CORPORATE GOVERNANCE

-

THE BANK'S PHILOSOPHY ON CODE OF GOVERNANCEOpen or Close

State Bank of India is committed to the best practices in the area of Corporate Governance, in letter and in spirit. The Bank believes that good Corporate Governance is much more than complying with legal and regulatory requirements. Good governance facilitates effective management and control of business, enables the Bank to maintain a high level of business ethics and to optimise the value for all its stakeholders. The objectives can be summarised as:

To protect and enhance shareholder value.

To protect the interest of all other stakeholders such as customers, employees and society at large.

To ensure transparency and integrity in communication and to make available full, accurate and clear information to all concerned.

To ensure accountability for performance and customer service and to achieve excellence at all levels.

To provide corporate leadership of highest standard for others to emulate.

The Bank is committed to:

Ensuring that the Bank's Board of Directors meets regularly, provides effective leadership and insights in business and functional matters and monitors Bank's performance.

Establishing a framework of strategic control and continuously reviewing its efficacy.

Establishing clearly documented and transparent management processes for policy development, implementation and review, decision-making, monitoring, control and reporting.

Providing free access to the Board to all relevant information, advices and resources as are necessary to enable it to carry out its role effectively.

Ensuring that the Chairman has the responsibility for all aspects of executive management and is accountable to the Board for the ultimate performance of the Bank and implementation of the policies laid down by the Board. The role of the Chairman and the Board of Directors are also guided by the SBI Act, 1955 with all relevant amendments.

Ensuring that a senior executive is made responsible in respect of compliance issues with all applicable statutes, regulations and other procedures, policies as laid down by the GOI/RBI and other regulators and the Board, and reports deviations, if any.

The Bank has complied with the provisions of Corporate Governance as per Clause 49 of the Listing Agreement with the Stock Exchanges except where the provisions of Clause 49 are not in conformity with SBI Act, 1955 and the directives issued by RBI/GOI. A report on the implementation of these provisions of Corporate Governance in the Bank is furnished below.

Central Board : Role and Composition

State Bank of India was formed in 1955 by an Act of the Parliament, i.e., The State Bank of India Act, 1955 (Act). A Central Board of Directors was constituted according to the Act.

The Bank's Central Board draws its powers from and carries out its functions in compliance with the provisions of SBI Act & Regulations 1955. Its major roles include, among others,

Overseeing the risk profile of the Bank;

Monitoring the integrity of its business and control mechanisms;

Ensuring expert management, and

Maximising the interests of its stakeholders.

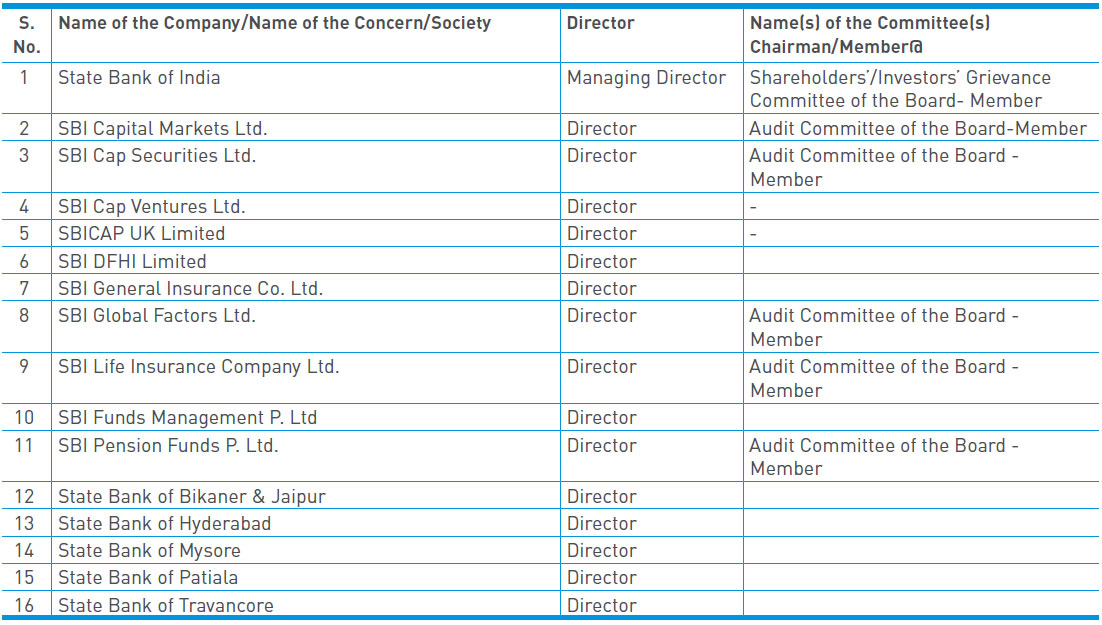

The Central Board is headed by the Chairman, appointed under section 19(a) of SBI Act; four Managing Directors are also appointed members of the Board under section 19(b) of SBI Act. The Chairman and Managing Directors are whole time Directors. As on 31st March 2014, there were twelve other directors on the Board including eminent professionals representing Technology, Accountancy, Finance and Economics. These included representatives of shareholders and staff of the Bank, nominee officials of Govt. of India and Reserve Bank of India and directors nominated by the Govt. of India under Section 19(d) of the State Bank of India Act, 1955. Apart from the whole time Directors, comprising Chairman and four Managing Directors in office, the composition of the Central Board, as on 31st March 2014, was as under :

four directors, elected by the shareholders under Section 19(c),

one director, nominated by the Central Government under Section 19(ca),

one director, nominated by the Central Government under Section 19(cb),

four directors, nominated by the Central Government under Section 19(d),

one director (official from the Govt. of India), nominated by the Central Government under Section 19(e), and

one director (official from the Reserve Bank of India), nominated by the Central Government under Section 19(f).

The composition of the Board complies with provisions laid down in Clause 49 of the Listing Agreement. There is no interse relationship between Directors.

