DIRECTORS' REPORT

-

ECONOMIC BACKDROP AND BANKING ENVIRONMENTOpen or Close

Global Economic Scenario

The global economic environment has broadly strengthened, and is likely to improve further, with much of the growth impetus emanating from advanced economies. However, global growth still remains uneven with strengthening of the US economy, subdued growth in the Euro Area and Japan and slowdown in Emerging Markets and Developing Economies (EMDC). Although full global recovery is a distant prospect, normalisation of fiscal policies is now on the agenda of governments across the world.

The prices of global energy items and non-fuel commodities reduced by 1% and 1.2%, respectively, due to lower demand in 2013. However, the decline in commodity prices reflected disproportionately on consumer inflation. For the advanced countries, consumer inflation declined by 0.6% to 1.4% in 2013, while in the EMDC it exhibited downward rigidity and declined marginally by 0.2% to 5.8%.

The policy responses of major central banks (the US, ECB and Japan) no more resemble the coordination of the earlier years. The US Federal Reserve's Quantitative Easing programme is expected to witness major unwinding before the end of 2014. However, conditions in Euro Zone and Japan may constrain the European Central Bank (ECB) and Bank of Japan to scale down monetary expansion programmes. In such a scenario, we may enter into a new phase of asymmetric policy responses, where both ECB and Bank of Japan will be expanding, while the US will, in part, contracting. These policy stances may heighten the uncertainty associated with global growth momentum. The impact on asset prices and commodity prices thus will remain uncertain.

India's Economic Scenario

India remains one of the fastest growing economies of the world. However, the country's growth momentum has remained subdued for two consecutive years, reflecting weak and fragile global growth and domestic supply constraints. India's GDP growth improved moderately to 4.7% in FY 2013-14 against 4.5% in the previous year, and is estimated to increase further to 5.3%-5.5% in the current financial year (SBI estimates).

The forecast for below normal rainfall in current fiscal does not augur well for agricultural production. There were also unseasonal rains, accompanied by hailstorm and frost during early part of March 2014 in various parts of the country, adversely impacting Rabi crops. However, the good thing is that, led by higher crop production, agricultural GDP including allied sector is poised to grow by 4.7% in FY 2013-14, over three times higher than 1.4% in the previous year. Industrial growth continues to remain sluggish due to lackluster investment climate, stalled projects and subdued consumption demand. Persistent contraction in the mining sector, owing to regulatory and environmental hurdles also contributed to the overall decline in industrial activity.

However, the electricity sub-sector grew smartly by 5.9% in FY 2013-14 against 2.3% in the previous year. It continued to generate some optimism amidst a bleak industrial scenario, but its buoyancy was clearly inadequate to counter the weakness of other constituent sectors. With the formation of a stable Government at the Centre with renewed focus on reforms, economic activity across all sectors is likely to pick up pace.

Inflation, both Wholesale Price Index (WPI) and Consumer Price Index (CPI), remains a matter of concern. Both the build-up of inflation during April - November 2013 and the subsequent fall in inflation during December - February 2013-14 was driven by food prices. During the period June - December 2013, inflation in food articles remained in double digits, while in manufactured products it was stable at around 3% throughout the year. In fuel and power sector, inflation rose to 8.9% in April 2014 from 8.3% in April 2013. The core inflation remained below 3% during April – November 2013 but thereafter rose gradually to 3.50% by end of March 2014. However, it again declined to 3.40% in April 2014.

The Indian economy is now on the threshold of a major transformation, with expectations of policy initiatives by the newly elected Central Government.

On the external front, improvement in the current account deficit (CAD) from 4.7% of GDP in FY 2012-13 to 1.7% for FY 2013-14 is good news. The narrowing of CAD followed a lower trade deficit due to higher exports as well as moderation in imports. With a gradual recovery in key partner economies, India's exports began to improve in July 2013; this was also helped by rupee depreciation. During FY 2013-14, exports grew by 3.98%, while imports contracted by 8.1%. It resulted in sharp contraction in trade deficit from USD 190.3 bn in March 2013 to USD 138.6 bn in March 2014, primarily due to a 40% decline in gold imports. Going forward, with a likely improvement in world GDP and global trade, export growth is likely to recover in 2014-15.

Due to various measures taken by the RBI since September 2013, surge in capital inflows led to reserve accretion. This is yet another positive development during the financial year 2013-14. The RBI's swap windows for banks' mobilisation of fresh FCNR(B) deposits and overseas borrowing helped to build reserve during September - November 2013. With the revival of portfolio flows since December 2013, India's forex reserves reached USD 314.9 billion (as on 16th May, 2014), an accretion of USD 22.9 bn over that of a year ago. With a lower CAD and build-up of foreign exchange reserves, the downward pressure on the currency and the volatility in the Indian rupee have subsided down. The rupee has also moved in a narrow range of `60.10 to `62.99 per US dollar since End-November 2013 to March 2014. In fact, during this period the rupee outstripped most of the other emerging market currencies.

Outlook

The Indian economy is now on the threshold of a major transformation, with expectations of policy initiatives by the newly elected Central Government. The economy is on the road to modest recovery with cautiously positive business sentiments, improved consumer confidence and more controlled inflation. The sectors which were significantly impacted by the crisis and slowdown in the economy are now showing definite signs of improvement. The challenge for maintaining disinflationary momentum over the medium term, however, remains on the horizon. A moderate recovery is likely to set in 2014-15 and real GDP may grow by 5.3% to 5.5%.

However, data revisions for previous quarters and the consequent changes in base effects impart uncertainty to the growth trajectory ahead. The pace of recovery, nevertheless, is likely to be modest. It is likely to be supported by investment activity picking up due to part resolution of stalled projects and improved business and consumer confidence.

In an interesting development, the Indian Meteorological Department's (IMD) forecast of below normal rains have triggered widespread discussions about India's production of food grains, agriculture's contribution to the GDP and concerns about food inflation in the current fiscal. Whatever may be the course of Monsoon 2014 going forward, fears of drought are unfounded at this point of time.

The outlook for industrial activity is positive. Industrial growth, which had been subdued in the past two fiscal, is now likely to gather momentum with moderately stronger global growth, improving export competitiveness and implementation of recently approved investment projects. The new Central Government's reforms focus should also act as an impetus to growth.

In the baseline scenario, commodity prices will remain muted during 2014. In the current scenario, global food and meal prices are likely to moderate. According to the US Energy Information Administration (EIA), the Brent crude oil price is projected to average USD 105 and USD 101 per barrel in 2014 and 2015, respectively, thus imparting a clear softening bias.

Going forward, while the global commodity price scenario provides some comfort, the rate of inflation may decelerate further from what has been witnessed in recent months.

In the coming years, we may see a fascinating scenario emerging in the India-China growth debate. While India is now focusing on increasing its share of manufacturing sector to 25% by 2025, China has already embarked on a mission of significantly revamping its services sector. The strategy of shifting the Chinese economy towards a service-sector bias may sooner or later impact India's services trade balance. However, considering China's growing ageing population such structural transformation would take a while to materialise.

Banking Industry Developments

Being one of the top 10 global economies with a billionplus population, India offers a significant potential for the banking sector to grow. In addition, one third of the country's population still remains outside the purview of formal banking offering the Indian banking industry a rare opportunity to grow and help facilitate the nation's inclusive growth agenda.

Going forward, the country's `81 trillion (USD 1.34 trillion) banking industry may see more participants and greater healthy competition. Two new banks have already received licences from the RBI i.e. IDFC and Bandhan Group, which apart from providing impetus to financial inclusion, is expected to intensify competition in the banking sector in the medium term.

Going forward, the country's `81 trillion (USD 1.34 trillion) banking industry may see more participants and greater healthy competition

In addition, by postponing the implementation of Basel III capital accord by one year, RBI has given some breathing space to banks struggling with plummeting margins and lower profitability on account of increase in NPAs. The Reserve Bank of India's (RBI) new norms will further encourage banks to identify potential bad loans and take corrective actions.

As a part of monetary transmission, base rate of major banks inched up from 9.70%-10.25% in April 2013 to 10.0% -10.25% in March 2014, while deposit rates were readjusted from 7.5%-9.00% to 8.0%-9.25% in the same period.

While aggregate deposit of All Scheduled Commercial Banks (ASCBs) grew by 14.1% in FY 2013-14 against 14.2% growth in FY 2012-13, credit expanded by 13.9% against 14.1% in the previous year.

The Reserve Bank of India's (RBI) new norms will further encourage banks to identify potential bad loans and take corrective actions.

-

Financial PerformanceOpen or Close

Profit

Given the system wide economic slowdown, the financial performance of the Bank during the financial year ended 31st March, 2014, remained satisfactory. The Bank registered a good growth in Operating Profit during the fourth quarter of the year as compared to previous quarters. The Operating Profit of the Bank for 2013-14 was higher at `32,109.24 crores, as compared to `31,081.72 crores in 2012-13, an increase of 3.31%.

The Bank posted a Net Profit of `10,891.17 crores for 2013-14, as compared to `14,104.98 crores in 2012-13, i.e. a decline of 22.78% on the back of higher provisioning requirement.

Net Interest Income

Due to higher growth in the advances and investment portfolios, the gross interest income from global operations rose from `1,19,655.10 crores to `1,36,350.80 crores during the year registering a growth of 13.95%.

The Net Interest Income of the Bank correspondingly registered a growth of 11.17% from `44,329.30 crores in 2012-13 to `49,282.17 crores in 2013-14.

Interest income on advances in India increased from `85,782.26 crores in 2012-13 to `97,674.91 crores in 2013- 14 registering a growth of 13.86%, due to higher volumes. However, the average yield on advances in India has declined from 10.54% in 2012-13 to 10.30% in 2013-14.

Income from resources deployed in treasury operations in India increased by 15.24% mainly due to higher average resources deployed. The average yield has also increased to 7.65% in 2013-14 from 7.54% in 2012-13.

