Types of Bank Deposits - Unlocking the Power of Your Savings - Yono

Secure & Grow your Wealth with SBI Term Deposits - Managed easily on the YONO SBI app!

27 Nov, 2024

fixed deposit investment recurring deposits

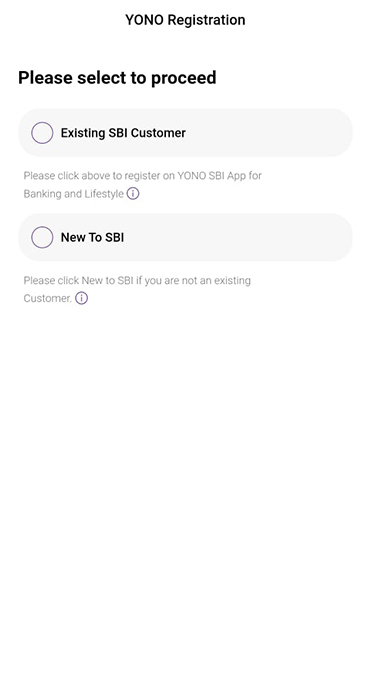

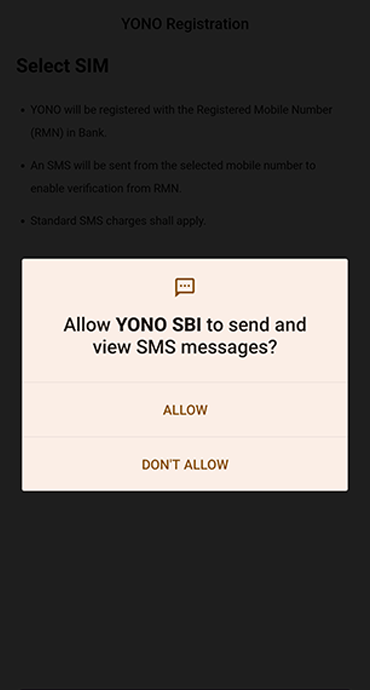

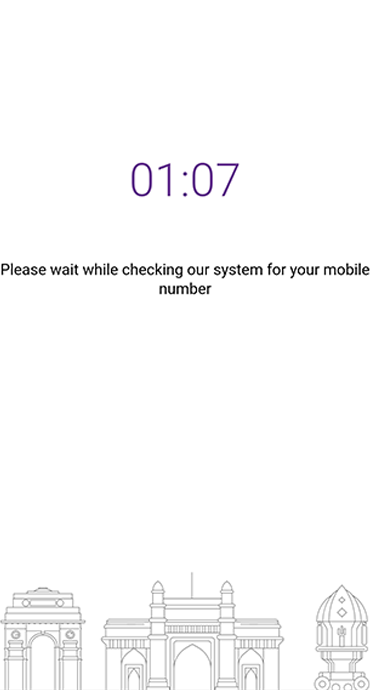

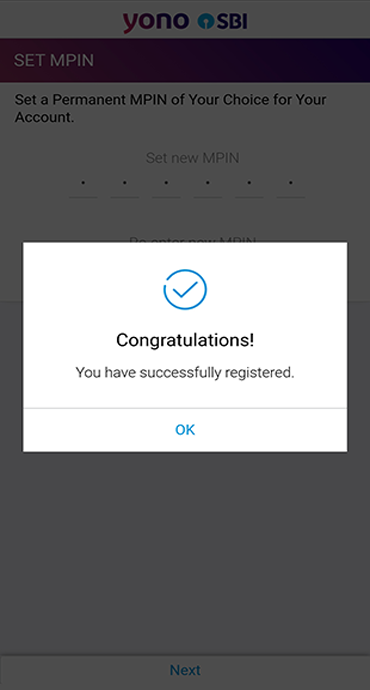

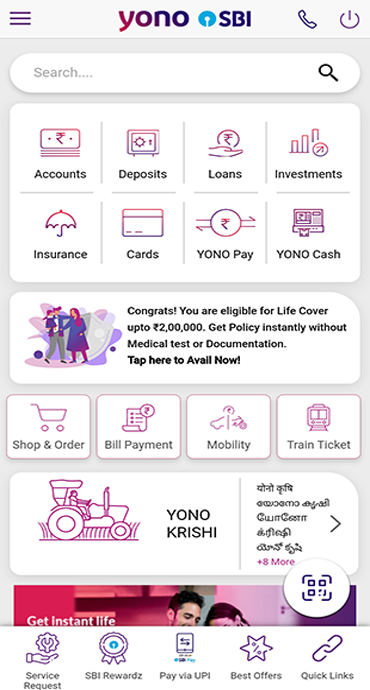

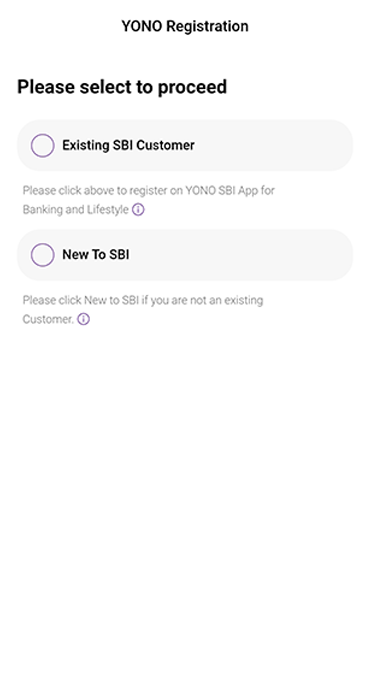

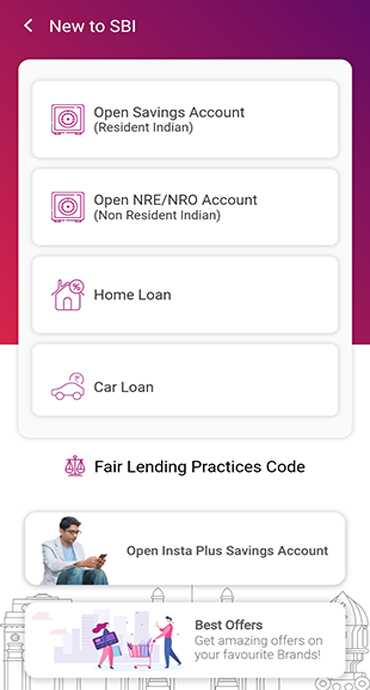

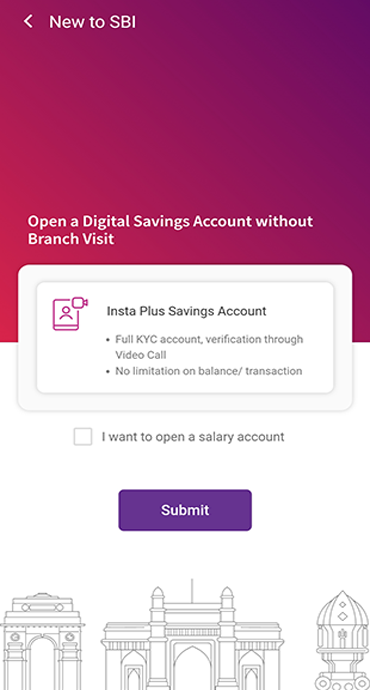

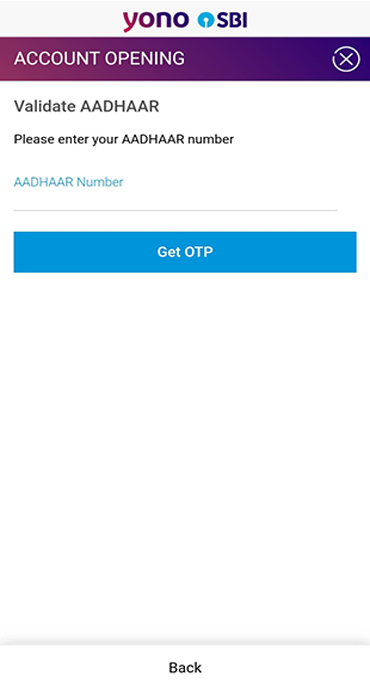

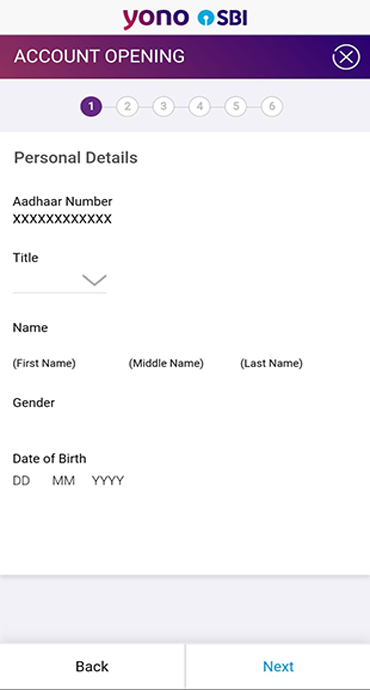

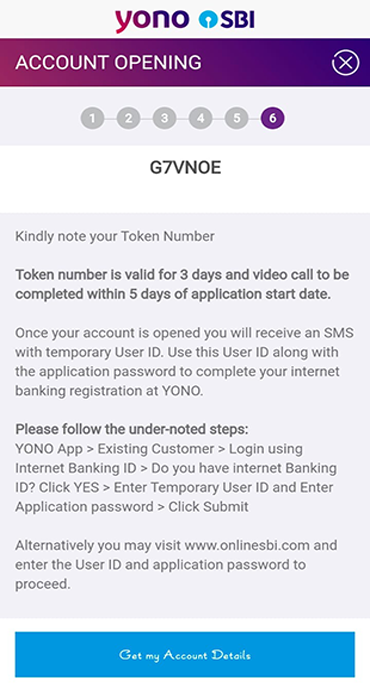