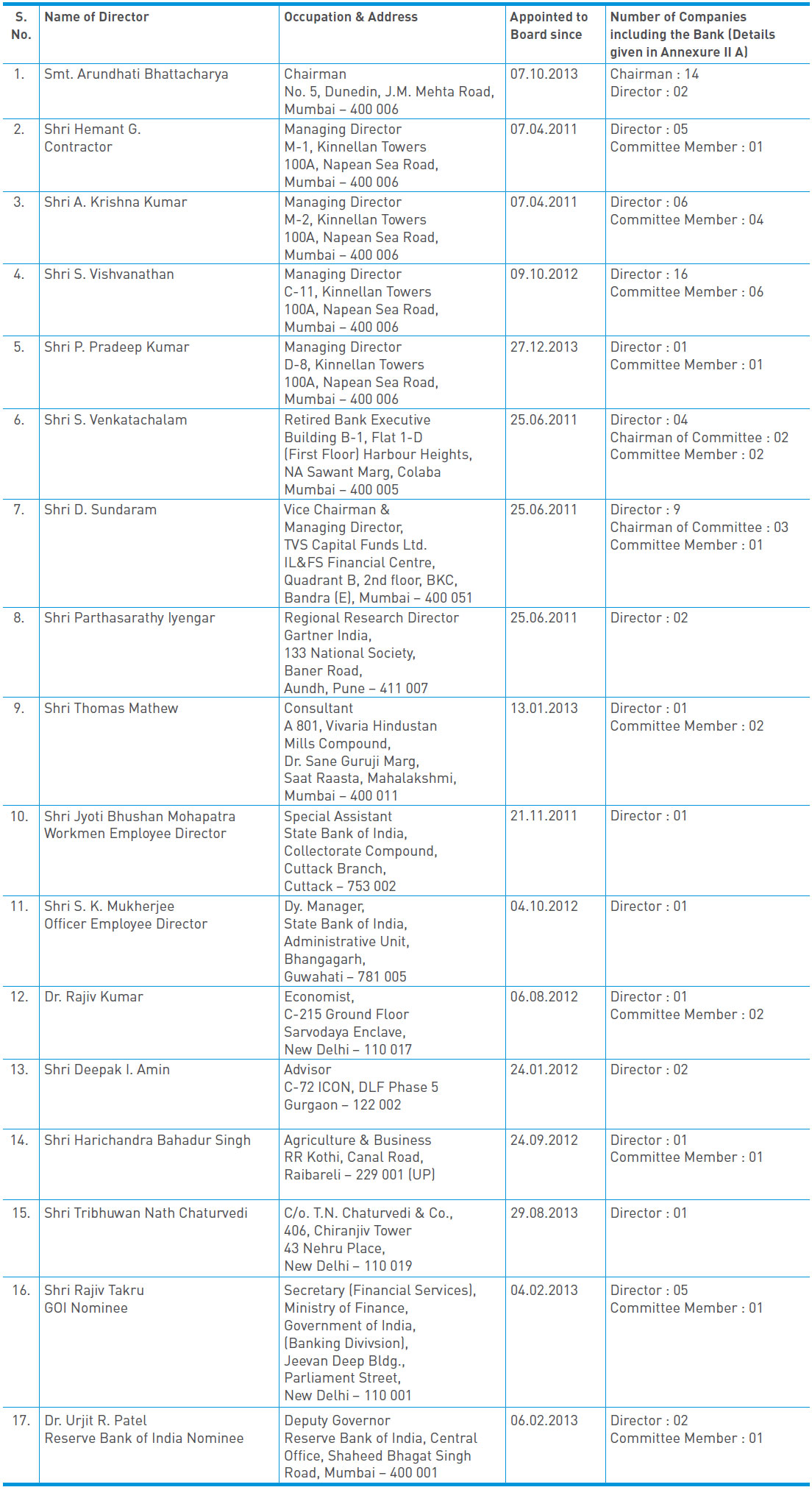

A brief resume of each of the Non-Executive Directors is presented in Annexure I. Particulars of the directorships/ memberships held by all the Directors in various Boards/Committees are presented in Annexure II and the details of their shareholding in the Bank are mentioned in Annexure III.

Meetings of the Central Board

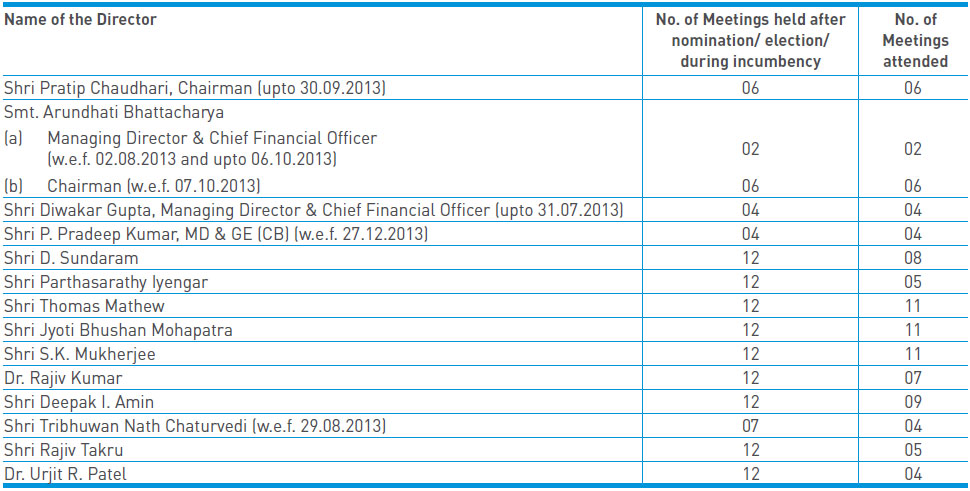

The Bank's Central Board meets a minimum of six times a year. During the year 2013-14, twelve Central Board Meetings were held. The dates of the meetings and attendance of the directors are as under :

Dates & Attendance of Directors at Board Meetings during 2013-14

No. of Meetings held : 12 Dates of the Meetings : 18.04.2013, 23.05.2013, 21.06.2013, 16.07.2013, 12.08.2013, 30.09.2013, 30.10.2013, 13.11.2013, 30.12.2013, 31.01.2014,14.02.2014, 03.03.2014

Shri H. G. Contractor, MD & GE (IB), Shri A. Krishna Kumar, MD & GE (NB), Shri S. Vishvanathan, MD & GE (A&S), Shri S. Venkatachalam and Shri Harichandra Bahadur Singh, Directors attended all the twelve Meetings.