Total interest expenses of global operations increased from `75,325.80 crores in 2012-13 to `87,068.63 crores in 2013- 14. Interest expenses on deposits in India during 2013-14 recorded an increase of 15.65% compared to the previous year. The average cost of deposits has increased by 6 basis points from 6.29% in 2012-13 to 6.35% in 2013-14, whereas the average level of deposits in India grew by 14.55%.

Non-Interest Income

Non-interest income increased by 15.69% to `18,552.92 crores in 2013-14 as against `16,036.84 crores in 2012- 13. During the year, the Bank received an income of `496.86 crores (`715.51 crores in the previous year) by way of dividends from Associate Banks/subsidiaries and joint ventures in India and abroad.

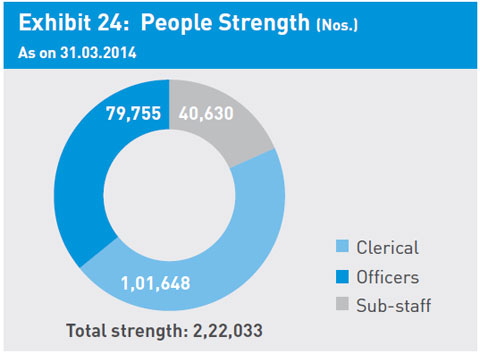

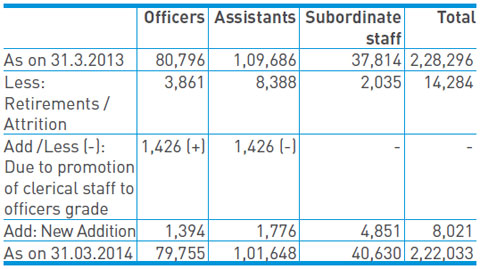

Operating Expenses

There was an increase of 22.43% in the Staff Cost from `18,380.90 crores in 2012-13 to `22,504.28 crores in 2013- 14. The main reasons for increase were higher provision for pension liability due to revision in mortality table from 01.04.2013, impact of which was `2,400.00 crores and provision for wage revision to the tune of `1,814.00 crores. Other Operating Expenses registered an increase of 21.26% mainly due to increase in expenses on rent, taxes and lighting, law charges, postage, telephones, printing and stationery, insurance and miscellaneous expenditure.

Provisions and Contingencies

Major amounts of provisions made in 2013-14 were as under:

`14,223.57 crores (net of write-back) for non-performing assets (as against `11,367.79 crores in 2012-13).

`1,260.69 crores towards Standard Assets (as against `749.61crores in 2012-13), including the current year's provision, the total provision held on Standard Assets amounts to `6,575.43 crores.

`5,282.71 crores towards Provision for Tax in 2013-14, (as against `5,845.91 crores in 2012-13).

`563.25 crores provisions for depreciation on investments, excluding amortisation of premium on 'Held to Maturity' category (as against `961.29 crores write back towards depreciation on investments in 2012-13).

Reserves and Surplus

An amount of `3,339.62 crores (as against `4,417.86 crores in 2012-13) has been transferred to Statutory Reserves.

An amount of `216.75 crores (as against `19.17 crores in 2012-13) has been transferred to Capital Reserves.

An amount of `4,796.63 crores (as against `6,453.26 crores in 2012-13) has been transferred to other Reserves.

Assets

The total assets of the Bank increased by 14.43% from `15,66,211.27 crores at the end of March 2013 to `17,92,234.60 crores as at the end of March 2014. During the period, the loan portfolio increased by 15.70% from `10,45,616.55 crores to `12,09,828.72 crores. Investments increased by 13.52% from `3,50,877.51 crores to `3,98,308.19 crores as at the end of March 2014. A major portion of the investment was in the domestic market in government securities.

Liabilities

The Bank's aggregate liabilities (excluding capital and reserves) rose by 14.08% from `14,67,327.59 crores on 31st March, 2013 to `16,73,952.35 crores on 31st March, 2014. The increase in liabilities was mainly contributed by increase in deposits and borrowings. The Global deposits rose by 15.94% and stood at `13,94,408.50 crores as on 31st March, 2014 against `12,02,739.57 crores as on 31st March 2013. The borrowings increased by 8.24% from `1,69,182.71 crores at the end of March 2013 to `1,83,130.88 crores as at the end of March 2014.

-

CORE OPERATIONSOpen or Close

Customer Service

At SBI, we believe customers represent the foundation of our achievements across decades. It is their continuing support in our vision that has helped us strengthen our legacy as the nation's most successful commercial Bank. Therefore, all our strategies and initiatives revolve around the 'Customer' and his/her preferences and aspirations.

Our Customer Service link, available 24 x 7 on SBI-Online, has the option of Online/Offline Complaint Registration. Also Online/Offline Appreciation/ Feedback portal provides the feeling of 'Customer Delight', to our customers.

The Bank was the first in India to introduce a code of Fair Banking Practices in the country called 'Towards Excellence'. The code reflects the Bank's continuing commitment to provide world-class banking services to all sections of society. Towards this purpose, SBI has laid down several policies:

Policy on Grievance Redressal

Compensation Policy

Cheque Collection Policy

Policy on Depositors' Rights

Policy on Security Repossession/Code of Conduct for Recovery Agents

Policy on Multi-city Cheque

Contact Centre

SBI's Contact Centre caters to customers through inbound calls and e-mails. It has emerged as a strong alternate channel and is providing following customer services:

Account Information to customers having ATM-cum- Debit Card (Balance info, last five transactions, among others).

Debit Card hot-listing and Status of the debit card, ATM PIN re-generation request.

Information on products and services and lead registration.

Registration of complaints.

Pension particulars (Basic Pension, Dearness allowances, status of life certificate, among others).

Online trouble shooting for Mobile Banking, Internet Banking and Mobi-cash.

Status of NEFT/RTGS and SBI Express Remittances.

Contact Centre is available 24x7 through 2 toll free helpline nos. 1800 11 2211/1800 425 3800 and toll number 08026599990. Bank has 4 Contact Centres at Vadodara, Bangalore, Agra & Kolkata.

This helpline provides a human interface of the Bank, thus helping in migrating the customers from branches. It is estimated that it helps in reducing footfalls at branches by an average of 20 customers/day per branch.

It is handling approximately 3.50 lakhs calls/day in 12 languages including Hindi and English. Out of this, Customer Service Representatives attend approx. 80,000 calls, whereas the remaining calls are served on self-service options through Interactive Voice Response System (IVRS).

It is also responding to e-mails received on major SBI Corporate IDs like contactcentre@sbi.co.in, ibanking@ sbi.co.in, customercare.homeloans@sbi.co.in, feedback. mobicash@sbi.co.in

Customer Day

In keeping with our Vision Statement, SBI strives to achieve one of the highest standards in customer service. Customers have direct access to relevant Authorities, Controllers and the Management at the apex. Two days in a month are observed as 'Customer Day', when Branch Head & Administration Officers are available to receive suggestions from customers and resolve their grievances.

The Bank's mandate is to redress customer grievances within maximum three weeks of receipt, as against a 30-day timeline prescribed in the BCSBI Code. All ATM related customer complaints are redressed within seven days (prescribed by the RBI). The Bank has put in place a Compensation Policy to compensate aggrieved customers financially for any slippage in services extended.

Fraud Prevention and Monitoring

The Bank has taken several measures to strengthen the internal control mechanism to prevent frauds.

I. Business Groups

- A) National Banking Group

- B) Corporate Banking Group

- C) Mid Corporate Group

- D) International Banking Group

- E) Global Market Operation

A) National Banking Group

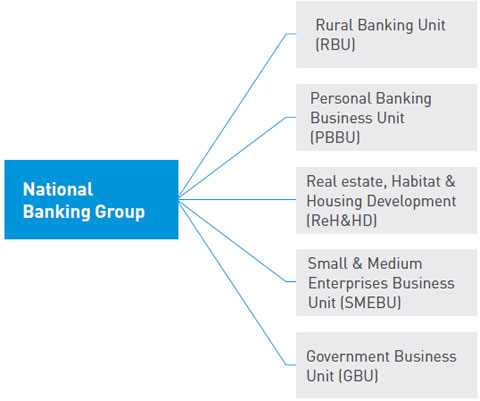

The National Banking Group (NBG) is the largest business vertical of the Bank, anchoring 95.24% of total domestic deposits and 52.05% of total domestic advances, as on 31st March, 2014. It is also the largest business vertical in terms of branch network and human resources.

RBU, PBBU, ReH & HD and SME business units are having business portfolios above Rupees One Lakh crores, each.

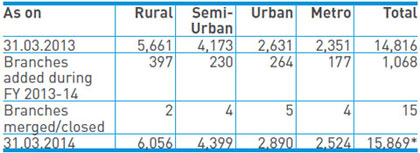

Exhibit 1: Branch Expansion Trend

* Excluding 24 BPR/ other outfits (RACPCs, CPCs, etc.)

Exhibit 2: NBG Business Performance (` in crores)

* excluding account transfer to MCG during FY 2013-14

Financial Inclusion (FI)

The Bank has set up 45,487 Business Correspondent (BC) Customer Service Points through alliances both at the national and regional level.

The Bank is offering various technologically enabled products through BC channel, such as Savings Bank, flexi RD, STDR, remittance and SB-OD facilities.

The Bank has achieved 100% coverage across 31,729 villages during FY 2013-14. The cumulative coverage totalled 52,260 villages.

Over 11,423 BC outlets have been set up across urban/ metro centres, which cater to the requirements of migrant labourers and vendors, among others. During FY 2013-14, 226 lakhs remittance transactions for `9,983 crores were registered through BC channel.

During FY 2013-14, the Bank has opened 1.50 crores small accounts with simplified KYC, taking the overall tally to 3.53 crores accounts.

The transactions volume through the BC Channel has grown to `22,525 crores during FY 2013-14 as against `13,033 crores during FY 2012-13.

To facilitate transactions through alternate channels, the Bank has issued 24 lakhs FI Rupay ATM Debit Cards to FI customers.