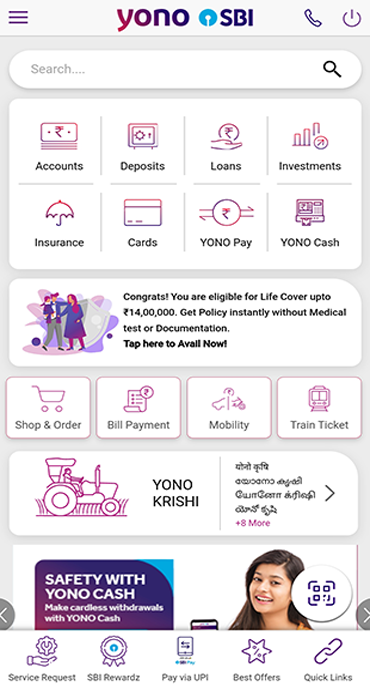

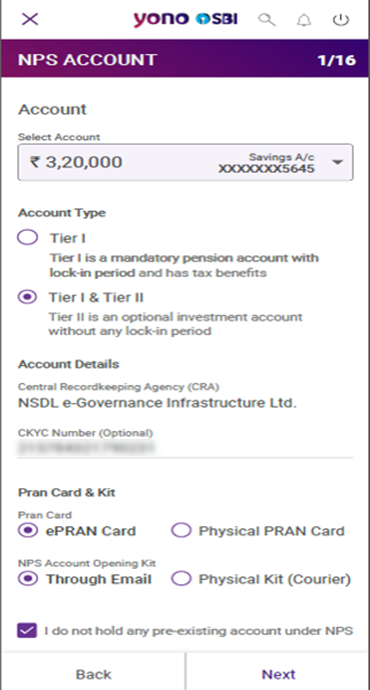

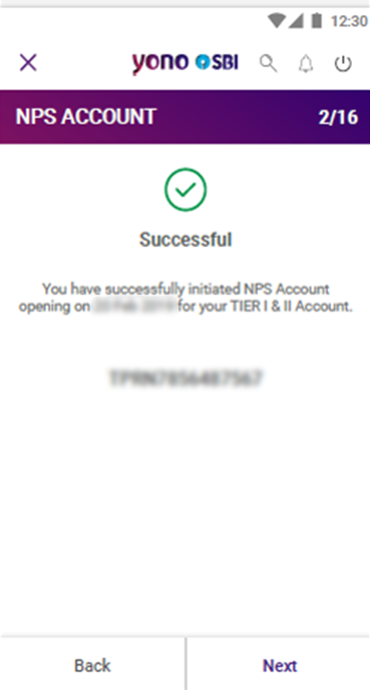

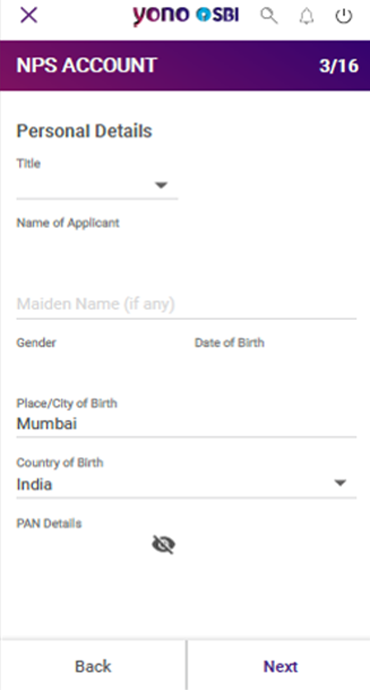

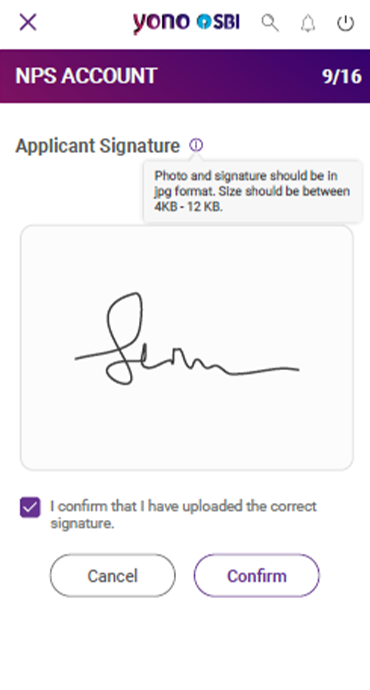

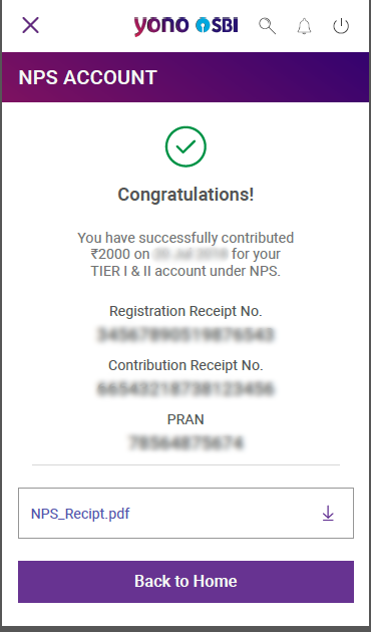

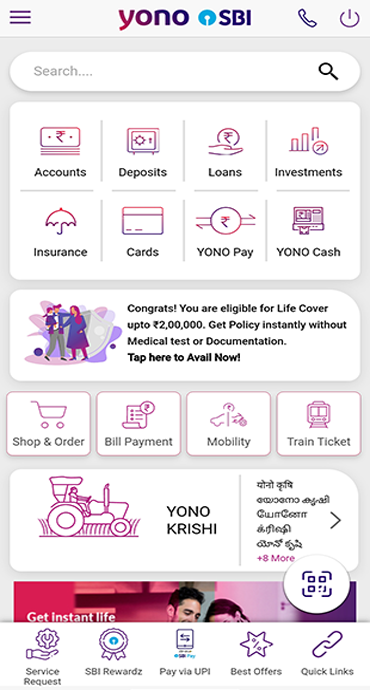

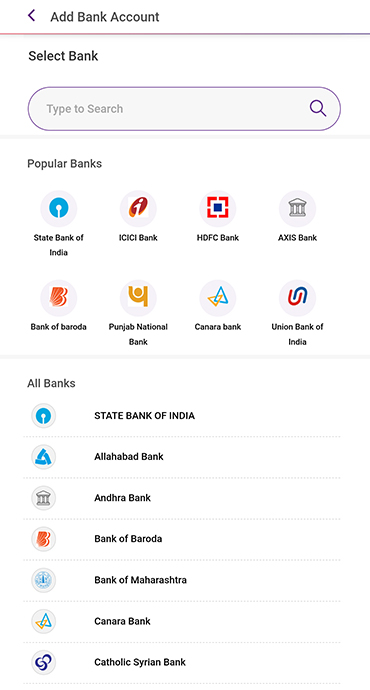

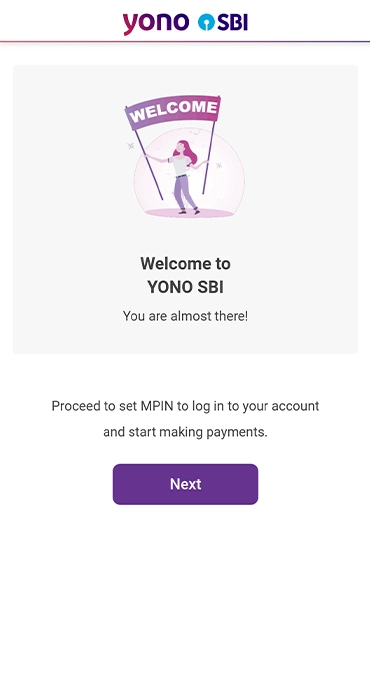

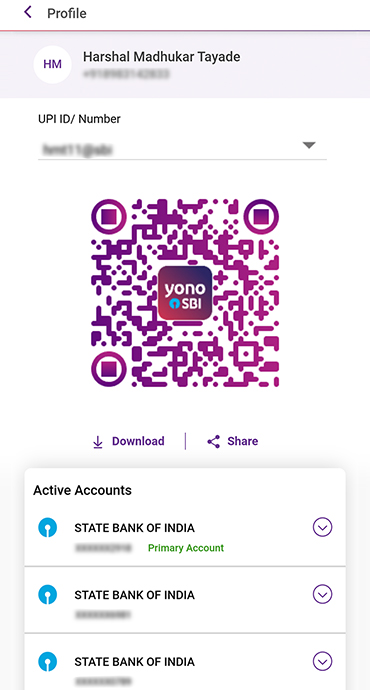

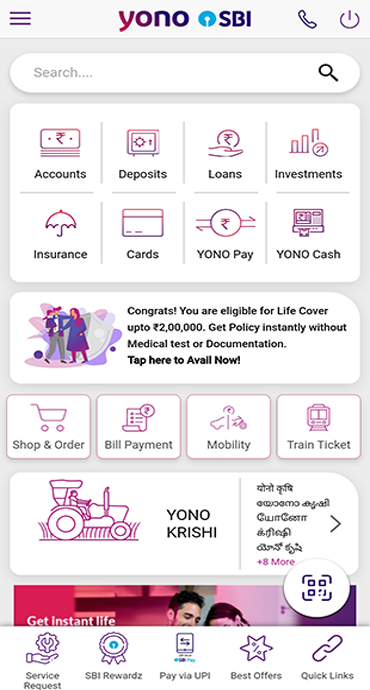

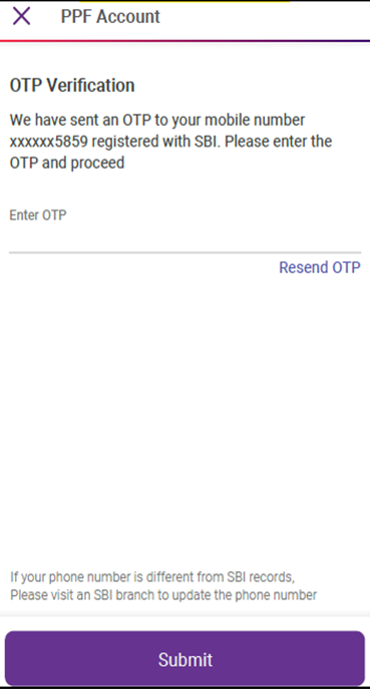

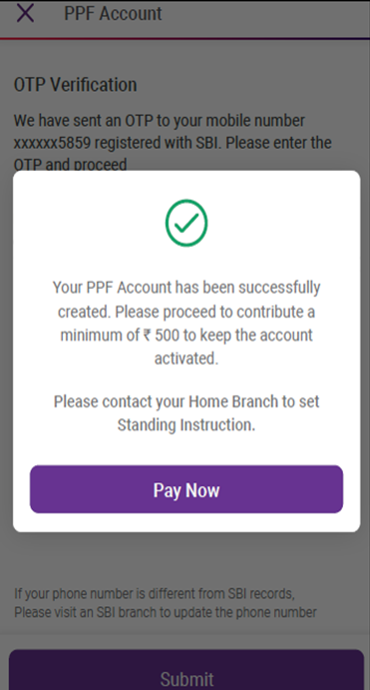

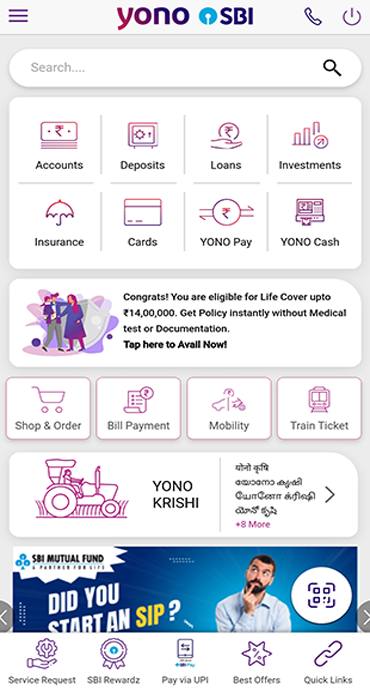

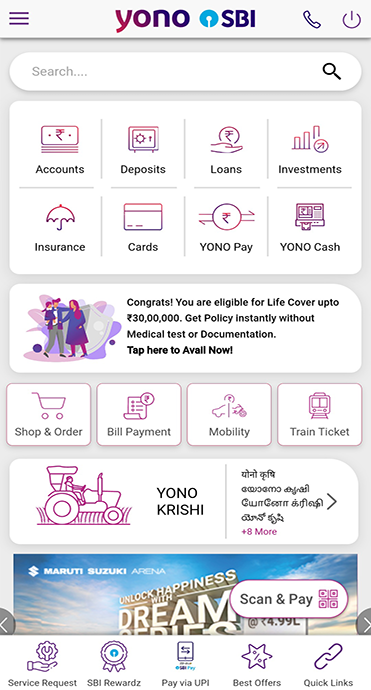

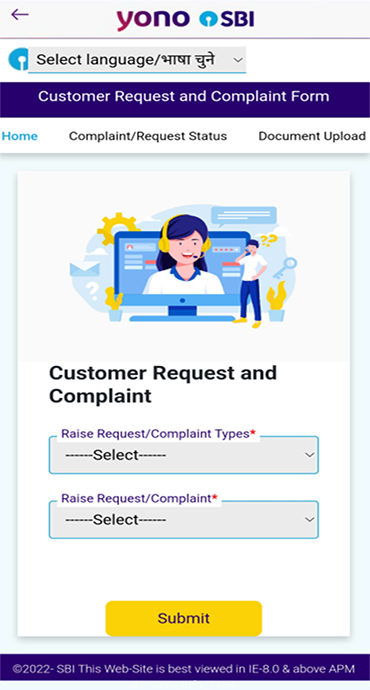