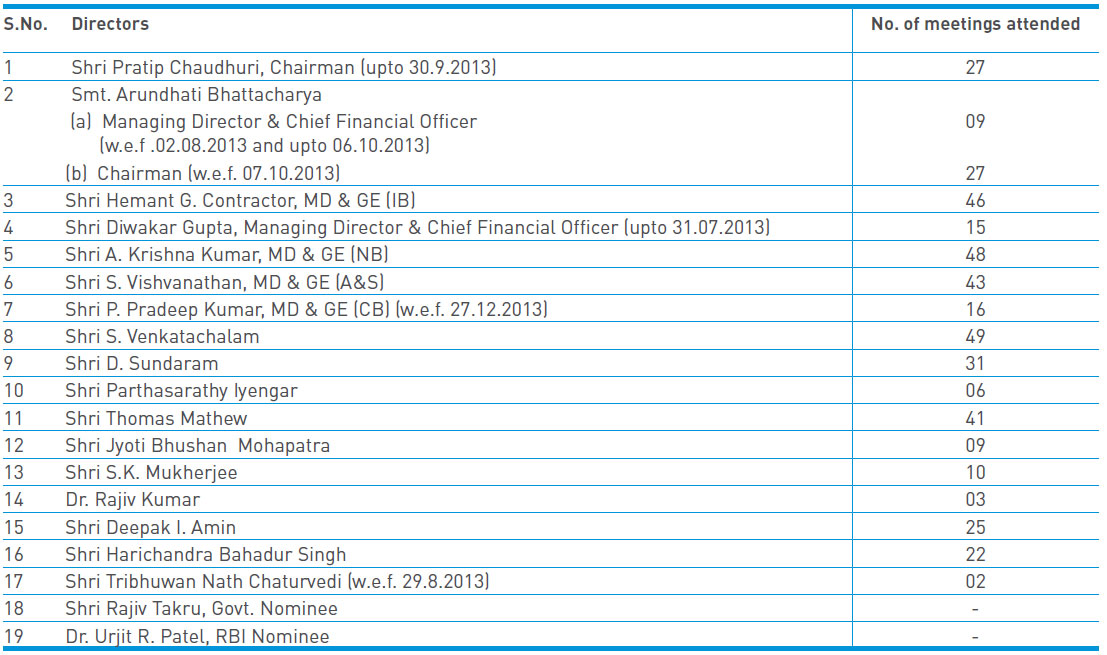

Executive Committee of the Central Board

The Executive Committee of the Central Board (ECCB) is constituted in terms of Section 30 of the SBI Act, 1955. The State Bank of India General Regulations (46 & 47) provide that, subject to the general or special directions of the Central Board, ECCB may deal with any matter within the competence of the Central Board. ECCB consists of the Chairman, the Managing Directors, the Director nominated under Section 19(f) of the SBI Act (Reserve Bank of India nominee), and all or any of the other Directors who are normally residents or may for the time being be present at any place within India where the meeting is held. The ECCB meetings are held once every week. The details of attendance of ECCB Meetings during the year 2013-14 are as under :

Attendance of Directors at ECCB Meetings during 2013-14

No. of Meetings held : 55

Other Board Level Committees

In terms of the provisions of SBI Act and General Regulations, 1955 and Govt./RBI/SEBI guidelines, the Central Board has constituted eight Board Level Committees viz. Audit Committee, Risk Management Committee, Shareholders'/Investors' Grievance Committee, Special Committee of the Board for Monitoring of Large Value Frauds (` 1 crore and above), Customer Service Committee, IT Strategy Committee, Remuneration Committee & Board Committee to Monitor Recovery. These Committees provide effective professional support in the conduct of Board level business in key areas like Audit & Accounts, Risk Management, resolution of Shareholders'/Investors' grievances, Fraud Review and Control, Review of customer service and redressal of customer grievances, Technology Management, Payment of Incentives to Executive Directors and Oversight on Recovery of Loans and Advances. While the Remuneration Committee approves, once in a year, payment of incentives to wholetime Directors, based on Govt. of India guidelines, the other Committees meet periodically, once in a quarter generally, to deliberate on policy issues and/or review domain performance, as per the calendar of reviews approved by the Central Board. The Committees also call external specialists, besides drawing upon the services of top executives from the Bank, as and when needed. The minutes and proceedings containing brief reports on the discussions held at the meetings of the Committees are placed before the Central Board.

Audit Committee of the Board

The Audit Committee of the Board (ACB) was constituted on 27th July 1994 and last re-constituted on the 31st January 2014. The ACB functions as per RBI guidelines and complies with the provisions of Clause 49 of the Listing Agreement to the extent that they do not violate the directives/guidelines issued by RBI.

Functions of ACB

a) ACB provides direction as also oversees the operation of the total audit function in the Bank. Total audit function implies the organisation, operationalisation and quality control of internal audit and inspection within the Bank, and follow-up on the statutory/external audit, compliance of RBI inspection. It also appoints Statutory Auditors of the Bank and review their performance from time to time.

b) ACB reviews the Bank's financial, Risk Management, IS Audit Policies and Accounting Policies/Systems of the Bank to ensure greater transparency.

c) ACB reviews the internal inspection/audit plan and functions in the Bank – the system, its quality and effectiveness in terms of follow-up. It also, especially, focuses on the follow up of :

KYC-AML guidelines;

Major areas of housekeeping;

Compliance of Clause 49 and other guidelines issued by SEBI from time to time;

Status of implementation of Ghosh and Jilani Committee recommendations.

d) It obtains and reviews reports from the Compliance Department in the Bank.

e) ACB follows up on all the issues raised in RBI's Annual Financial Inspection Reports under Section 35 of Banking Regulation Act, 1949 and Long Form Audit Reports of the Statutory Auditors and other Internal Audit Reports. It interacts with the external auditors before the finalisation of the annual/quarterly financial accounts and reports. A formal 'Audit Charter' or 'Terms of Reference' laid down by the Central Board, is in place and updated periodically, the last revision effected from 16th March 2011.