Linking of villages to branches through CSPs in a hub-and-spoke model has been launched and 69,749 villages have been linked so far. A facility of depositing loan repayments at 31,919 BC outlets has also been enabled.

Direct Benefit Transfer (DBT) Scheme has been successfully rolled-out. The Bank has successfully completed 27.41 lakhs transactions amounting to `505 crores as Sponsoring Bank in addition to handling 7.1 lakhs transactions amounting to `98.61 crores as Receiving Bank. Overall 1.36 crores accounts were linked with Aadhaar across the country.

SBI is the sole Sponsoring Bank for DBT for LPG transactions, which are processed centrally for all the three Oil Marketing Companies; over 8.98 crores transactions amounting `5,393 crores were successfully processed.

Over 4.46 lakhs SHGs are credit linked with credit deployment of `5,134 crores. Our market share in SHGs is 22%.

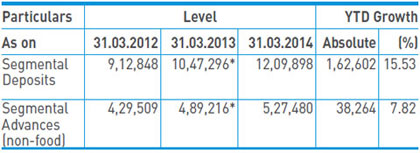

Agri Business

The Bank retained its leadership in Agri Business by crossing `1,16,081 crores under agri-segmental advances covering over 1.13 crores customers. A total of 5.13 lakhs new customers were brought in the Bank's fold during FY 2013-14.

Short-term production credit constituting KCC and Agri Gold Loan, recorded 14% Y-o-Y growth.

Average agri loan ticket size increased to `1.03 lakhs through migration of crop loans to revised Kisan Credit Card scheme operated through ATM enabled State Bank Kisan Cards.

The number of Kisan Credit Card issued by Bank crossed 61.60 lakhs during FY 2013-2014.

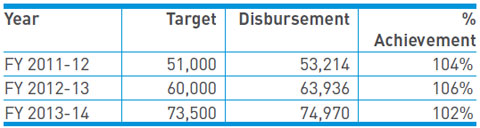

Flow of Credit to Agriculture

As in the past, the Bank has surpassed Agri credit flow target set by GOI during FY 2013-14.

Exhibit 4: Flow of Credit to Agriculture Trend

New Products Launched

To meet the emerging needs of the farmer in tune with market dynamics, the Bank has rolled out new loan products - 'Multi-Purpose Agri Gold Loan' a hassle-free and tailor-made product to tap the potential in Agri Gold Loan business for all investment credit needs, such as minor irrigation, horticulture and farm machinery, among others.

Special Campaigns

To create awareness among farmers and to improve coverage/penetration of the Bank's Agri products, special campaigns were launched.

KCC Campaign: To drive growth in KCC loan portfolio through renewal and migration of existing KCC accounts under the revised KCC scheme, a business of `6,841 crores was garnered under the campaign in FY 2013-14.

Swarnadhara Campaign: To promote Agri gold loans and Multi-Purpose Agri Gold Loan, the campaign was re-launched quarterly and mobilised a business of `4,342 crores during FY 2013-14.

Tractor Loan Carnival: To promote 'New Tractor Loan scheme', which was dovetailed to capture and regain the competitive tractor market and garnered a business of `274 crores in FY 2013-14.

Krishi Plus: To target the existing high-value agri borrowers (limit of `3 lakhs and above) with good track record for the sanction of an additional loan to capture growth with quality. A total of 4,148 accounts, aggregating to `108.15 crores, have been sanctioned under the campaign.

Bonding with Farmers

SBI Ka Apna Goan Scheme: During FY 2013-14, 121 new villages were adopted under 'SBI Ka Apna Goan Scheme' for overall development, taking the total number of villages adopted to 1,393.

Farmers Club: A total of 145 new Farmer Clubs were formed for fostering continued relationship with the farming community taking the total number of Farmer Clubs to 10,670 as on 31st March, 2014.

Growth Enablers

Hub-and-Spoke Model with BC network: The Bank has established linkage with 67,489 villages through 34,064 rural CSPs for scouting applications from customers residing in remote unbanked areas and bringing them into the banking fold.

Loan Origination Software (LOS):

Loan Origination Software (LOS) for SME: The LOS for SME Business Unit has been conceived to capture the presanction process of advance portfolio, thereby ensuring quality and uniform standards of credit dispensation and finally ensuring a robust record and information retrieval system. The LOS system helps in handling a large volume of applications, eliminates repetitive work and improves the record and retrieval system.

Personal Banking Business Unit (PBBU)

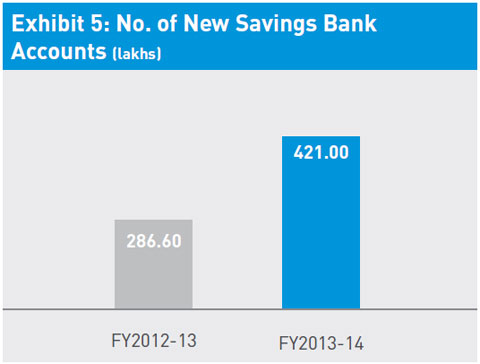

Domestic Business

Domestic Deposits have grown by `1,17,100 crores (16.87%) and Advances by `6,702 crores (7.43%) as on 31st March, 2014. CASA Deposit has grown by 15.51% and CASA Ratio as on 31.03.2014 is 46.95%. During the year, we have taken the following steps to strengthen our Savings Bank product and to make it more competitive:

Online Account opening facility has been popularised.

Personal Accident Insurance was enhanced by adding two new insurance cover slabs of `10 lakhs and `20 lakhs.

Medical Insurance was introduced for Savings Bank Account holders.

Number of free multicity cheques was linked to the Average Quarterly Balance (AQB).

The above mentioned initiatives strengthened customer acquisition.

Other Highlights

The number of Premier Banking customers has increased from 2,78,509 to 3,57,679 customers during FY 2013-14. There is 27% growth in deposits in this segment.

During the year, four exclusive HNI branches and 45 new PBBs were opened.

NRI Services

During FY 2013-14, NRI Deposits have grown by `32,518 crores (42%) and reached a level of `109,958 crores as on 31.03.2014. Advances to NRIs recorded a growth of `538 crores (24%) during the FY 2013-14, the level reached being `2,751 crores as on 31.03.2014. We had also launched the special FCNB scheme to mobilise foreign currency deposits under the RBI's special SWAP window from 04.10.2013 to 25.11.2013 and garnered an amount of USD 3089 million.

The Bank has been to make the most of our available services and products through online channels. Therefore, we recently launched the Online Account Opening facility for NRI customers.

SBI was the Principal Sponsor of Pravasi Bharatiya Divas, an annual flagship event for NRI Diaspora from all over the world, organised by the Ministry of Overseas Indian Affairs, which was held at Vigyan Bhavan, New Delhi from 7th-9th January, 2014.

To strengthen our pre-eminent position in the area of NRI Services, we have opened five new NRI branches in India during the current financial year, taking the number of total NRI branches to 74. These dedicated branches have an excellent ambience, along with a well-skilled team of officials to serve NRI customers. Apart from these branches, there are also about 100 NRI intensive branches across all Circles servicing substantial volumes of NRI business.

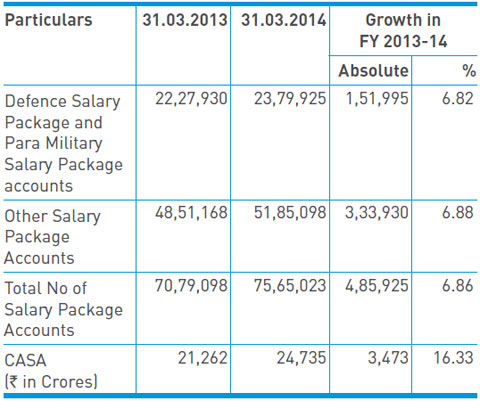

Corporate and Institutional Tie-Ups

The Bank now has customised Special Salary Packages for employees of Corporates, Defence, Para Military, Railways, Central Government, State Governments as well as Police, which enable a focused marketing approach.

Related Assets and Liabilities business garnered from this niche group is `36,970 crores in Time Deposits and `29,999 crores in retail loans comprising Home Loans (`14,913 crores), Auto loans (`3,135 crores), Xpress Credit Loans (`11,951 crores). Four hundred and sixty six new tie-ups were entered under the Corporate Salary Package during FY 2013-14.

Exhibit 6: Corporate & Institutional Tie-Ups

Auto Loans

The Auto Loan portfolio has grown by 12.60% during FY 2013-14, despite negative growth in the passenger car market. The Bank is currently offering car finance on 'On Road Price' of the car, with longest repayment period of 7 years, no pre-payment penalty, no advance EMI and at competitive interest rates. A new online Car Loan application system was launched and rolled out pan-India to source Car Loans online.

Education Loans

SBI Education Loans has grown at 7.19% YoY (during FY 2013-14). SBI has a total exposure of `14,740 crores as on March 2014. SBI is the market leader in Education Loans with a market share of around 24.9% among ASCB as on February 2014.

SBI Student Plus Advantage Credit Card, designed specifically for Education Loan Borrowers, was launched in collaboration with SBI Cards Ltd. to provide them with an additional means of financing their expenditure whenever needed.

Personal Loans

The Personal Loans Portfolio, which is the second largest in the Personal Banking Segment with an outstanding of `48,432 crores as on 31.03.2014, includes Personal Loans, Loan against Securities, Loan against Properties and Gold Loan. It has grown by `2,244 crores during FY 2013-14. Loan against Time Deposits, which is one of the major products in Personal Loans Portfolio, grew by `1,162 crores.

Real Estate, Habitat & Housing Development (ReH & HD)

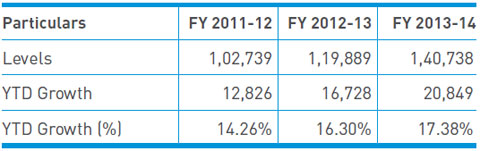

During FY 2013-14, the Bank has recorded an all time high growth of `20,849 crores in home loans and maintained its position as the country's largest home loan provider. The market share amongst All Scheduled Commercial Banks (ASCB) in home loans has improved by 8 bps from 25.94% (as on 31.03.2013) to 26.02% (as on 31.03.2014).