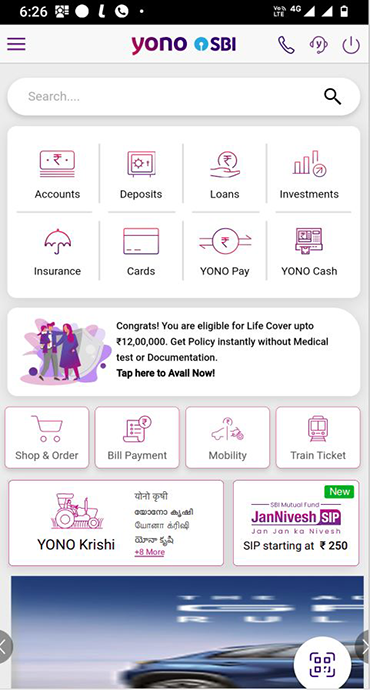

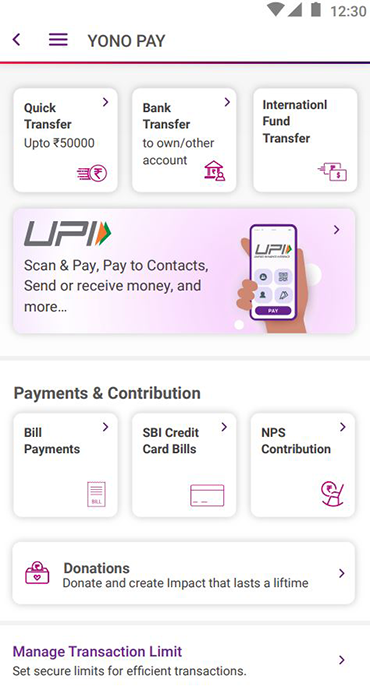

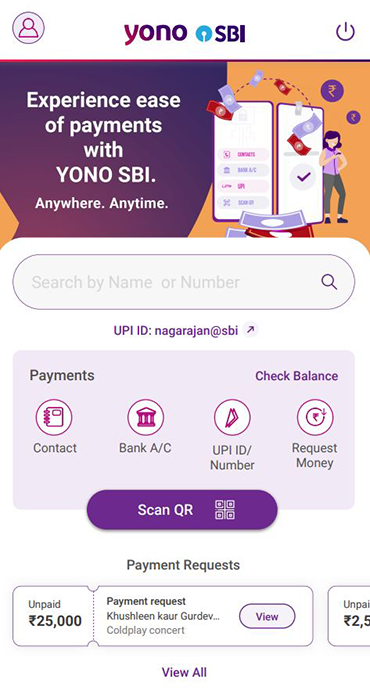

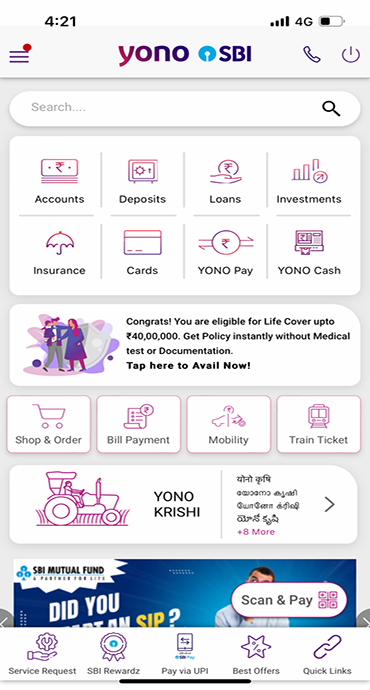

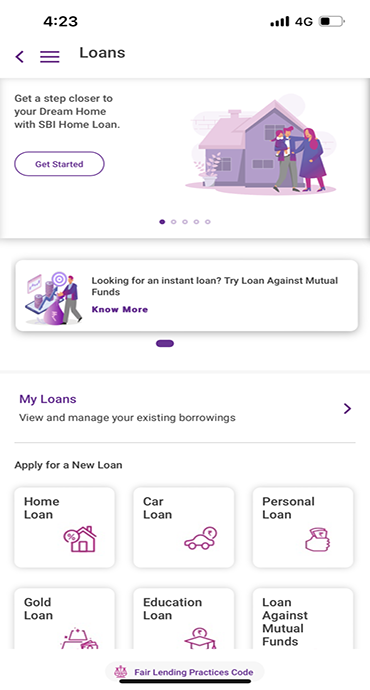

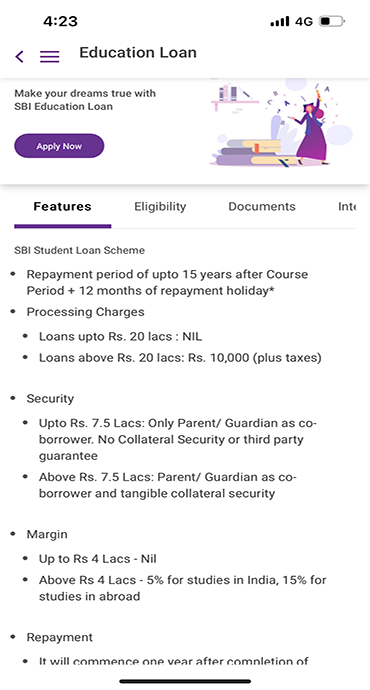

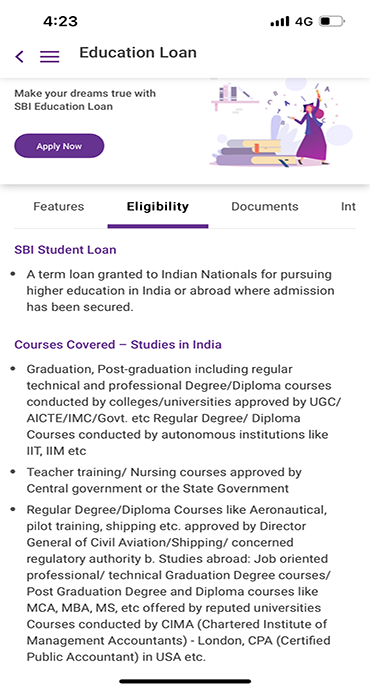

Today's fast-paced world demands proper management of personal finance for a sound future. Through the YONO SBI app, one can easily manage term deposits, whether it is a Fixed Deposit or a Recurring Deposit - two safe and secured avenues through which savings are amassed over time.