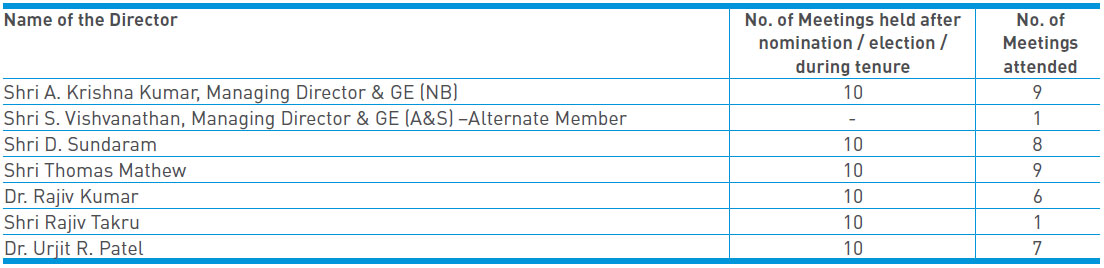

Composition & Attendance during 2013-14

The ACB has eight members of the Board of Directors, including two whole time Directors, two official Directors (nominees of GOI and RBI) and four non-official, non-executive Directors. Meetings of the ACB are chaired by a Non-Executive Director. The constitution and quorum requirements, as per RBI guidelines, are complied with meticulously. During the year, ten meetings of ACB were held to review the various matters connected with the internal control, systems and procedures and other aspects as required in terms of RBI guidelines.

Dates of Meetings of ACB held & Attendance of Directors during 2013-14

No. of Meetings held : 10 Dates of the Meetings : 17.04.2013, 22.05.2013, 19.07.2013, 10.08.2013, 23.10.2013, 12.11.2013, 27.12.2013, 13.02.2014, 03.03.2014, 18.03.2014

Shri H. G. Contractor, MD & GE (IB) and Shri S. Venkatachalam, Director attended all the ten Meetings.

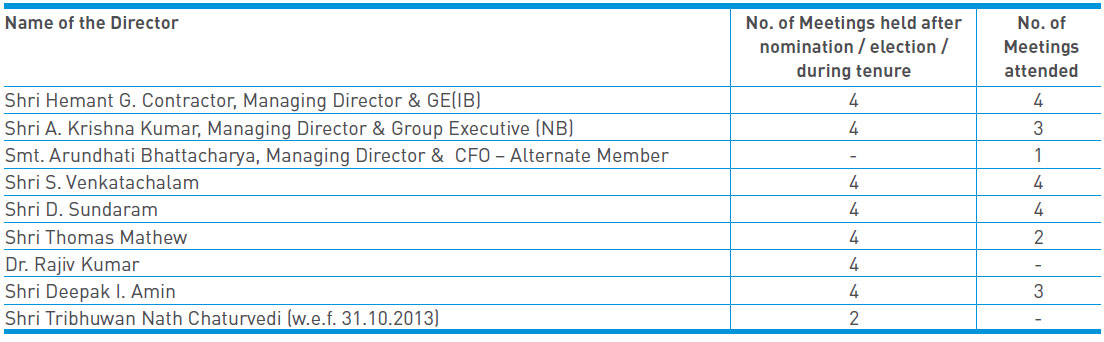

Risk Management Committee of the Board

The Risk Management Committee of the Board (RMCB) was constituted on the 23rd March 2004, to oversee the policy and strategy for integrated risk management relating to credit risk, market risk and operational risk. The Committee was last reconstituted on the 31st January 2014 and has, eight members. The Senior Managing Director is the Chairman of the Committee. RMCB meets a minimum of four times a year, once in each quarter. During 2013-14, four meetings of the RMCB were held.

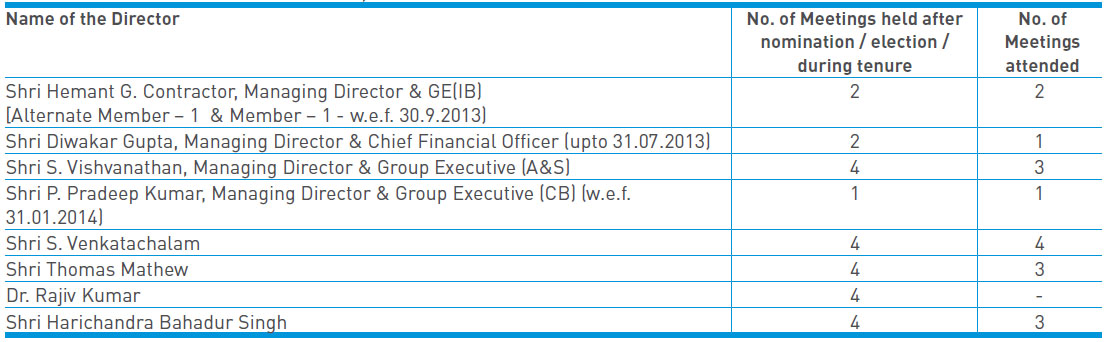

Dates of Meetings of RMCB held & Attendance of Directors during 2013-14

No. of Meetings held : 4 Dates of the Meetings : 31.05.2013, 18.09.2013, 12.12.2013, 18.03.2014,

Shareholders'/Investors' Grievance Committee of the Board

In pursuance of Clause 49 of the Listing Agreement with the Stock Exchanges, Shareholders'/Investors' Grievance Committee of the Board (SIGCB) was formed on the 30th January 2001, to look into the redressal of Shareholders' and Investors' complaints regarding transfer of shares, non-receipt of annual report, non-receipt of interest on bonds/declared dividends, etc. The Committee was last reconstituted on the 31st January 2014 and has, six members and is chaired by a Non-Executive Director. The Committee met four times during 2013-14 and reviewed the position of complaints.

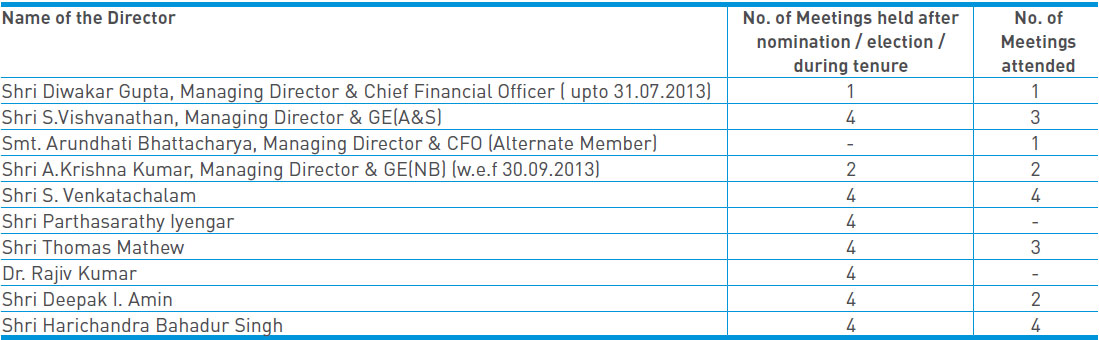

Dates of Meetings of SIGCB held & Attendance of Directors during 2013-14

No. of Meetings held : 4 Dates of the Meetings : 25.04.2013, 22.07.2013, 23.10.2013, 03.02.2014