Exhibit 7: Performance in Home Loans (` in crores)

During FY 2013-14, the Bank took several initiatives to provide an additional thrust to its Home Loan portfolio. Some of the important initiatives in this regard comprise the following:

A new product named 'SBI HER Ghar' offering a concession of 5 bps on the prevailing Home Loan interest rates was introduced for women borrowers in December, 2013. The Scheme has been well accepted in the market and now accounts for 24% of the incremental sanction of home loans.

Select branches at major centres have been authorised for execution of home loan documents to enhance the level of customer convenience and satisfaction.

The maximum permissible moratorium period under a different scenario has been revised and a higher moratorium period of up to 48 months has been permitted for integrated township and Mega projects.

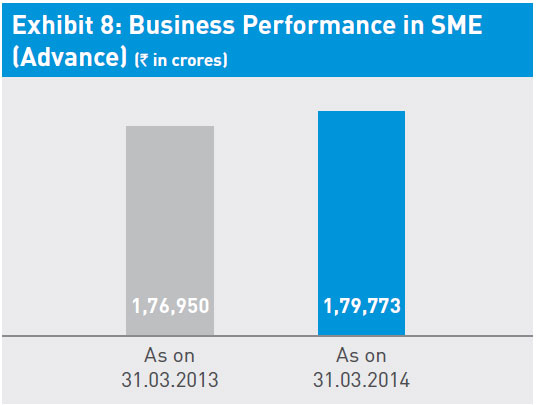

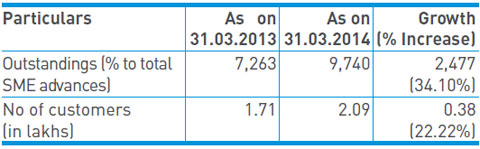

Small & Medium Enterprise (SME) Business Unit

Innovation and New Products: We have developed riskmitigated products for SMEs, such as SBI Asset Backed Loan, SBI Fleet Finance Scheme and POS Linked Current Account with Overdraft Scheme, which are launched in FY 2013-14. We are incorporating sector-specific Scoring Models in the new products and schemes to screen the borrowers at an initial stage to facilitate faster processing.

Relationship Banking: Under a single-window approach, the Bank is offering Relationship Banking to SME Entrepreneurs. The strength of Relationship Managers (Medium Enterprises) was augmented to 597 as on 31.03.2014 and mapped to ME units with credit limits of `1.00 crores and above across the country. The advances portfolio under Relationship banking as on 31.03.2014 is `1,37,180 crores.

Specialised SME Branches: To provide specialised services to SME Entrepreneurs, 579 branches with a predominant portfolio of SME advances are branded as 'SME Branches'. The objective is to identify these branches with a common nomenclature and develop them as centres of excellence for SME loan delivery.

Credit Flow to Micro and Small Enterprises (CGTMSE): The Bank is extending collateral-free lending up to `1 crores to MSE sector under guarantee of CGTMSE.

Exhibit 9: Performance in CGTMSE (` in crores)

Loan Origination Software (LOS) for SME: The LOS for SME Business Unit has been conceived to capture the presanction process of advance portfolio, thereby ensuring quality and uniform standards of credit dispensation and finally ensuring a robust record and information retrieval system. The LOS system helps in handling a large volume of applications, eliminates repetitive work and improves the record and retrieval system.

As on 31.01.2014 one of the schemes of the SME BU i.e. 'SME Smart Score for loans up to `25 lakhs' under LOS was soft launched across all Circles by the GITC, Belapur.

Supply Chain Finance

Leveraging its state-of-the-art technology, SBI is focusing on further strengthening its relationship with the Corporate World by financing their Supply Chain partners.

The Bank has tied up with 70 industry majors across all industry verticals, such as Auto, Oil, Steel, Power, Fertilizer, FMCG and Textile under e-DFS.

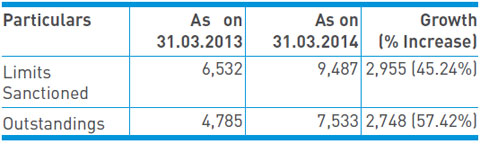

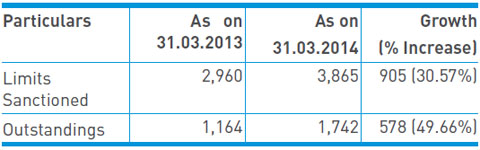

Exhibit 10: Performance in Electronic Dealer Finance Scheme (` in crores)

Exhibit 11: Performance in Electronic Vendor Finance Scheme (` in crores)

SME Insta Deposit Cards: There are 1,516 CDMs installed at various locations across the country, as on 31st March, 2014. The Bank has issued 2,16,847 SME Insta Deposit Cards and 1,33,576 Business Debit Cards to SME customers.

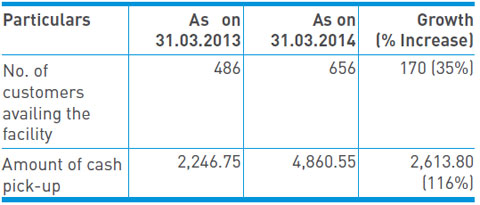

Cash Pick up Facility: The cash pickup facility of collecting cash at customers' doorsteps was introduced for SME customers in August 2011. The growth in usage of this facility has been as under:

Exhibit 12: Performance in Cash Pickup Facility (` in crores)

SME Power Current Account: As on 31.03.2014, the number of Power Accounts stands at 28,215, constituting a deposit base of `3,032.44 crores, as against `2,741 crores in 26,160 accounts as on 31.03.2013.

Unfixed Deposits: The popularity of Unfixed Deposits, launched during November 2011, received good response from a large section of SME and Corporate Client base. The deposit under the scheme grew to a level of `42,159 crores as on 31.03.2014.

Government Business

The Bank handles government transactions (receipts, payments, pensions, among others) as an agent of the RBI on behalf of the Government and various state governments through its authorised branches. During FY 2013-14, the Bank was able to retain its position as the market leader in this business segment, with a market share of around 58% in terms of handling government payments and receipts.

The Bank earned commission from Government transactions of `16.59 billion and `17.80 billion during FY 2013-14 and FY 2012-13, respectively.

The decline in government commission during FY 2013-14 by 6.70% over FY 2012-13, despite a growth of 10.92% in Government turnover is due to:

Migration of Government Receipts on e-mode (which earn `12/- per transaction as against `50/- for physical transaction).

Higher rates of commission were applicable during Q1 FY 2012-13.

The Bank is facilitating the Government of India's e-governance initiatives by launching multiple e-products, such as e-Auction, e-Freight, Rail Shakti, Fee collection for Passport and various examinations, Imprest Cards, Central Plan Scheme Monitoring System, SAAKSHAR Bharat, among others . Many other e-products are expected to be launched during FY 2014-15.

Marketing and Cross Selling

SBI is Corporate Distributor of SBI Life, SBI Cards, SBI Cap Securities Ltd. and SBIMF, along with four other major AMC tie-up partners, such as UTI MF, Tata MF, Franklin Templeton MF & L&T MF, through our branches.

The Bank's cross selling income has increased to `282 crores as on 31.03.2014 from with YTD growth of 14%, as compared to `274 crores as on 31.03.2013. SBI Life life insurance policy has covered 51% of the Bank's home loan borrowers and 50% of education loan borrowers during FY 2013-14. A new Health – Personal Accident Insurance product, launched by State Bank General Insurance, sold 1.44 crores Policies and SBI General has issued 44,000 health insurance policies during the year. State Bank Card & Payment Services Private Ltd. has issued a total of 25,000 credit cards and we have opened 1,20,000 Demat and Trading accounts through our subsidiary SBICAP Security Ltd. during FY 2013-14.

B) Corporate Accounts Group (CAG)

CAG is the dedicated SBU for handling the 'large credit' portfolio of the Bank. The SBU has 7 Offices in 6 regional centers viz. Mumbai, Delhi, Chennai, Kolkata, Hyderabad and Ahmedabad headed by General Managers. The business model of CAG is centered around the Relationship Management concept and each client is mapped to a Relationship Manager who spearheads a cross-functional Client Service Team. The Relationship strategy is anchored on delivering integrated and comprehensive solutions to the clients, including structured products, within a strict Turn-Around-Time. The principal objective of the strategy is to make SBI the first choice of the top corporates thereby increasing the wallet-share and improving the Return on Capital Employed. A sustained Account Planning exercise with rigorous review of the account by senior management sets the pace for the Relationship Management in CAG.

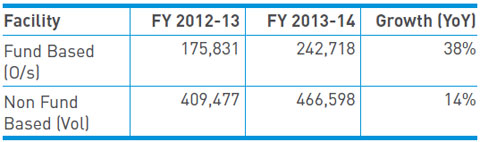

Exhibit 13: Business Performance of CAG (` in crores)

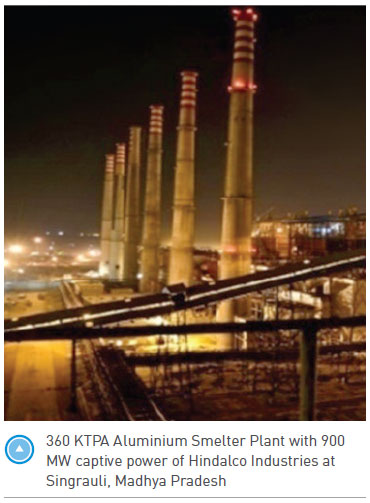

While the Fund Based outstandings of CAG constitutes 20% of total credit portfolio of the Bank, CAG also handles about 61% of the domestic forex business of the Bank. During the year, CAG handled several high value deals eg. Power Grid Corporation, DVC, Tata Steel, Hindalco Industries, etc.

In addition to rupee loans, many clients of CAG borrow significantly in foreign currency. During the year, substantial business was generated not only from Oil PSUs, but also from clients in the private sector.