Whether you are a newcomer to term deposits or an experienced investor, the correct choice can maximize benefits out of your money. The discussion will see how an individual can make the most of his deposits with SBI's safe and easy products through the seamless YONO SBI mobile application.

What Are Term Deposits?

Term deposits is an interest-bearing deposit received by the bank for a fixed period. It includes deposits such as Fixed Deposits and Recurring deposits. These deposits not only provide security but also enhance capital over time.

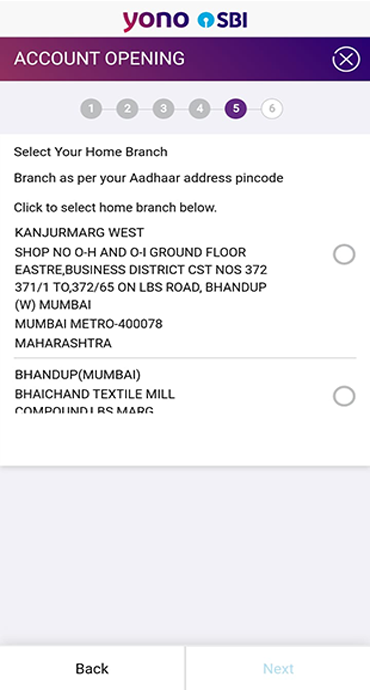

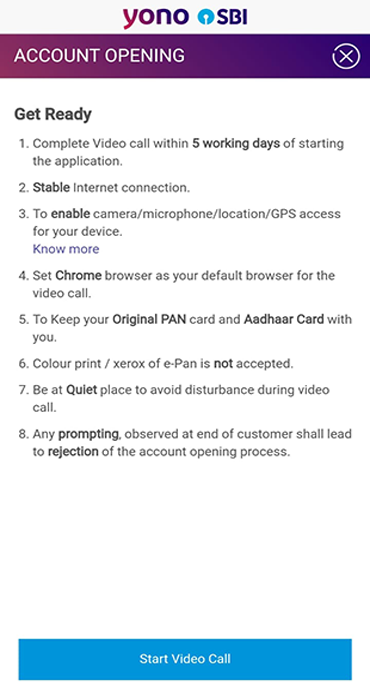

These deposits can now be opened and managed easily through YONO SBI app from any place of their convenience.