Number of shareholders' complaints received so far (during the year) : 219 Number of complaints not solved to the satisfaction of shareholders : NIL Number of Pending Complaints : NIL Name and designation of Compliance officer : Shri R. K. Agrawal,

General Manager (Compliance)Special Committee of the Board for Monitoring of Large Value Frauds (` 1 crore and above)

The Special Committee of the Board for monitoring of Large Value Frauds (` 1 crore and above) (SCBMF) was constituted on the 29th March 2004. The major functions of the Committee are to monitor and review all large value frauds with a view to identifying systemic lacunae, if any, reasons for delay in detection and reporting, if any, monitoring progress of CBI/Police investigation, recovery position, ensuring that staff accountability exercise is completed quickly, reviewing the efficacy of remedial action taken to prevent recurrence of frauds and putting in place suitable preventive measures. The Committee was last reconstituted on the 31st January 2014 and has, eight members. The Senior Managing Director on the Committee is the Chairman. The Committee met four times during 2013-14:

Dates of Meetings of SCBMF held & Attendance of Directors during 2013-14

No. of Meetings held : 4 Dates of the Meetings : 13.06.2013, 20.08.2013, 03.12.2013, 11.03.2014

Customer Service Committee of the Board

The Customer Service Committee of the Board (CSCB) was constituted on the 26th August 2004, to bring about ongoing improvements on a continuous basis in the quality of customer service provided by the Bank. The Committee was last reconstituted on the 31st January 2014 and has, eight members. The Senior Managing Director on the Committee is the Chairman. During the year 2013-14, four meetings of the Committee were held.

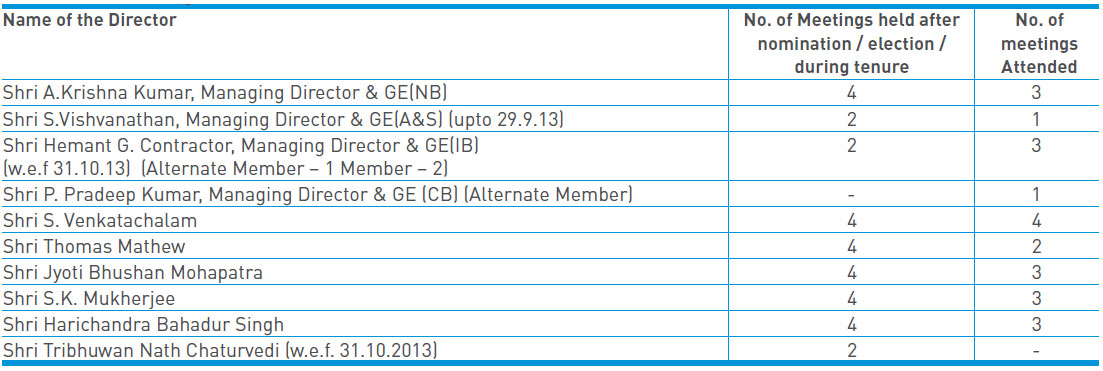

Dates of Meetings of CSCB held & Attendance of Directors during 2013-14

No. of Meetings held : 4 Dates of the Meetings : 08.06.2013, 26.08.2013, 07.11.2013,03.02.2014

IT Strategy Committee of the Board

With a view to tracking the progress of the Bank's IT initiatives, the Bank's Central Board constituted a Technology Committee of the Board on 26th August 2004. The Technology Committee has been renamed as IT Strategy Committee of the Board w.e.f. 24th October 2011. The Committee has played a strategic role in the Bank's technology domain. The Committee is entrusted with the following roles and responsibilities :

(i) approving IT strategy and policy documents, ensuring that the management has put an effective strategic planning process in place;

(ii) ensuring that the IT Organisational structure complements the business model and its direction ;

(iii) ensuring IT investments represent a balance of risks and benefits and that budgets are acceptable;

(iv) evaluating effectiveness of management's monitoring of IT risks and overseeing the aggregate funding of IT at the Bank level; and

(v) reviewing IT performance measurement and contribution of IT to businesses (i.e. delivering the promised value).

The Committee was last reconstituted on the 31st January 2014 with six members and is chaired by a Non-Executive Director. The Committee met four times during 2013-14.

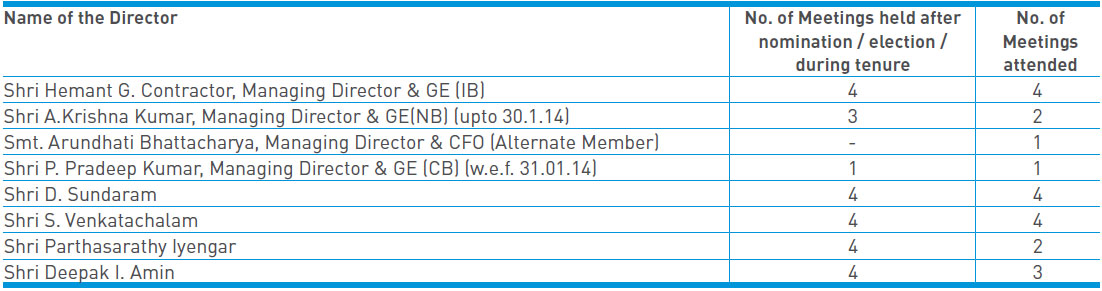

Dates of Meetings of ITSC held & Attendance of Directors during 2013-14

No. of Meetings held : 4 Dates of the Meetings : 06.06.2013, 16.08.2013, 21.11.2013, 26.02.2014

Remuneration Committee of the Board

The Remuneration Committee was constituted on 22nd March 2007, for evaluating the performance of Whole Time Directors of the Bank in connection with the payment of incentives, as per the scheme advised by Government of India in March 2007. The Committee was last reconstituted on 31st January 2014. The Committee has four members consisting of (i) the Government Nominee Director, (ii) the RBI Nominee Director and (iii) two other Directors – Shri S. Venkatachalam and Shri D. Sundaram. The Committee scrutinised and recommended payment of incentives to whole time Directors for the year ended 31.3.2013.