Around 44% of CAG's exposure is to Infrastructure sector of which 85% is to corporates with ratings of Investment Grade and above, and the risk profile of sectoral movement is well balanced.

In the backdrop of the robust growth of CAG-Mumbai, a second Office in BKC, Mumbai was opened during September -13, and it is proposed to open another office in Delhi shortly so as to ensure that the high standards of asset quality and service delivery are maintained.

Transaction Banking Unit (TBU)

TBU, with special focus on Cash Management Products, Trade Finance and Supply Chain (Dealer / Vendor) Finance, which started working in full-fledged manner during the year 2009-10, has expanded its activity during the last four years.

Cash Management Product (CMP): The Bank provides Cash Management Services "SBI F.A.S.T."- (Funds Available in Shortest Time) to Corporate customers through 1450 branches at 757 centers spread over the country by means of a technology driven platform. The Bank's entire network of over 15,500 branches is also offered to Large Corporates, Non-Banking Finance Companies and Insurance Companies for their Cash Management needs through certain 'Premium Products' such as Powerjyoti – Pre-upload. The whole spectrum of Cash Management services encompassing Liquidity Management, Cheque and Cash collections, Doorstep Banking for Cash and Cheque pickup, collections for Public Issues (IPO/Bonds), e-Collections, Post dated Cheques management, Mandate based debits and Payment services comprising Dividend Warrants, Multi City Cheques, Inter Office Instruments and e-payment are offered.

CMP Centre is the "Sole Refund Banker" for Central Board for Direct Taxes (CBDT). CMP Centre has brought about integration of payment Systems of Controller General of Defence Accounts, Civil Ministries under UMEA and some State Governments with the Core Banking Infrastructure of the Bank by providing Centralised e-Payment Solution enabling the Government Departments to achieve their objectives under National e-Governance Project (NeGP).

Trade Finance: As on 31.03.2014, LC/BG business and income under CAG recorded a YoY growth of 14% and 30% respectively despite the general economic slowdown, a result delivered on the back of the superior services provided.

e-Trade SBI

SBI has established an excellent technology and operation infrastructure for its Trade Finance business. e-Trade SBI, a web-based portal, which was launched by our Bank in March 2011, has been undergoing constant improvement to enhance customer comfort and provide the means to customers to access trade finance services with speed and efficiency by enabling them to lodge Letters of Credit, Bank Guarantees and Bills Collection/negotiation requirements online from any corner of the world. As on 31.03.2014, 1748 Corporates are registered under e-Trade SBI and more than 15000 transactions per month are taking place through e-Trade platform.

e-VFS (Electronic Vendor Financing Scheme) & e-DFS (Electronic Dealer Financing Scheme)

Leveraging our Bank's state-of-the art technology, our relationship with the Corporate World has been further strengthened by financing their Supply Chain Partners through the above two products which are fully automated, secured and robust. They are designed to ensure efficient management of working capital cycle, sustained growth and profitablility of business partners. As on 31.03.2014, 95 industry Majors (IMs) with more than 900 vendors and 3,000 dealers across the country have been migrated to the electronic facility under the e-VFS/e-DFS platform

Financial Institutions Business Unit (FIBU): FIBU, a dedicated vertical created for capturing potential business opportunities from financial institutions viz. Banks, Mutual Funds, Insurance Cos., Brokerage firms and NBFCs.

Capital Market Branch (CMB), Mumbai under FIBU, a specialised branch catering to Capital Market business and Brokers was given the award of being one of the 'Top Performers in BSE in Primary Market segment' by Bombay Stock Exchange for the third consecutive year. CMB has also acted as 'Bankers to Issue/Refund Banker' and mobilised over `18,000 crores in FY 2014.

Project Finance & Leasing SBU (PFSBU)

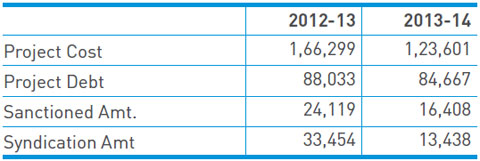

Exhibit 14: Business Performance (` in crores)

PFSBU deals with the approval and arrangement of funds for large projects in infrastructure sectors like power, telecom, roads, ports, airports, as also other non-infrastructure projects in sectors like metals, cements, oil & gas, among others, with certain threshold on minimum project cost. PFSBU also provides support to other verticals for vetting their large ticket term loan proposals. In order to strengthen the policy/ regulatory framework for financing infrastructure, inputs are also provided to various ministries of Govt. of India, Planning Commission, RBI etc. in respect of lenders' views on new policies, Model Concession Agreements, issues being faced in infrastructure financing, etc.

Business Performance of PFSBU: As on 31.03.2014, the portfolio of infrastructure projects under implementation and control with PFSBU involves Power projects with aggregate capacity of 49,335 MW; Telecom Projects serving 250 million subscribers; Road projects covering 5,565 kms; new Ports to handle 45 MTPA multi- purpose cargo and 1.2 million TeU of container capacity; Metro Project in Hyderabad besides a host of projects in steel, cement, Urban Infra, etc. During the year, a total (FB+NFB) of `9,691 crores (`12,884 crores in FY13) were disbursed to these projects.

From the perspective of environment sustainability, the Bank has also been laying emphasis on the renewable sector in power generation and loans aggregating `1,253 Crores (FB Limit) have been sanctioned to 10 projects in wind/solar sectors with total capacity of 624 MW.

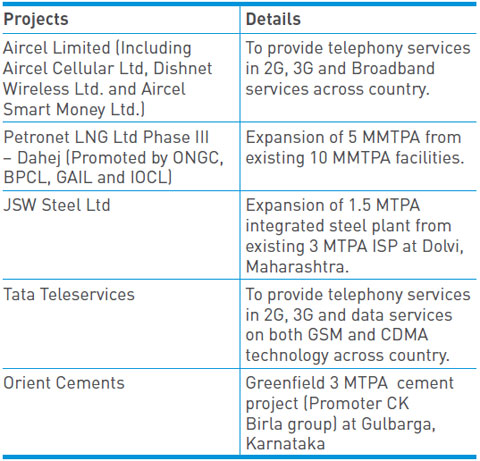

Exhibit 15: Significant deals during FY 2013-14

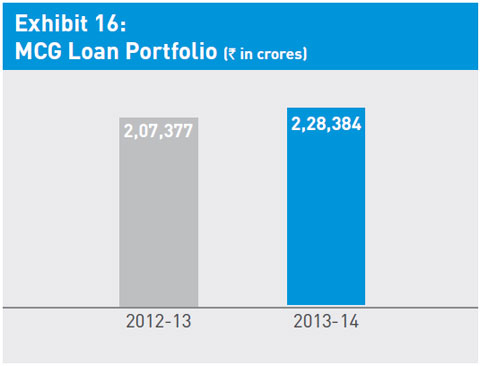

C) Mid Corporate Group

The Bank's Mid Corporate Group (MCG) operates through its 14 regional offices across Ahmedabad, Bangalore, Chandigarh, Chennai (2), Hyderabad, Indore, Kolkata (2), Mumbai (2), New Delhi (2) and Pune, and has 62 branches as on 31st March, 2014.

MCG customers in Eastern India now have easier access to senior officials. This has also resulted in improved credit delivery, with a greater thrust on attracting good quality new business.

Two new MCG branches were opened during FY 2013-14 at Ludhiana (the second branch of the city) and Vijayawada, in order to fully tap the business potential at these centres. This increases the number of Mid Corporate branches from 60 to 62.

The Group continues to assist our customers in India to expand their activities and provides them support for acquiring assets/companies overseas, including by way of loans to overseas subsidiaries/JVs (backed by Letters of Comfort or Stand-by Letters of Credit). Over the years, the Group has helped many such acquisitions by Indian companies in USA, Europe, Australia and Africa, among others.

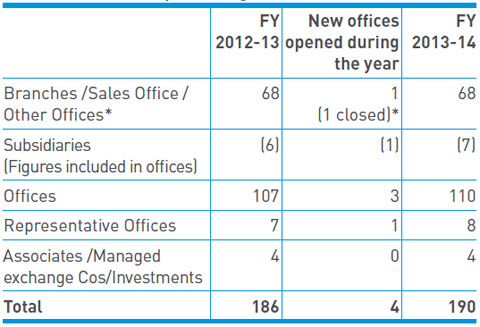

D) International Banking Group

The Bank's international banking network spans across 190 offices in 36 countries.

Exhibit 17: Business performance of Foreign Offices (In USD Million)

Overseas expansion

The number of foreign offices increased from 186 as on 31st March, 2013 to 190 as on 31st March, 2014 spread across 36 countries. The offices include 52 branches, 8 Representative Offices, 110 offices of the 7 foreign banking subsidiaries and 20 other offices. During FY 2013-14, we have forayed into two new countries – in Botswana by establishing a subsidiary and in South Korea by opening a representative office.

Exhibit 18: Break-up of foreign offices (No.)

* Maamigili sub-office in Maldives was upgraded to a Branch and Jackson Heights branch in the USA was closed.

Treasury Management

The Bank's foreign offices maintained comfortable liquidity position during the fiscal, despite volatile market conditions. In April 2013, we successfully priced a USD 1 billion Bond issue, which is a 144A/Regulation S offering and will mature in April 2018.

In September 2013, SBI undertook a Bond Buy Back programme under which Bank bought back USD 147 million worth of April 2018 bonds.

Our foreign offices introduced a leverage product for NRIs in November 2013 to increase Foreign Currency Non- Resident Bank (FCNRB) deposits under the Special Swap window scheme of RBI. An amount of USD 2.518 billion was disbursed to NRIs at Foreign Offices under this scheme.

Remittance

Inward remittances grew from `69,812 crores in FY 2012- 13 to `86,817 crores in FY 2013-14 (24%). Tie-ups with 30 exchange companies and six banks in the Middle-East Countries for routing remittances through our Bank have substantially contributed to increased inward remittances.

