FAQ on E-Mandate on Debit Cards - Personal Banking

आवर्ती लेनदेनों के लिए डेबिट कार्ड पर एसआईएचयूबी ई-मैंडेट

आवर्ती लेनदेनों के लिए डेबिट कार्ड पर एसआईएचयूबी ई-मैंडेट

आवर्ती लेनदेनों के लिए डेबिट कार्ड पर एसआईएचयूबी ई-मैंडेट

SiHub ई-मैंडेट समाधान डेबिट कार्डधारक को नियमित/आवर्ती भुगतान लेनदेन के लिए अपने डेबिट कार्ड पर ई-मैंडेट प्रदान करने में सक्षम बनाता है। बैंक को दिए गए मैंडेट के अनुसार, अतिरिक्त कारक प्रमाणीकरण के माध्यम से सत्यापन के बाद, आवर्ती लेनदेन नियत तारीख को किया जाएगा। ग्राहक को वास्तविक डेबिट से 24 घंटे पहले प्री-डेबिट नोटिफिकेशन भेजा जाएगा। इससे कार्डधारक, आवश्यक होने पर, तो वास्तविक डेबिट से पहले लेनदेन को रद्द कर पाएंगे।

ऑनलाइन व्यापारी, जो पहले से ही SiHub समाधान के सदस्य हैं, को भुगतान के समय ई-मैंडेट के लिए संदर्भित किया जाएगा।

ग्राहक को वेबसाइट में डेबिट कार्ड के विवरण और मांगी गई अन्य जानकारियां देनी हैं। सबमिशन के बाद, पंजीकृत मोबाइल नंबर में प्राप्त ओटीपी से वेलिडेशन के लिए साइट में दर्ज करना है।

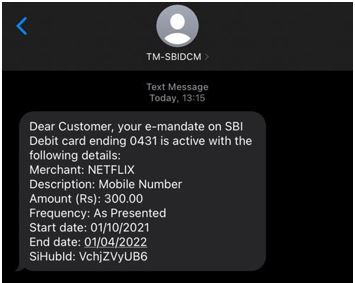

जी हाँ। ग्राहक को नीचे दर्शाए गए अनुसार उसके पंजीकृत मोबाइल नंबर पर एसएमएस प्राप्त होगा:

जी हाँ। ग्राहक बैंक की इंटरनेट बैंकिंग साइट https://www.onlinesbi.sbi के प्री लॉगिन पेज पर - कार्ड नंबर और प्राप्त ओटीपी दर्ज करके, विवरण देख सकेंगे। ग्राहक किसी भी मैंडेट का चयन करके उसे संशोधित/रद्द कर सकते हैं। वैकल्पिक रूप से, ग्राहक https://www.sihub.in/managesi/sbi यूआरएल का उपयोग कर सकते हैं।

जी हाँ। ग्राहक को वास्तविक डेबिट तिथि से कम से कम 24 घंटे पहले मैंडट लेनदेन के बारे में पंजीकृत मोबाइल नंबर पर अलर्ट एसएमएस प्राप्त होगा। नमूना अलर्ट एसएमएस निम्नानुसार है:

- प्रिय ग्राहक, आपका एबीसी मर्चेंट के लिए ई-मैंडेट (एसआई00000000001) जिसकी भुगतान राशि 000.00 रुपये है और 00/00/0000 को देय है और xxxx से समाप्त होनेवाले एसबीआई डेबिट कार्ड के माध्यम से संसाधित किया जाएगा।

जी हाँ। कार्डधारक https://www.sihub.in/manage/sbi पोर्टल पर जाकर अपनी पसंद के ई-मैंडेट को संशोधित या रद्द कर सकता है।

कोई नहीं। ग्राहक को ई-मैंडेट सुविधा निःशुल्क प्रदान की जाती है।

कृपया अपनी समस्या निम्नलिखित ईमेल पर भेजें :

- (i) sihubsupport@billdesk.com

Last Updated On : Saturday, 02-03-2024

ब्याज दर

2.70% प्रति वर्ष.

से प्रभावी>3.00% प्रति वर्ष.

10 करोड़ रुपए व अधिक, 15.10.2022 से प्रभावी

6.00%

₹2 लाख तक की ऋण राशि के लिए

8.15%

₹2 लाख से अधिक और ₹6 लाख तक की ऋण राशि के लिए

डेबिट कार्ड

एचपीसीएल को-ब्रांडेड डेबिट कार्ड (एवरीडे कार्ड)

अंतरराष्ट्रीय वेबसाइट पर एसबीआई इंटरनेशनल डेबिट कार्ड

एसबीआई आईओसीएल सह ब्रांडेड कॉन्टेक्टलेस रुपे डेबिट कार्ड

आवर्ती लेनदेनों के लिए डेबिट कार्ड पर एसआईएचयूबी ई-मैंडेट

Criteria

- Features

- Eligibility

- Terms and Conditions

ब्याज दर

2.70% प्रति वर्ष.

से प्रभावी>3.00% प्रति वर्ष.

10 करोड़ रुपए व अधिक, 15.10.2022 से प्रभावी

6.00%

₹2 लाख तक की ऋण राशि के लिए

8.15%

₹2 लाख से अधिक और ₹6 लाख तक की ऋण राशि के लिए