Board Committee to Monitor Recovery

In terms of Govt. of India advices, a Board Committee to Monitor Recovery was constituted by the Central Board at its meeting held on 20th December 2012 for oversight on Recovery of Loans and Advances. The Committee has six members consisting of Chairman, four Managing Directors and the Govt. Nominee Director. The Committee met three times during the year on 17.07.2013, 05.11.2013, 15.02.2014 and reviewed the NPA management and large NPA accounts of the Bank.

Local Boards

In terms of the provisions of SBI Act and General Regulations 1955, at every centre where the Bank has a Local Head Office (LHO), Local Boards/Committees of Local Boards are functional. The Local Boards exercise such powers and perform such other functions and duties delegated to them by the Central Board. As on 31st March 2014, Local Boards at Ten LHOs and Committees of the Local Boards at the remaining Four LHOs were functional. The minutes and proceedings of the meetings of Local Boards/Committees of Local Boards are placed before the Central Board.

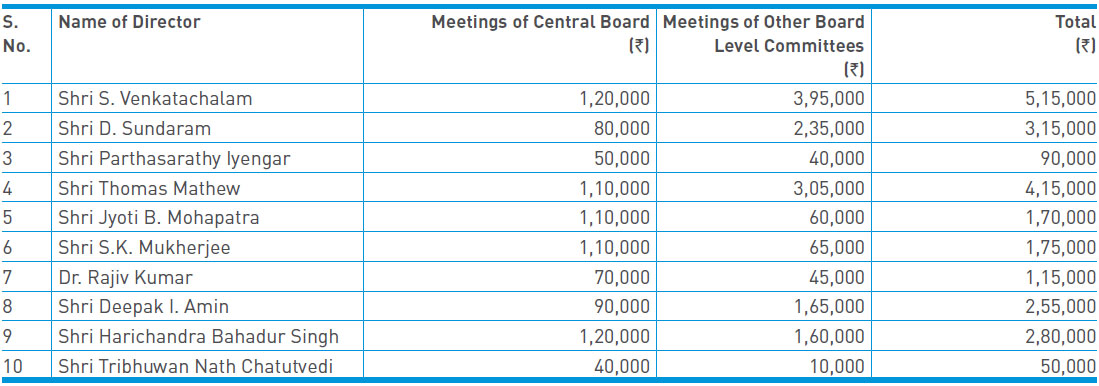

Sitting Fees

The remuneration of the whole-time Directors and the Sitting Fees paid to the Non-Executive Directors for attending the meetings of the Board/Committees of the Board are as prescribed by GOI from time to time. No remuneration, other than the Sitting Fees for attending Board and/or its Committee meetings, is paid to Non Executive Directors. At present, Sitting Fees of ` 10,000/- is paid for attending the meetings of the Central Board and ` 5,000/- for attending the meetings of Other Board level Committees. Sitting fees are, however, not paid to the Chairman and Managing Directors of the Bank and GOI Nominee/RBI Nominee Directors. Details of Sitting fees paid during the year 2013-14 are placed in Annexure-IV.

Compliance with Bank's Code of Conduct

The Directors on the Bank's Central Board and Senior Management have affirmed compliance with the Bank's Code of Conduct for the financial year 2013-14. Declaration to this effect signed by the Chairman is placed in Annexure-V. The Code is posted on the Bank's website.

Developments during the year

In an effort to keep the Directors contemporised, the Bank took the following initiatives during the year:

(i) One Director participated in Conference of Non Executive Directors on 13th and 14th May 2013, organised by Centre for Advances Financial Research and Learning (CAFRAL) at Mumbai.

(ii) One director nominated by Govt. of India, participated in an Interactive Meeting of Independent Directors on Effective Governance in Banks – Role of Independent Directors on 16th November 2013 by ICAI at New Delhi.

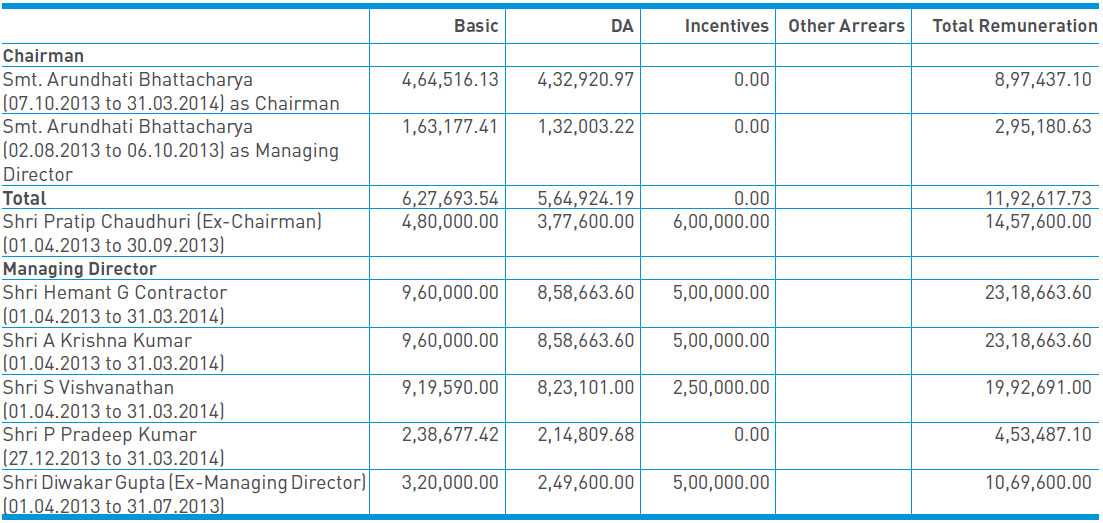

Salary and Allowances paid to the Chairman and Managing Directors in 2013-14

Attendance at the Annual General Meeting

The last Annual General Meeting (AGM) for the year 2012-13, held on the 21st June, 2013, was attended by 12 Directors, viz., Shri Pratip Chaudhuri, Shri Hemant G. Contractor, Shri Diwakar Gupta, Shri A. Krishna Kumar, Shri S. Vishvanathan, S. Venkatachalam, Shri D. Sundaram, Shri Parthasarthy Iyangar, Shri Thomas Mathew, Shri S.K. Mukherjee, Shri Harichandra Bahadur Singh and Shri Jyoti Bhushan Mohapatra. AGM (2011-12) was held on 22nd June, 2012 and AGM (2010-11) was held on 20th June, 2011. All three AGMs were held in Mumbai and no Special resolutions were passed in the previous three AGMs.