Domestic Operations Merchant

Merchant Banking

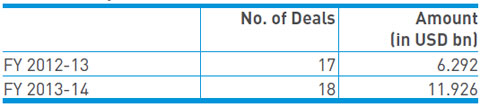

The Bank retained its premier position as Mandated Lead Arranger and Book Runner for syndicated loans in Asia Pacific (ex-Japan) for the eighth consecutive calendar year ending December 2013 and sustained its lead position in January-March 2014 period too.

During 2013-14, we acted as the Mandated Lead Arranger in 18 deals aggregating USD 11.926 billion for several leading Indian corporates like Tata Steel Canada Capital Ltd., IOCL, HPCL, OIL, ONGC Videsh, REC, ONGC Mangalore Petrochemical Ltd., Reliance Industries, HDFC Ltd., IDFC Ltd. and Yes Bank.

Exhibit 19: Syndicated Loan Deals

Apart from this, we extended 23 foreign currency facilities aggregating USD 4.611 billion to Indian corporates on a bilateral basis. We also acquired 5 loans amounting to USD 120.00 million through the secondary market.

The Bank earned a fee income of USD 79.70 million from foreign currency term loans concluded during FY 2013-14 through syndication/ bilateral deals.

Global Link Services (GLS)

Global Link Services (GLS), a specialised outfit, caters to centralised processing of Export Bills collection, Cheque collection and online inward remittance transactions.

During FY 2013-14, GLS (on behalf of domestic branches) handled 75,177 export bills and 58,248 foreign currency cheque collections aggregating USD 13.20 billion. In addition, it handled 78,49,396 online inward remittance transactions amounting to USD 6.10 billion received globally.

During FY 2013-14, the Bank launched a new online instant remittance product 'Sri Lanka to India – SBI Flash' for remittances from Sri Lanka to India. GLS has also developed a platform for cross border remittances from Gulf to Bangladesh/ Nepal/ Sri Lanka.

Correspondent relations

The Bank maintains correspondent banking arrangement with 385 reputed International Banks across 113 countries in order to extend seamless services to varied clients. Along with the correspondent banks, we also have more than 1,725 Relationship Management Application (RMA) arrangements with Society for Worldwide Interbank Financial Telecommunication (SWIFT), facilitating speedier flow of financial messages.

E) Global Markets Operations

Global Markets Group performs the treasury functions of the Bank, ensuring safety, liquidity and yield, besides maintaining statutory reserve requirements. The corpus under management of Global Markets increased by around 20% Y-o-Y to `4,70,000 crores. Further, Global Markets Group provides foreign exchange services and hedging instruments for risk management to customers. It also offers portfolio management services to many retirement funds.

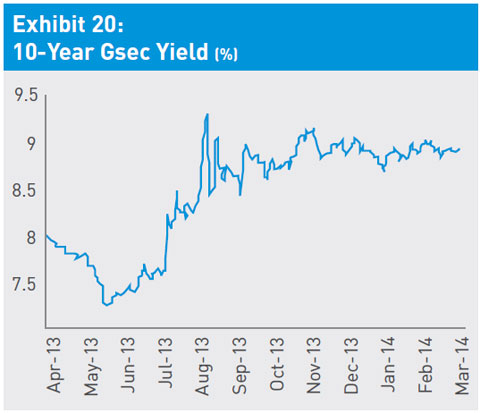

The FY 2013-14 started on a positive note with RBI cutting the repo rate by 25 bps to 7.25% in May 2013. The 10 year benchmark yield fell from 8.01% in April 2013 to 7.09% in May 2013. However, conditions deteriorated for Indian financial markets after Federal Reserve's announcement of its intention to taper QE purchases which led to a sharp depreciation of the rupee.

The Reserve Bank of India (RBI) announced unprecedented measures like capping Repo borrowing to 0.5% of NDTL and increasing MSF rate by 200 bps to 10.25% which led to a sudden surge in bond yields to 9.48%. Conditions improved from October 2013 onwards with RBI gradually reversing many of the tightening measures and injecting liquidity into the financial system through term repos. As RBI remained focused on inflation control, benchmark yields closed the year at elevated levels.

During FY 2013-14, the Bank made record profit of `1,846 crores from sale of investments as against `180 crores in FY 2012-13. Moreover, in the area of cash management, we have consistently outperformed peer banks in CRR maintenance by about 270 basis points, resulting in interest cost savings of over `100 crores.

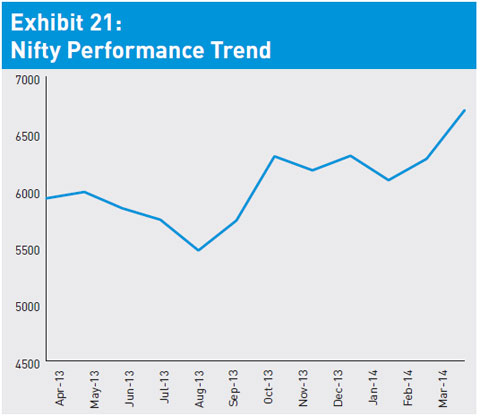

Equity markets witnessed a rally from September on improvement in macroeconomic parameters like stable exchange rate and current account deficit buoying FII inflows. During FY 2013-14, the Bank's active equity portfolio (excluding Non Performing Investments) yielded a cash flow return of 22.73% against a Nifty return of 17.12%. If we reckon the dividend income, the return improves further to 25.56%. During the year, the Bank participated in select Equity MFs, IPOs, Offers for Sale and FPOs.

The Bank continued to explore opportunities in the area of private equity and venture capital fund investments. During FY 2013-14, investments of `345 crores were made in different venture capital and private equity funds.

Global Markets provides foreign exchange solutions to the customers in all currencies for managing their currency flows and hedging risks through options, swaps, forwards and bullion services. As part of its continuous endeavour to provide enhanced services to its customers, the Bank has also introduced digital signatures for its corporate customers. The Bank also leverages a world class technology platform to seamlessly process currency flows between its customers through branches and the dealing room.

The treasury marketing outfits complement this by engaging with customers to provide them with inputs about markets and suggesting products to suit their requirements. The Bank earned an income of over `1,470 crores (from domestic operations) by covering the customer flows in foreign exchange, hedging, gold, and proprietary trading.

Global Markets also manages FCNR(B) corpus of the Bank and provides funds for Export Finance in Foreign Currency and FCNR(B) loans in foreign currencies for the customers in India.

The Bank provides portfolio management services to an array of retirement funds in the country consistently giving superlative returns. The Portfolio Management Services section, with an AUM of over `2,79,000 crores has consistently outperformed private sector peers in generating returns for the Employees Provident Fund Organisation (EPFO) funds. For the last three years, your Bank has been consistently adjudged as the best fund manager for EPFO.

The Bank was ranked the 'Best Local FX Bank in India' in Asiamoney's 25th anniversary Poll of Polls for its consistently stellar performances in Asiamoney's annual polls.

-

New BusinessesOpen or Close

A dedicated department develops and launches initiatives in emerging business areas, including tech-based products. Some key initiatives are:

Debit Card

State Bank Group (SBG) continues to lead Debit Card issuance in the country with over 150 million Debit Cards as on 31st March, 2014 and over 40% market share.

Spending by debit cardholders of the SBG across 'Point of Sale' and 'e-Commerce' transactions crossed `22,407 crores in FY 2013-14. We have introduced some significant offers like the '3-Swipe Campaign' during August- September, 2013 and 'Shop Big and Gain Big' campaign in collaboration with SBI Card (subsidiary), in October- November, 2013.

Prepaid Card

The Bank's product range includes the following Prepaid Cards to cater to various payment needs of its customers:

Foreign Travel Card: The Foreign Travel Card, now a chip based EMV compliant Card, is available in 8 currencies, US Dollar (USD), Great Britain Pound (GBP), Euro, Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (JPY), Saudi Riyal (SAR) and Singapore Dollar (SGD), providing safety, security and convenience to overseas travellers. We have also introduced corporate variants of State Bank Foreign Travel Card (SBFTC) to cater to the needs of corporate employees travelling overseas. Sales stood at USD 83.34 million in FY 2013-14.

eZ- Pay Card: The eZ- Pay Cards are aligned with most of the social schemes of the State and Central Governments in addition to salary payments by corporate entities, thus benefitting millions of households. Sales stood at `829.19 crores in FY 2013-14.

Gift Card: Gift Cards are a preferred option for consumers to gift the 'Freedom of Choice' to their loved ones. Customers can purchase Gift Cards online. Sales stood at `128.73 crores in FY 2013-14.

State Bank Achiever Card: Rolled out in November 2013. This is a re-loadable Corporate incentive Card with a validity of 10-years for disbursement of incentives/ awards.

Smart Payout Card: We launched the Smart Payout Card, a reloadable Card, on 27th April, 2013, for blue collar workers and contract labourers, among others. This Card can also be issued as an 'Add-on Card' to our savings Bank account holders. Sales stood at `15.19 crores in FY 2013-14.

Merchant Acquiring Business (MAB)

The MAB division aims to activate more than 150 million SBG Debit Cards on POS terminals, increase visibility and create a comprehensive electronic infrastructure in the country. We are already the largest player among Public Sector Banks with around 1,35,853 terminals (as on 31st March, 2014) in the market. We are also the 4th largest Acquirer in India and have entered into corporate tie-ups with many prominent players, including top educational institutions and hospitals as we continue to tap the huge potential available in the market. During the year the Bank has also launched Mobile POS on a pilot basis and will be rolling it out on a pan-India basis in the next few months.

Mobile Banking Service

The Bank is the market leader with a market share of 57% in transaction volume and 17% share in terms of value.

During 2013-14, financial transactions worth `3,763 crores were executed through the Mobile Banking Service, resulting in an income of `6.43 crores.

Green Channel Counter (GCC)

The Bank has launched the GCC facility in all retail branches (14,981 branches) to enhance convenience to the customers and save on cost and time per transaction. More than 360,000 transactions are taking place on a daily basis through these counters.