Fixed Deposits (FD)

Understanding Fixed Deposits

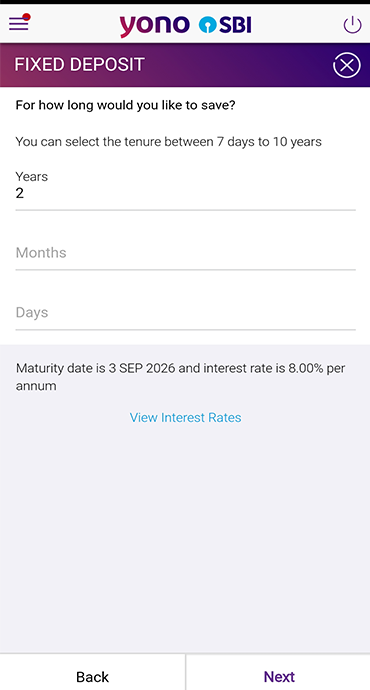

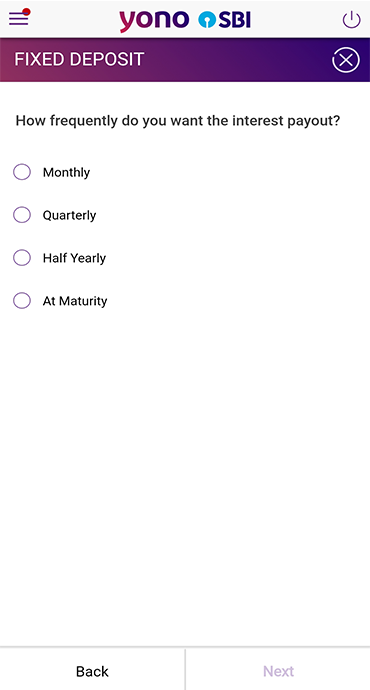

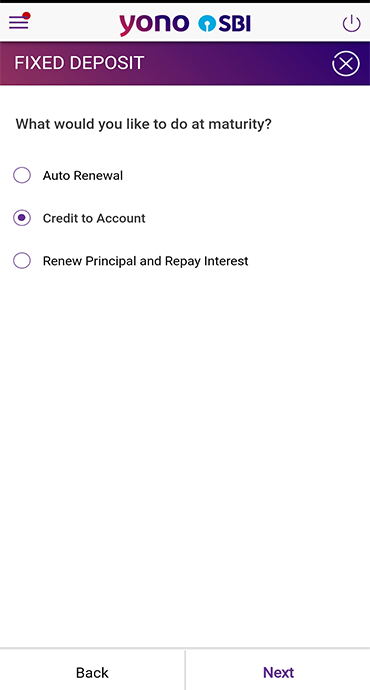

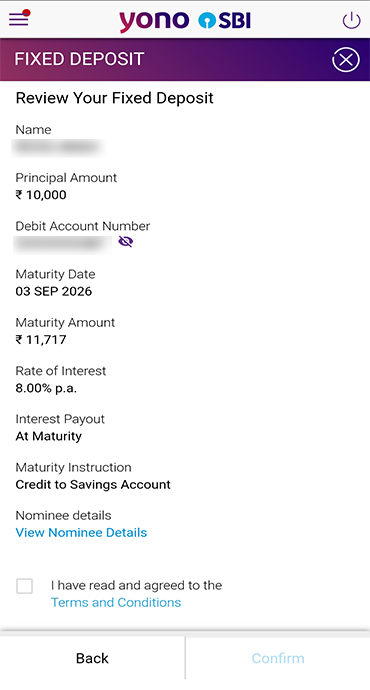

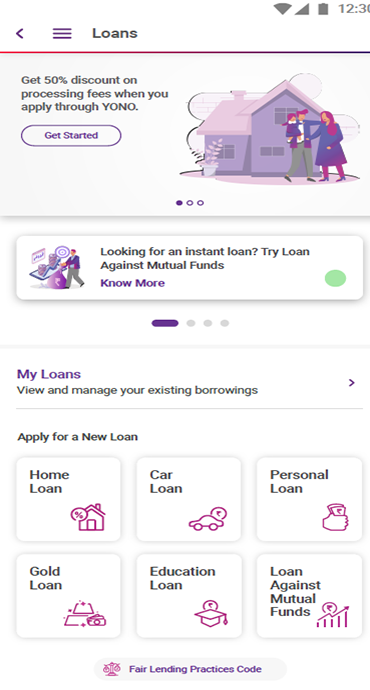

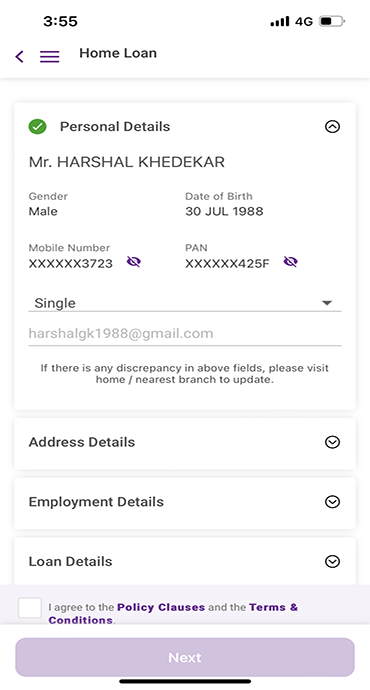

Fixed Deposits are the most known type of safe investment. Under such investments, Bank provides a facility to park surplus funds in a high interest earning product. It has flexibility of depositing for period from 07 days to 120 months and varied periodicity options of paying interest as per one's requirement. These investments are quite appropriate when a safe long-term financial instrument with predictable income is in need.