Disclosure

The Bank has not entered into any materially significant related party transactions with its Promoters, Directors, or Management, their subsidiaries or relatives, etc., that may have potential conflict with the interests of the Bank at large.

The Bank has complied with applicable rules and regulations prescribed by Stock Exchanges, SEBI, RBI or any other statutory authority relating to the capital markets. During the last three years. no penalties or strictures have been imposed by them on the Bank.

A Whistle Blower Policy has been put in place and displayed on "State Bank Times" for reporting any unethical practices or behaviour by employees in violation of their service rules, with a provision for protection of interest / identity of the whistleblower.

The Bank has complied in all respects with the requirements of Clause 49 of the Listing Agreement with the Stock Exchanges, to the extent that the requirements of the Clause do not violate the provisions of State Bank of India Act 1955, the rules and regulations made thereunder and guidelines or directives issued by the Reserve Bank of India.

Mandatory requirements of Clause 49 as to the composition of the Board of Directors, composition and quorum of the Audit Committee, Non-Executive Directors' compensation, the appointment, re-appointment of the Statutory auditors and fixation of their fees are not binding on the Bank, as separate provisions in the State Bank of India Act, SBI General Regulations and the Reserve Bank of India guidelines deal with the same.

The Bank has complied with all applicable non-mandatory requirements of Clause 49, except for sending half-yearly declaration of financial performance and summary of significant events to the households of shareholders, since detailed information on the same is posted on the website of the Bank.

Means of Communication

The Bank strongly believes that all stakeholders should have access to complete information on its activities, performance and product initiatives. Annual, half-yearly and quarterly results of the Bank for the year 2013-14 were published in the leading newspapers of the country. The results were also displayed on the Bank's website (www.sbi.co.in and www.statebankofindia.com). The annual report is sent to all shareholders of the Bank. The Bank's website displays, interalia, official news releases of the Bank, the Bank's Annual Report and Half-yearly report and details of various product offerings. Every year, after the annual and half-yearly results are declared, a Press meet is held on the same day, in which the Chairman makes a presentation and answers the queries of the media. This is followed by another meeting to which a number of investment analysts are invited. Details of the Bank's performance are discussed with the analysts in the meeting. After declaring quarterly results, press notifications are issued

General Shareholder Information

The Annual General Meeting of the Shareholders : Date: 03.07.2014, Time 03.00 pm . Venue: Y. B. Chavan Auditorium, Mumbai Financial Calendar : 01.04.2013 to 31.03.2014 Period of Book Closure : 31.05.2014 to 04.06.2014 Interim Dividend paid @ ` 15.00 per share : 02.04.2014 Final Dividend @ ` 15.00 per share-payment date : 19.06.2014 Electronic Clearing : Dividend on SBI shares is also being paid through various electronic modes Listing on Stock Exchanges : Mumbai, Ahmedabad, Kolkata, New Delhi, Chennai and National Stock Exchange, Mumbai. GDRs listed on London Stock Exchange (LSE). Listing fees have been paid upto date to all Stock exchanges, including LSE Stock Code/CUSIP : Stock Code 500112 (BSE) SBIN (NSE) CUSIP US 856552203 (LSE) Share Transfer System : Share transfers in Physical form are processed and returned to the shareholders within stipulated time. Quarterly Share transfer audit and reconciliation of Share Capital audit in terms of the Listing Agreements are regularly carried out by an independent Company Secretary. Registrar and Transfer : M/s Datamatics Financial Services Limited Agent and their Unit Address : Plot B-5, and Part B, Cross Lane, MIDC, Marol, Andheri (E), Mumbai 400 093. Board Phone numbers : 022-6671 2151 to 56 (between 10 a.m. to 1.00 p.m. and 2 p.m. to 4.30 p.m.) Direct Numbers : 022-6671 2198, 022-667121 99, 022-6671 2201 to 6671 2203 E-mail address : sbi_eq@dfssl.com, Fax : (022) 6671 2204 Address for Correspondence : State Bank of India

Shares & Bonds Department, Corporate Centre, 14th Floor, State Bank Bhavan, Madam Cama Road, Nariman Point, Mumbai 400 021.Telephones : (022) 22740841 to 22740848 Fax : (022) 22855348 E-mail Address : gm.snb@sbi.co.in Trustees of Bonds (Capital Instruments) issued in INR : IDBI Trusteeship Services Limited Capital Augmentation during FY 2013-14

Capital Augmentation was the key focus area for the Bank during FY 2013-14. Pursuant to the approvals from the Reserve Bank of India and the Government of India under Section 5(2) of the SBI Act, 1955, the Bank raised the undernoted equity capital:

(i) Allotted 1,12,18,685 equity shares to GoI under Preferential Issue, on 02.01.2014, at an issue price of ` 1,782.74 (Rupees One Thousand Seven Hundred Eighty Two and Paisa Seventy Four Only) per share, including premium of ` 1,772.74 (Rupees One Thousand Seven Hundred Seventy Two and Paisa Seventy Four Only) per share aggregating ` 1999,99,98,496.90 (One Thousand Nine Hundred Ninety Nine crores Ninety Nine lakhs Ninety Eight Thousand Four Hundred Ninety Six and Paisa Ninety Only). The shares so allotted, have been locked-in upto 14th January 2017, in terms of Regulation 78(1) of SEBI (ICDR) Regulations, 2009.

(ii) Allotted 5,13,20,436 Equity Shares, on 03.02.2014 to eligible Qualified Institutional Buyers (QIBs) under Qualified Institutions Placement at an Issue Price of ` 1,565.00 per equity share of ` 10 each, including a premium of ` 1,555.00 per share, which is at a discount of 3.95% to the floor price of ` 1,629.35, as calculated in terms of the SEBI ICDR Regulations, aggregating to ` 8031,64,82,340 (Rupees Eight thousand thirty one crores sixty four lakhs eighty two thousand three hundred forty only).