Self Service Kiosk (SSK)

The Bank has 1,352 SSKs as on 31st March, 2014 enabling more than 55,000 transactions daily.

Green Remit Card (GRC)

The Bank introduced GRC, a remittance card, on 2nd January, 2012 for facilitating large number of non-home cash deposit transactions at our branches. A cardholder can swipe the card at GCC or at Cash Deposit Machines (CDM) and remit money to the beneficiary whose account number is mapped to the card. Once the transaction is completed, both the remitter and beneficiary get a confirmation through SMS. The Bank has issued more than 48,00,000 cards resulting into 1,81,00,000 transactions as on 31st March, 2014.

State Bank Aggregator Service (SBIePay)

The Bank has launched 'SBIePay', a payment aggregator service, which facilitates e-Commerce/ m-Commerce transactions among merchants, customers and various financial institutions for all kinds of e-Commerce payments. The Bank's Chairman, Smt Arundhati Bhattacharya, launched the service at Corporate Centre, Mumbai on 13th March, 2014. The new service will go a long way in providing our customers with online payment facilities.

-

NPA ManagementOpen or Close

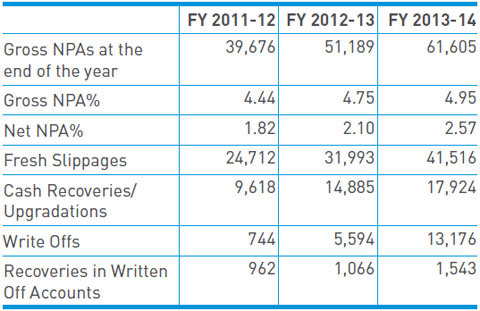

A depressed macro-economic environment in FY 2013-14 led to increased loan defaults with deterioration in asset quality of Indian banks. Slippages have occurred across all sectors and today, resolution of NPAs is the single largest challenge before all banks.

Stressed Assets Management Group (SAMG) is a dedicated and specialised vertical, headed by a Deputy Managing Director, created specially to efficiently resolve high value NPAs. Today SAMG has 16 SAMG branches and 43 SARBs across the country. Currently, SAMG covers 23.79% and 54.33% of the Bank's Non Performing Assets (NPAs) and Advances under Collection Account (AUCA) respectively. The recovery efforts of SAMG are supplemented by efforts put in by front-line operating staff at our 15,869 branches across the country. Besides, Account Tracking & Monitoring (AT & M) Centres have been operationalised in all Circles to contact retail Special Mention Accounts (SMAs) and NPAs. Business Correspondents, Business Facilitators and Self Help Groups are also involved in recovery of Agricultural NPAs.

The sale of final assets to ARCs has resulted in reduction of NPAs by `3,590 crores and AUCA reversal of `1,092 crores. different strategies were adopted for achieving optimum sales level and price.

SAMG resorts to various strategies to resolve stressed assets. Some of these are enumerated below:

Restructuring of both Standard assets and NPAs, either though the corporate debt restructuring mechanism or through a bilateral arrangement.

Recovery through auction of assets using the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) route.

Filing suits in Debt Recovery Tribunals and other Courts for recovery of dues.

Identifying and engaging with strategic investors for takeover of stressed assets.

Sale of NPAs to Asset Reconstruction Companies.

Entering into One-Time Settlements with borrowers.

Using Resolution Agents to take possession of properties mortgaged to the Bank and arranging for their auction.

Using the e-auction platform to reach out to as many prospective bidders as possible.

Considering Debt Asset swaps in some cases.

Engaging investigation agencies to trace out unencumbered promoter and guarantor assets and obtaining attachment before judgements over these properties.

Identifying Companies and promoters as Wilful Defaulters and arranging for display of their names on the websites of Credit Information Companies such as CIBIL. These names are also reported to the RBI.

Publishing photographs of defaulters in newspapers where warranted.

Persuading Large Corporate borrowers under stress to sell non-core assets, dilute their shareholding and bring in strategic investors thus reducing debt and improving viability.

Asset Quality Improvement measures for P-Segment

The Special One Time Settlement (OTS) scheme for the National Lok Adalat/Bank Adalat to settle NPA accounts has been used diligently.

SMSes are being sent to borrowers: (i) Seven days before EMI due date, (ii) One day before EMI due date, and (iii) After EMI due date.

The scope of Bank's Contact Centre at Baroda and telecalling centre at SBI Cards/GE, Gurgaon has been expanded to encompass soft recovery follow-ups of all P-Segment Loans.

A tie-up has been made with Shriram Automall India Limited (SAMIL) to assist operating functionaries in seizure and auction of vehicles.

Use of Loan Origination Software (LOS) has been made mandatory for Auto Loans and Personal Loans (except Loan against Time Deposits, P-Segment Gold Loans and Education Loans) and its integration with the Risk Scoring Model (RSM) and CIBIL check to take care of many process related risks.

Asset Quality Improvement measures for Agriculture loans

As far as agriculture loans were concerned, various One-Time Settlement Scheme (OTS) schemes like 'OTS Scheme for Tractor Loan', 'OTS Scheme for ATL' were rolled out for quick resolution of hardcore NPAs in Agri term loans. These schemes resulted in a recovery of `378 crores during FY 2013-14.

Campaigns launched: 'KCC (Zero NPA) Campaign' was launched to drive renewal of overdue KCCs with the objective of arresting NPAs accretion and reduction. Over 16.57 lakhs KCCs in the likely stressed category were renewed. Kitna Baki Hai campaign was launched during December 2013 to drive daily monitoring of KCC renewal position through SMS based reporting to reach KBN (Kuchi Baki Nahi).

Green Power represents an innovative scheme to improve loan recovery culture among farmers by rewarding the villages with solar street lights under corporate social responsibility.

Asset Quality Improvement measures for Corporate accounts

The asset quality of CAG remained well under control with the gross NPAs at 0.99% of total advances. About 87% of CAG's portfolio is investment grade with 40% carrying the highest rating from the external rating agencies.

Mid corporate segment has been more severely affected by the economic downturn, leading to deterioration in asset quality. The Non Performing Assets (NPAs) of MCG have increased from `18,443 crores in March 2013 to `32,715 crores in March 2014. To tackle this issue, the Group has strengthened the processes of appraisal/sanction, follow-up and supervision. Every effort is made to improve the asset quality through regular engagement with promoters of weak/ stressed accounts.

The Bank has formed various committees headed by Chairman/ Managing Directors/ Deputy Managing Directors/ Chief General Managers/ General Managers/ Deputy General Managers to periodically review stressed assets and suggest resolution strategies.

SAMG has brought in substantial recoveries in high value NPAs and some decades-old dues during FY 2013-14 due to its specialised attention and concerted efforts. Despite a harsh environment last year, we achieved a deceleration in NPA accretion due to SAMG's relentless efforts along with the support of SAMBs/ SARBs/ SARCs.

This was particularly evident during Q4 of FY 2013-14 when Gross and Net NPA percentages were brought down by 78 basis points and 67 basis points respectively from the peak levels of 5.73% and 3.24% witnessed during the year. More details are furnished below:

Exhibit 22: NPA Management Performance (` in crores)

The SAMG and other recovery outfits of the Bank are fully geared to meet the asset quality challenges of FY 2014-15 when near-term pressure is expected to continue. We are in the process of establishing an Early Warning System to identify incipient sickness and stress in loan accounts so that we can take in advance corrective action, including timely restructuring in deserving cases. This would prevent slippages and maintain good asset quality.

-

SUPPORT AND CONTROL OPERATIONSOpen or Close

II. 1 Information Technology

Core Banking Project

CBS environment has been benchmarked to support one billion accounts, over 250 million transactions in a day, and delivering a throughput of over 17,000 transactions per second. Biometric authentication as a second-factor authentication has been implemented in branches for all CBS users. The process for the systematic and proactive risk identification, assessment, measurement, monitoring and mitigation of various risks in the IT vertical has been initiated.

Alternate Channels

Exhibit 23: Alternate Channels Growth (Numbers)

ATM

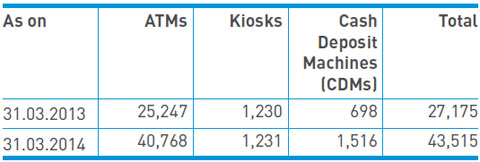

State Bank of India, along with its Associate Banks has one of the largest ATM networks in the world with more than 51,491 ATMs including Kiosks and Cash Deposit Machines as on 31.03.2014. SBI has issued more than 17.04 crores Cards. The ATM Base 24 Switch has recently been upgraded to handle close to 50,000 ATMs.

The objective is to strengthen ATM facilities across every nook and corner of this vast country and enhance customer convenience. During 2013-14, SBI has installed 16,340 ATMs, a record in India's banking history for such a massive ATM rollout. The total number of ATMs (standalone) now stands at 43,515 as on 31.03.2014.

With 26% of market share in India's ATM population, SBI's ATM network transacts 38% of the country's total ATM transactions. On an average, over 70.00 lakhs transactions per day are routed through our ATM network. Our ATM network is one of the busiest in the country with average hit rate of more than 200 transactions per day per ATM. SBI has a Debit Card base (standalone) of 13.74 crores.

More than 1000+ ATMs have been enabled as Talking ATMs for Visually Impaired Customers during FY 2013-14, which took the total Talking ATM strength to 4,000+ as on 31st March, 2014.

Cash Deposit Machines (CDM): SBI is aggressive in rolling out CDMs for cash deposit by customers at these machines by using their ATM-cum-Debit card. As on 31.03.2014, the number of CDMs installed was 1,516. These CDMs are available to the customer 24 x 7 for their convenience.

INB & e-Commerce

Internet Banking

Internet Banking service is available through the Bank's website "https://www.onlinesbi.com". The Bank's internet banking solution is a comprehensive product for both retail and corporate users.

The Bank's Net Banking Platform 'onlinesbi.com' provides secured and hassle-free on-line banking services to its retail and corporate customers, including PSUs and Government Agencies:

This cost-effective channel has enabled 63.77 crores transactions during FY 2013-14, achieving 52% growth over the previous year.

