIF) for our customers.

- DEMAT Account

The customers who understand direct investment in equities and have appetite for the risk associated with it can enjoy preferred broking services through SBI Wealth’s tie-up with SBI Cap Securities Limited.

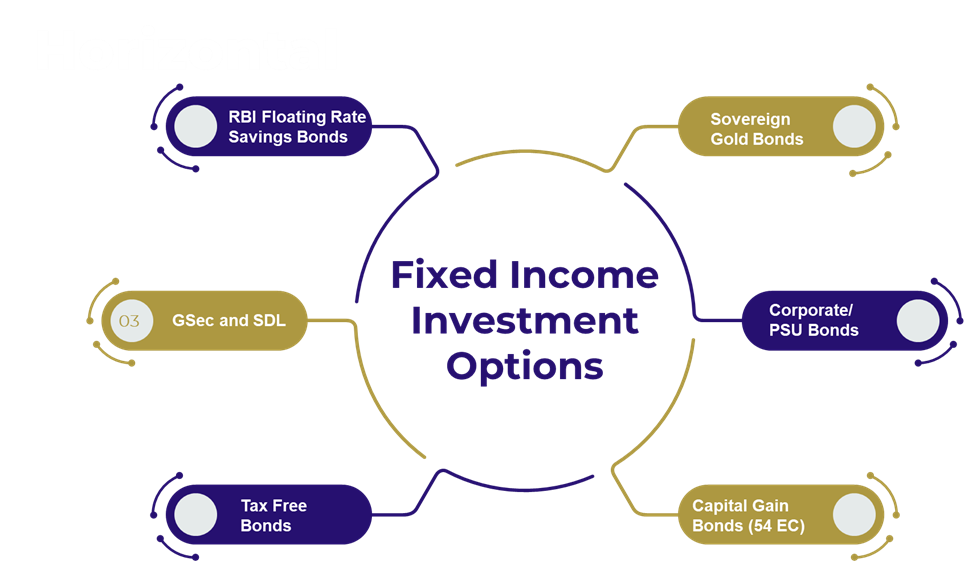

- Fixed Income Investment Options (Bonds)

Through our preferred partners, we bring investment opportunities in various fixed income securities for the customers who are looking for stable returns with regular income flow.

Mutual Fund Commission Disclosure

As per SEBI circular:SEBI/IMD/CIR No.4/168230/09, the details of the commission earned by SBI (AMFI Registered Mutual Funds Distributor) from various Mutual Funds. Please select the AMC for more details on the scheme wise commission structure.

- Aditya Birla Sun Life Mutual Fund

- Axis Mutual Fund

- Bandhan Mutual Fund

- Canara Robeco Mutual Fund

- DSP Mutual Fund

- Edelweiss Mutual Fund

- Franklin Templeton Mutual Fund

- HDFC Mutual Fund

- HSBC Mutual Fund

- ICICI Prudential Mutual Fund

- Invesco Mutual Fund

- Kotak Mutual Fund

- LIC Mutual Fund

- Mirae Mutual Fund

- Motilal Oswal Mutual Fund

- Nippon Mutual Fund

- Parag Parikh Mutual Fund

- SBI Mutual Fund

- Sundaram Mutual Fund

- Tata Mutual Fund

- UTI Mutual Fund

Last Updated On : Monday, 01-04-2024

Interest Rates

6.00% p.a.

for loan amount up to Rs. 2 lacs

8.15% p.a.

for loan amount > Rs. 2 lacs up to Rs. 6 lacs

Product

Criteria

- Features

- Eligibility

- Terms and Conditions

Interest Rates

6.00% p.a.

for loan amount up to Rs. 2 lacs

8.15% p.a.

for loan amount > Rs. 2 lacs up to Rs. 6 lacs