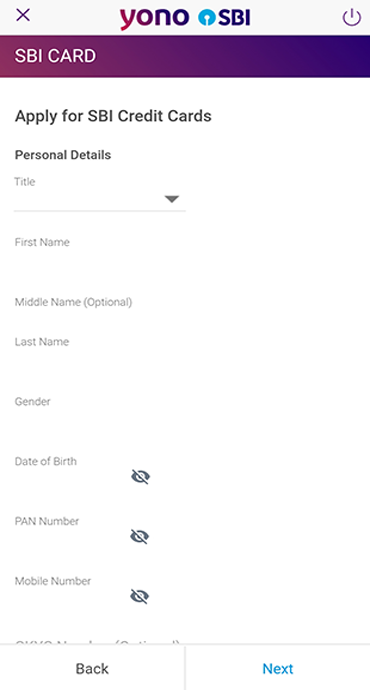

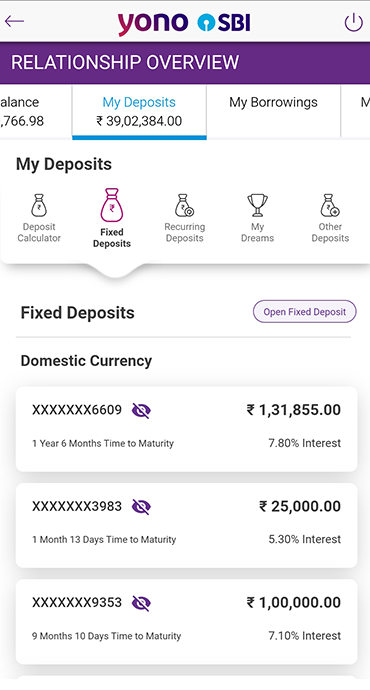

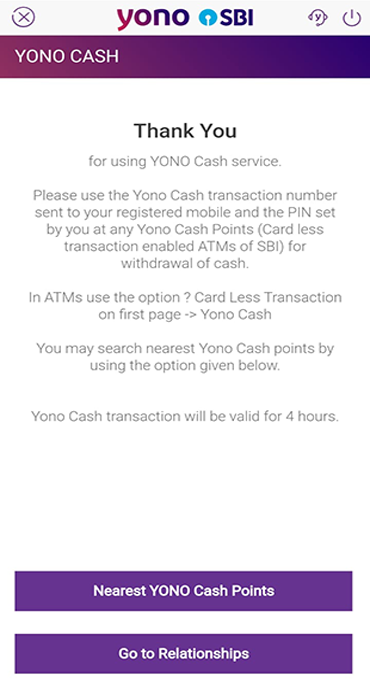

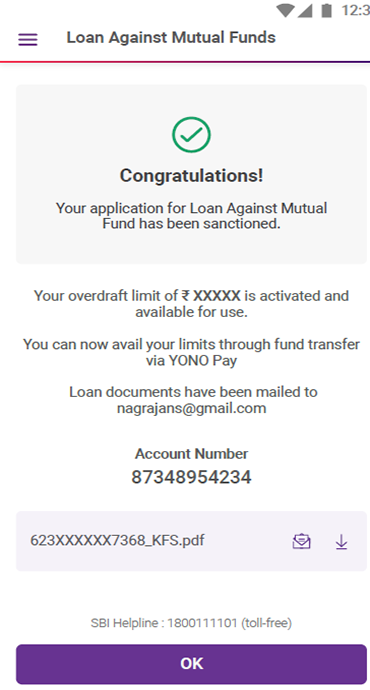

Manage your FDs anywhere, anytime with YONO SBI

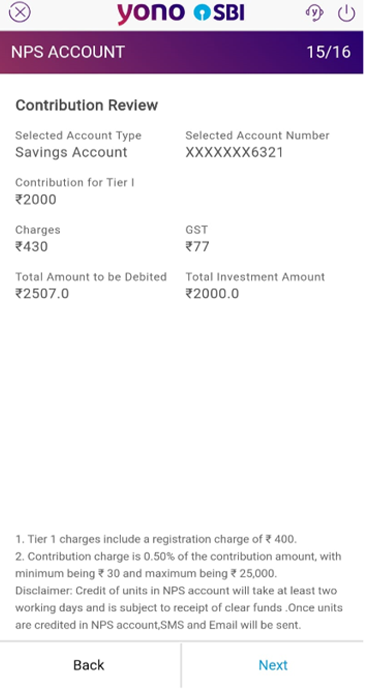

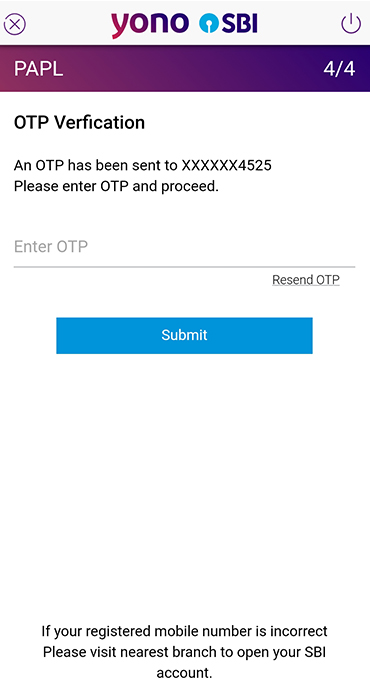

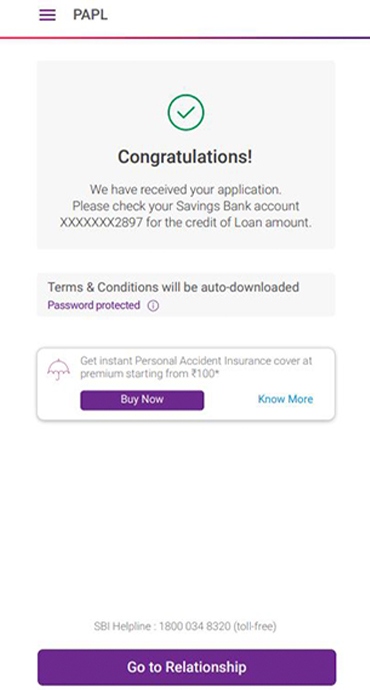

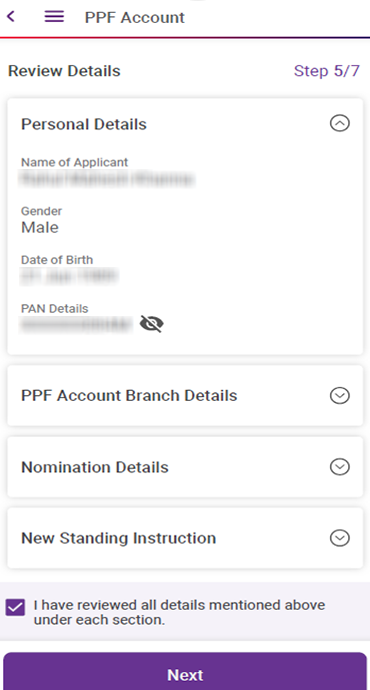

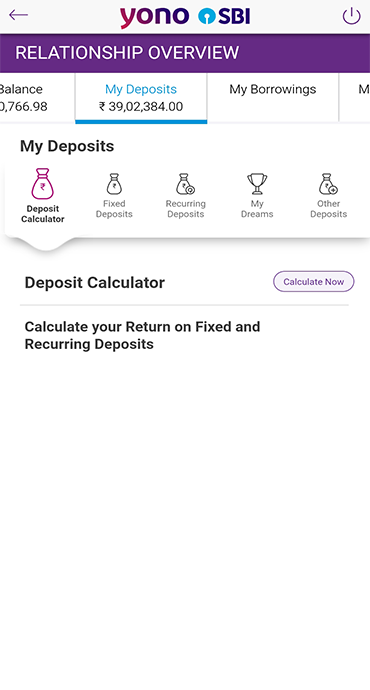

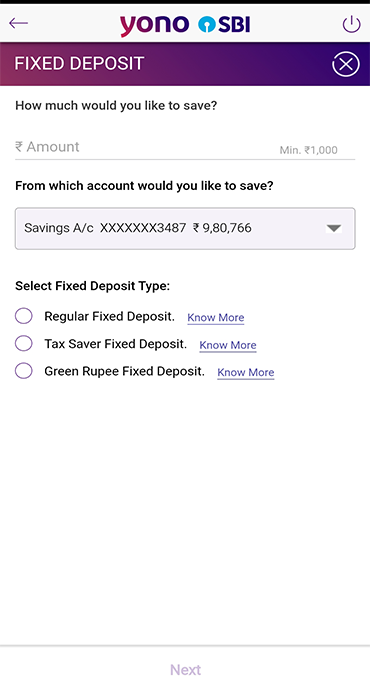

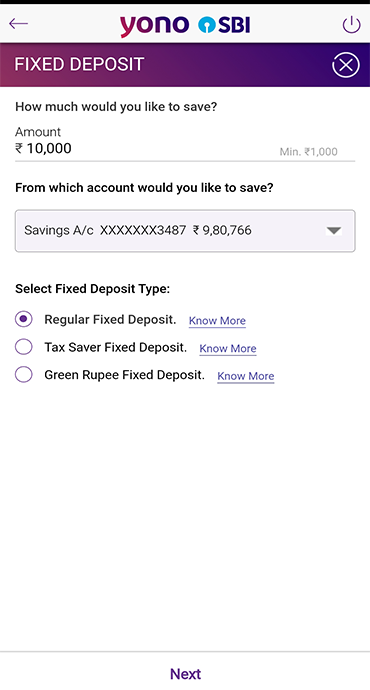

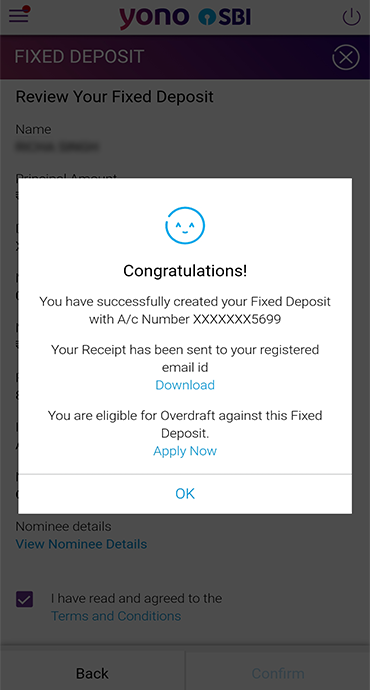

YONO SBI has made managing Fixed Deposits easier than ever. Whether you want to open a new Fixed Deposit, amend existing maturity instructions, close a Fixed Deposit, or avail an overdraft against your FD, all these features are readily accessible through the YONO SBI app. This seamless integration allows you to manage your deposit accounts swiftly, securely, and conveniently—all from your smartphone.

Tax Saver Fixed Deposits

What are Tax Saver Fixed Deposits?

Unlike a normal Fixed Deposit which offers an option for flexible tenure, Tax Saver FDs have a lock-in period of 5 years, which makes them suitable for long-term investment and tax planning.

Tax Benefits and Regulation

Tax Savings: Avail of deduction of up to ₹1.5 lakh under Section 80C of Income- tax Act,1961.

Lock-in for Five Years: Funds cannot be withdrawn for five years, thus ensuring long-term growth in addition to tax benefits.