Our robust Retail Internet Banking platform has also been optimised for visually impaired customers.

The Corporate Internet Banking is well suited to Small, Medium and Large Corporates in establishing traction with Government Treasury and Accounts Departments too.

During FY 2013-14, the Bank has established itself as a major player in the e-Commerce space:

Through over 15,000 direct merchant tie-ups, through State Bank Collect or through private aggregators, the Bank has facilitated more than 42 crores e-Commerce transactions during the year.

On-line collection of Taxes/ Fee/ EMD towards e-Trading/ e-Auction is being facilitated through the new Multi- Option Payment System (MOPS) interfaced with portals of PSUs, Corporations and Govt. Departments.

SBI was awarded seven out of nine awards in the IBA Banking Technology Awards:

The Best Technology Bank of the Year

Best Internet Bank

Best use of Mobile Technology

Best use of Technology in Financial Inclusion

Best Customer Management Initiative

Best use of Technology in Training and E-learning

Best use of Technology in Business Intelligence

IT - Foreign Offices

153 Foreign Offices of the Bank in 26 countries use the Finacle Core Banking solution along with a host of add on/surround applications to meet all the regulatory requirements besides providing high class customer experience.

Enterprise Data Warehouse

'Customer One View' is a solution for a 360 degree view of holdings with the Bank, including that of our Associates and Subsidiaries, namely, SBI Life, SBI Cards, SBI Mutual Funds made available to the Relationship Managers to enable them to offer better customer service. Also, a large number of predictive and analytic reports are regularly being generated by the DWH to aid business planning.

Networking

The Bank has implemented a secured, robust WAN architecture network connecting branches/offices and ATMs of State Bank Group through Leased lines and VSAT's. The Bank is in the process of migrating to Multi Protocol Label Switching (MPLS) architecture for improved network performance.

Corporate Web and Mail Services

Internal Social Media "SBI Aspirations" social software is designed to meet the needs of business and empowers bank's employees to be more innovative and productive, where creative ideas can be exchanged that can foster increase in business growth. Bank has made available its presence on External Social Media sites like Facebook, Twitter and YouTube for listening to and engaging with generation Y customers and general public.

II. 2 Risk Management and Internal Controls

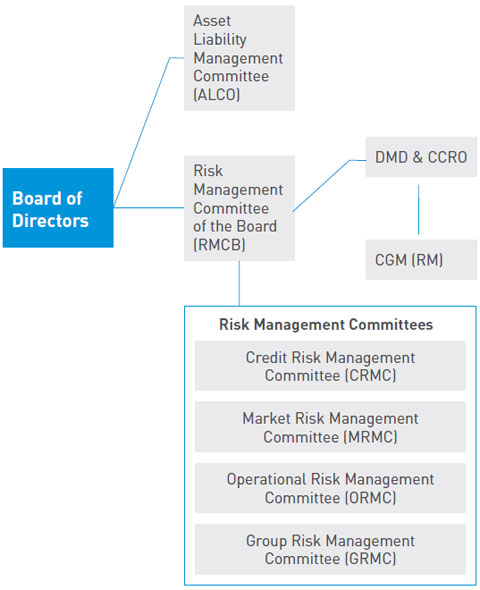

Risk governance structure at SBI

An independent Risk Governance Structure, in line with international best practices, has been put in place, in the context of separation of duties and ensuring independence of Risk Measurement, Monitoring and Control functions. This framework visualises empowerment of Business Units at the operating level, with technology being the key driver, enabling identification and management of risk at the place of origination.

The Bank has in place a Country Risk Management Policy in tune with RBI guidelines. The policy outlines a robust risk management model with prescriptions for Country, Bank, Product and Counterparty exposure limits. Both Countrywise and Bank-wise exposure limits are monitored and reviewed on a regular basis. The exposure ceilings and classifications are moderated in line with the dynamics of their risk profiles. Corrective steps are initiated periodically to safeguard the Bank's interests.

Credit Risk

Credit Risk is defined as the possibility of losses associated with the diminution in the credit quality of borrowers or counterparties from outright default or from reduction in portfolio value. Credit Risk emanates from a bank's dealings with an individual, non-corporate, corporate, Bank, financial institution or sovereign.

Mitigation measures

The Bank has strong credit appraisal and risk assessment practices in place for identification, measurement, monitoring and control of the credit risk exposures. The Bank uses various internal Credit Risk Assessment Models for assessing credit risk under different exposure segments. Internal ratings of the Bank are subject to comprehensive rating validation framework.

Credit Risk Management Department (CRMD) studies 37 industries, including sectors, such as Telecom, Power, Coal, Aviation, NBFC, Textile, Iron and Steel and disseminates the reports to operating staff for informed decision-making. Specific studies on Companies/ Groups as required are also conducted.

RBI has allowed the Bank to participate in the parallel run process for Foundation Internal Ratings Based (FIRB) under the Advanced Approaches for Credit Risk.

The CRM project for migration to FIRB is being implemented by the Bank with guidance from an external Consultant appointed for the purpose.

The governance structure has been made more robust for effective implementation of the FIRB and new policies related to the same have been approved by the Risk Management Committee of the Board (RMCB).

Models for estimation of Probability of Default (PD), Loss Given Default (LGD) and Exposure at Default (EAD) have been developed.

Bank regularly conducts Stress Test on its Credit portfolio and Stress Scenarios are regularly updated in line with RBI guidelines, Industry best practices and changes in macro economic variables.

Credit Risk Management Committee (CRMC) and Risk Management Committee of Board (RMCB) meetings were held regularly.

Market Risk

Market Risk is the possibility of loss a Bank may suffer on account of changes in values of its trading portfolio, due to change in market variables, such as exchange rates, interest rates and equity price, among others.

Mitigation measures

The Bank's market risk management consists of identification and measurement of risks, control measures, monitoring and reporting systems.

The Bank has Board approved policies pertaining to the said risks for Trading in Foreign Exchange, Derivatives, Interest Rate Securities, Equities and Mutual Fund. Market risks are controlled through various risk limits, such as Net Overnight Open Position, Modified Duration, Stop Loss, Management Action Trigger, Cut Loss Trigger, Concentration and Exposure Limits, among others as mentioned in the respective policies.

Currently, market risk capital is computed under the Standardised Measurement Method (SMM). The Bank has submitted its Letter of Intent to the Reserve Bank of India to migrate to the Internal Models Approach (IMA) under the Advanced Approaches for market risk.

IMA is a Value at Risk (VaR) based tool for monitoring of the Bank's trading portfolio. The VaR methodology is supplemented by conducting quarterly stress tests of the trading portfolio.

The MRM project for migration to IMA is being implemented by the Bank with guidance from an external Consultant appointed for the purpose.

SBI's Market Risk is monitored and reviewed by the Market Risk Management Committee (MRMC) and the Risk Management Committee of the Board (RMCB) which meet regularly.

Operational Risk

Operational Risk is the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events.

Mitigation measures

The main objectives of the Bank's Operational Risk Management are to continuously review systems and control mechanisms, create awareness of operational risk throughout the Bank, assign risk ownership, align risk management activities with business strategy and ensure compliance with regulatory requirements, which are the key elements of the Bank's Operational Risk Management Policy.

Important policies, manuals and framework documents in line with RBI guidelines on Operational Risk Management Framework (ORMF) for migration to Advanced Measurement Approach (AMA) are in place.

The Bank has already submitted its Letter of Intent (LOI) to migrate to the Advanced Measurement Approach (AMA) under the Advanced Approaches for Operational risk.

The ORM project for migration to AMA is being implemented by the Bank with guidance from external Consultant appointed for the purpose.

The Bank-level Operational Risk Management Committee (ORMC) reviews the operational risk profile of the Bank periodically and recommends suitable controls/ mitigations for managing operational risk in the Bank. Risk Management Committees at Operational unit and Business unit level are in place.

Group Risk

Group Risk Management aims to put in place standardised risk management processes in Group entities. Group Risk Management Committee, a committee of executives, has been constituted under the chairmanship of the DMD and CCRO to oversee the management of risk functions across the Group entities.

Mitigation measures

A quarterly analysis of risk-based parameters for Credit Risk, Market Risk, Operational Risk and Liquidity Risk, among others, is presented to Group Risk Management Committee/Risk Management Committee of the Board.

Exposure limits for Large Borrower Exposure and Capital Market Exposure as per RBI have been adopted for the Group. In addition, limits for Unsecured Exposures, Real Estate and Intra-Group Exposures have been set by the Bank.

A voluntary annual disclosure on Group Risk is part of the Bank's published Disclosures.

The Group Internal Capital Adequacy Assessment Process (Group ICAAP) document includes an assessment of identified risks by Group entities, internal controls and mitigation measures, and capital assessment, under normal and stressed conditions. All Group entities, including Non-banking entities, carry out the ICAAP exercise and a Group ICAAP Policy is in place to ensure uniformity.

To overhaul the Group Risk Management and adopt global best practices, the Bank has embarked upon a Group Risk Management Project recently.

Enterprise Risk

Enterprise Risk Management aims to put in place a comprehensive framework to manage various risks. It encompasses Global best practices like Risk Appetite, Risk Aggregation and Risk-based Performance Management System.

Mitigation measures

For assessment of Pillar I risks and Pillar 2 risks, such as Liquidity Risk, Interest Rate Risk, Credit Concentration Risk, as well as adequacy of Capital and overall Risk Management practices under normal and stressed conditions, the Bank has comprehensive Internal Capital Adequacy Assessment Process (ICAAP) in place.

As part of the Bank's Risk Management Project to transform its role into a Strategic function, aligned with Business Objectives, Bank has initiated the Enterprise Risk Management (ERM) module.

Information Security risk

Information Security risk seeks to establish stringent information security structure to prevent data loss and threats.

Mitigation measures

The Bank has implemented a robust IT policy and Information System Security policy, which are in line with international best practices. These policies are reviewed periodically and suitably strengthened to address emerging threats.