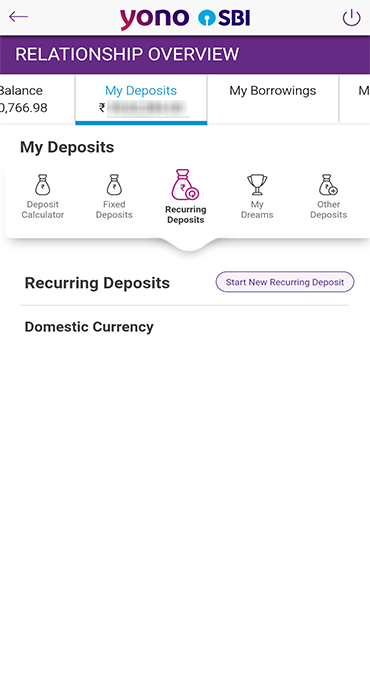

Recurring Deposits (RDs)

Introduction to Recurring Deposits

Recurring Deposits are especially ideal for those who prefer to have savings steadily over an extended period. Under a Recurring Deposit, the individual deposits a particular amount regularly. Once that period is over, the account holder receives the total amount deposited together with the interest generated.

Recurring Deposits will help individuals build the saving culture while at the same time creating steady financial expansion.

Characteristics and Benefits of RDs

Regular Deposits (RDs) are especially beneficial for investors who wish to deposit a fixed amount on a regular basis.

Flexible Contributions:

You set the amount to be contributed each month, as well as gain control over your finances.

Interest Earnings:

RDs offer interest rates like FDs, making them a reliable way to grow your funds.

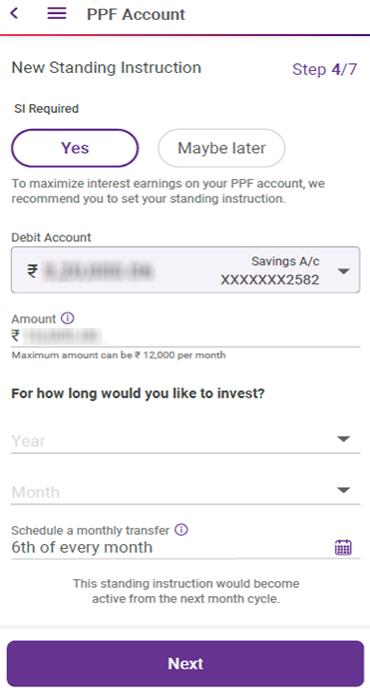

YONO SBI offers you easy and effective management of your Recurring Deposits. It allows you to set up automatic, recurring monthly payments and check progress of your RDs from anywhere, thereby making investments easily and effectively managed by people.

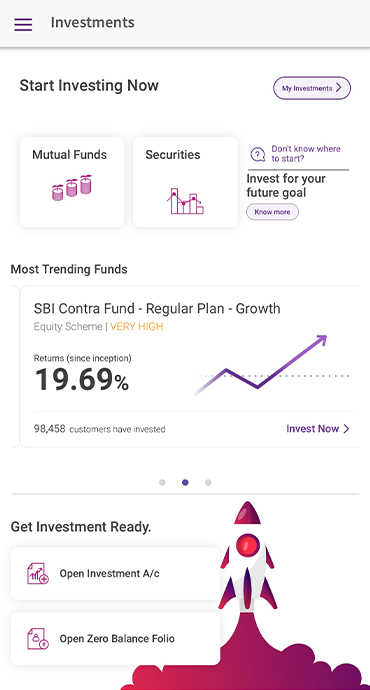

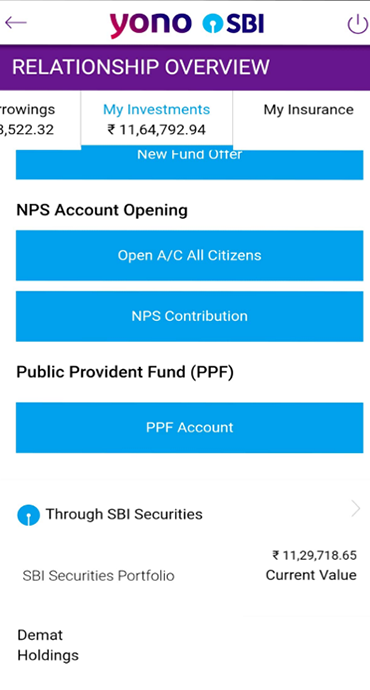

My Dreams

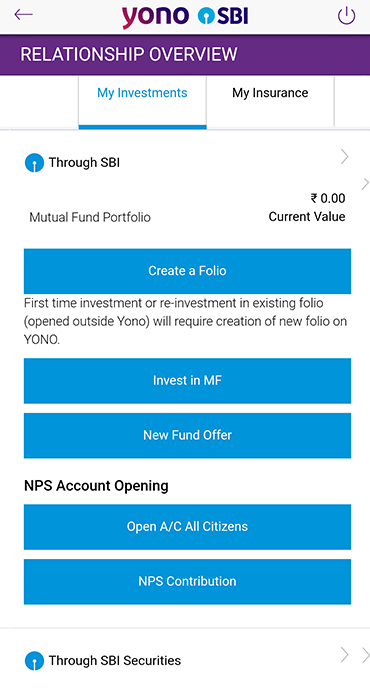

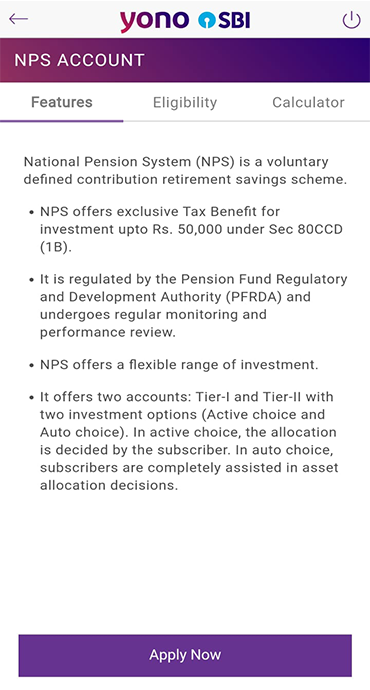

My Dreams feature helps you set and plan for your financial goals while allowing you to save systematically towards achieving them. With this feature, you can create and link your goals to either:

- Fixed Deposits

- Recurring Deposits

This way, you can organize your savings and meet your financial objectives efficiently and effortlessly.

Fixed Deposits and Recurring Deposits

Here are the special benefits of Fixed Deposits and Recurring Deposits. Let's quickly compare both so you know which one suits your needs best.

|

Feature |

Fixed Deposit (FD) |

Recurring Deposit (RD) |

|

Deposit Frequency |

Lump sum amount deposited once |

Fixed amount deposited monthly |

|

Interest Rate |

Higher, locked-in tenure |

Slightly lower, accumulates monthly |

|

Flexibility |

Locked in for a fixed tenure |

More flexible with regular contributions |

|

Withdrawal |

Premature withdrawal with penalty |

Partial withdrawals are usually not allowed |

Whether you prefer the one-time investment of an FD or the regular contributions of an RD, both options are easily managed through the YONO SBI app.

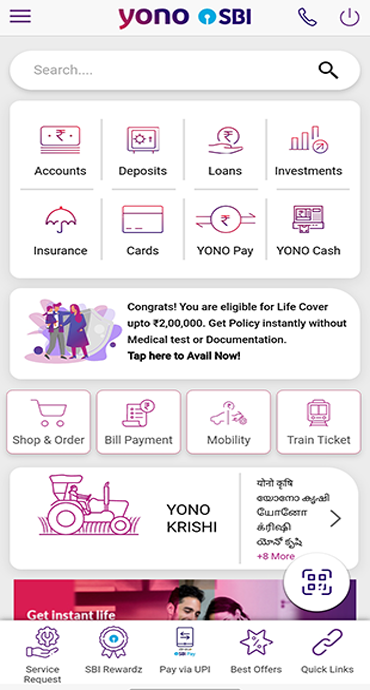

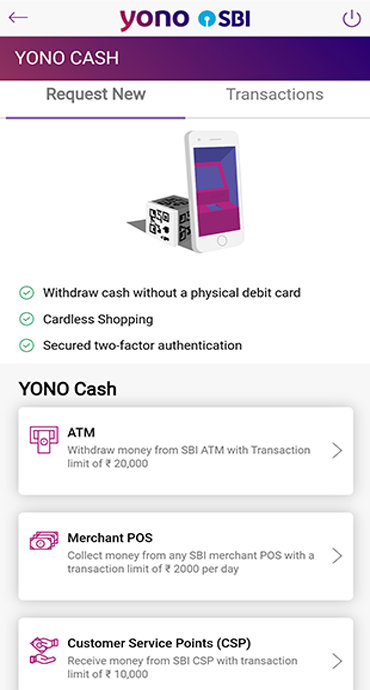

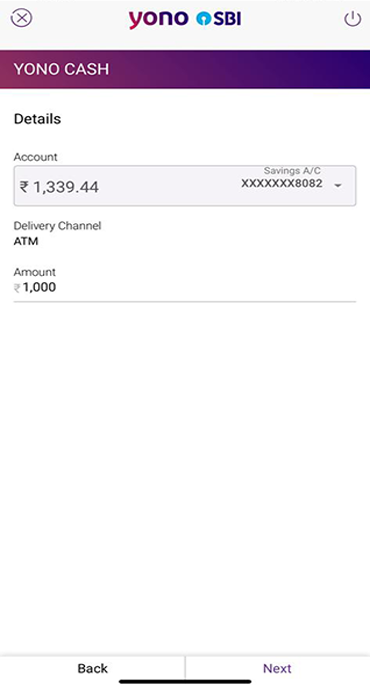

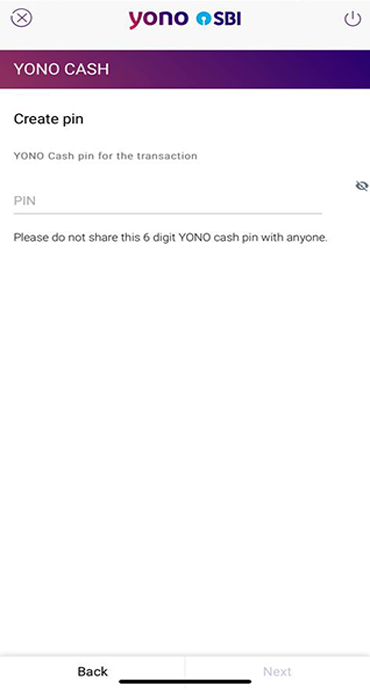

Benefits of Using the YONO SBI App for Deposits

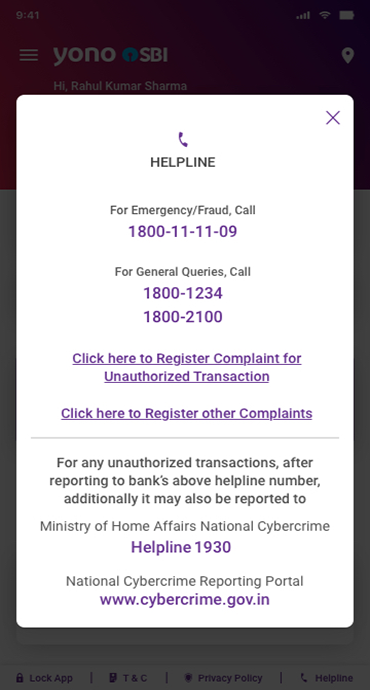

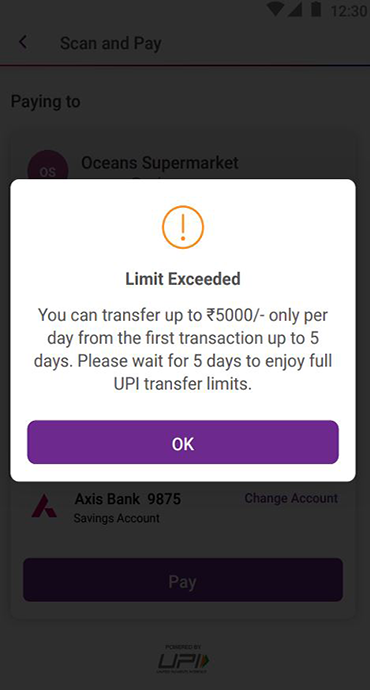

The YONO SBI app offers unmatched convenience and security for managing your term deposits. Here's how:

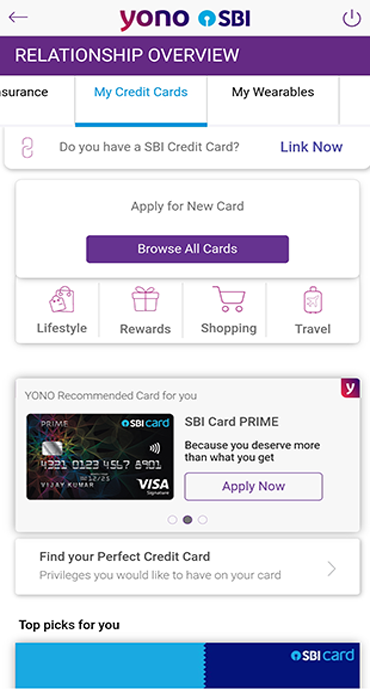

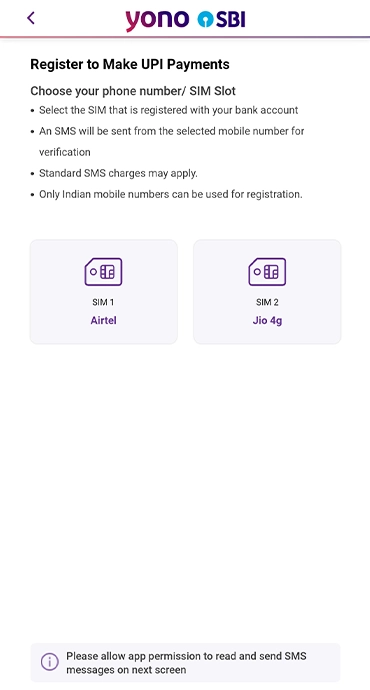

- Convenience: Open, manage, track your Deposit account anytime along with an option to check the interest rates before opening the deposit account.

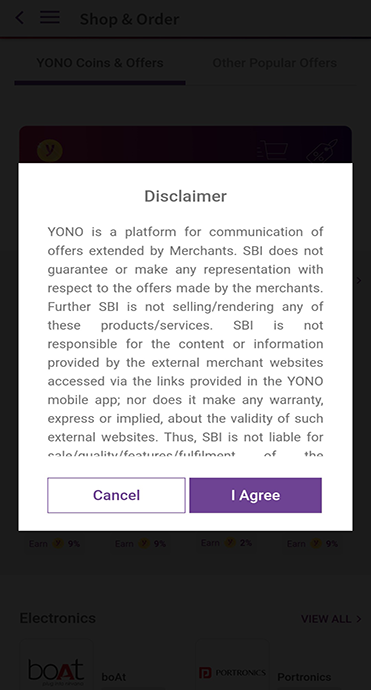

- Exclusive Offers: Access exclusive deals and offers through YONO SBI's integrated financial services.

- Secure Transactions: Ensure the highest level of security with advanced authentication features.

Factors That Affect Term Deposit Interest Rates

Several factors influence the interest rates on term deposits, such as:

- Duration of Deposits: The tenure of the deposit influences the interest rate, with longer durations usually providing better returns. You can choose tenure of your choice ranging from 7 days to 10 years.

- Market Interest Rates: Interest rates may fluctuate based on current economic conditions.

- Deposit Amount: Larger deposits can result in better interest rates.

- Financial Institution Policies: Banks may adjust interest rates based on broader economic policies.

Liquidity and Premature Withdrawal

While Term Deposits offer good returns, however premature withdrawal may result in small percentage of penalty.

Conclusion

Fixed Deposits and Recurring Deposits provide reliable ways to grow your funds over time. With SBI's comprehensive range of term deposit options and the convenience of the YONO SBI app, managing your finances has never been easier. Whether you prefer the one-time investment of a Fixed Deposit or the regular contributions of a Recurring Deposit, YONO SBI is here to simplify the process.

Download the YONO SBI app today and take control of your financial future!

Related Blogs That May Interest You