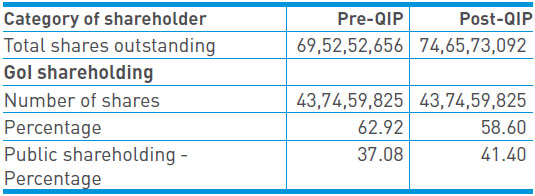

Pre & post-QIP shareholding pattern of the Bank

Equity shares allotted pursuant to the Preferential Issue and Qualified Institutions Placement (QIP) have been listed and admitted by the Stock Exchanges (BSE/NSE) for trading. Post equity augmentation (Preferential Issue/QIP), paid-up Capital of the Bank is ` 746.57 crores, as against the Authorised Capital of ` 5,000 crores.

We may also add that, the Bank has issued and allotted Basel III compliant Tier 2 bonds of ` 2,000 crores, issued for 120 months (10 year bullet), w.e.f. 02.01.2014, at an annually payable coupon of 9.69%, by way of private placement. The Instrument has been rated as 'AAA' by both CARE and ICRA.

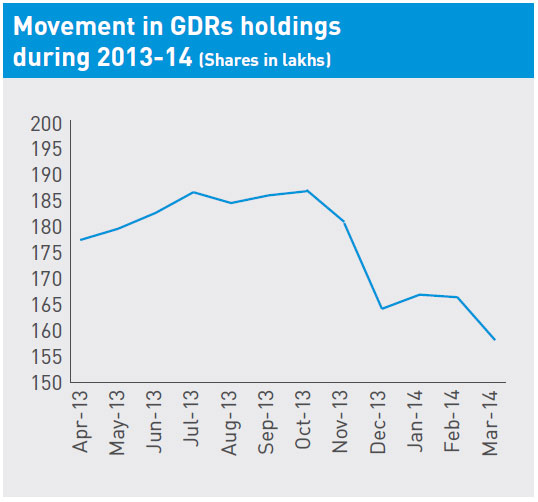

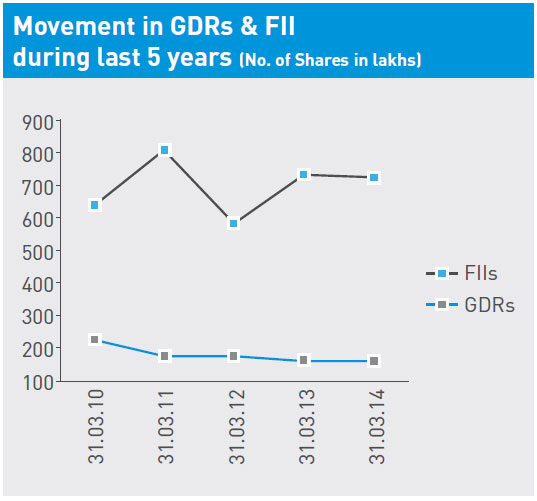

Outstanding Global Depository Receipts (GDR)

At the time of issue of GDRs in 1996, two-way fungibility was not permitted by the Government/RBI, i.e. if the holder of GDR desired to obtain the underlying equity shares of the Indian Company then such GDR was to be converted into shares of the Indian Company, but not vice versa. Later, two-way fungibility of ADRs/GDRs was permit ted by the Government of India/RBI. The Bank has permitted twoway fungibility to the Bank's GDR programme.

The Bank had 79,36,777 GDRs as on 31.03.2014 representing 1,58,73,554 shares.

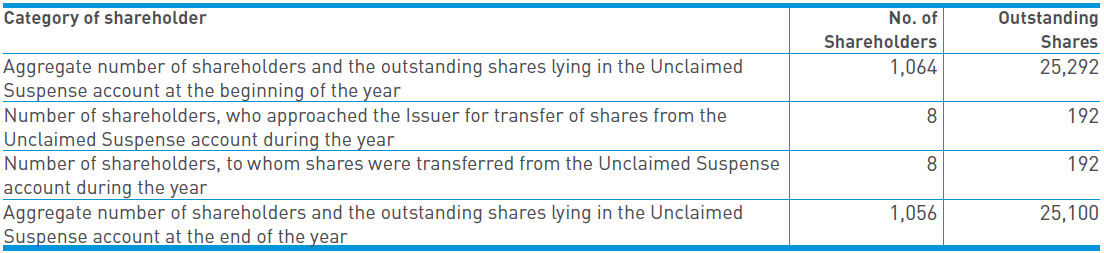

Unclaimed Shares

Dividend History: SBI has the distinction of making uninterrupted dividend payment to the shareholders for the last so many years.

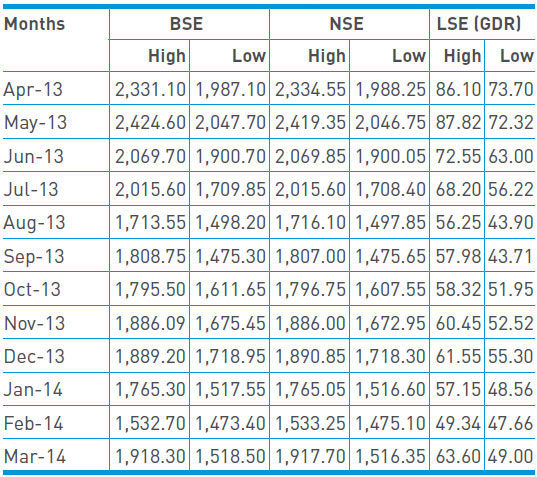

Share Price Movement

The movement of the share price and the BSE Sensex/ NSE Nifty is presented in the following tables. The market capitalisation of the Bank's shares had a weightage of 3.30% in BSE Sensex and 2.64% in NSE Nifty as on 31.03.2014.

Table: Market Price Data (Closing Values)

Book Value per Share ` 1,503.43

Economic Value Added (EVA): ` 4,668 crores

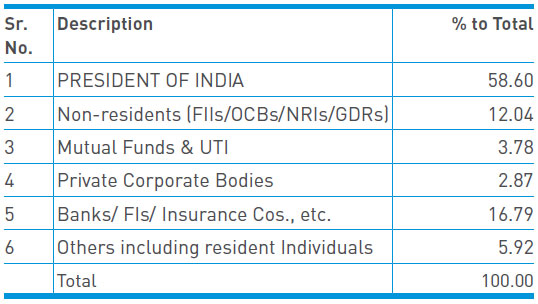

Distribution of Shareholding as on 31.03.2014

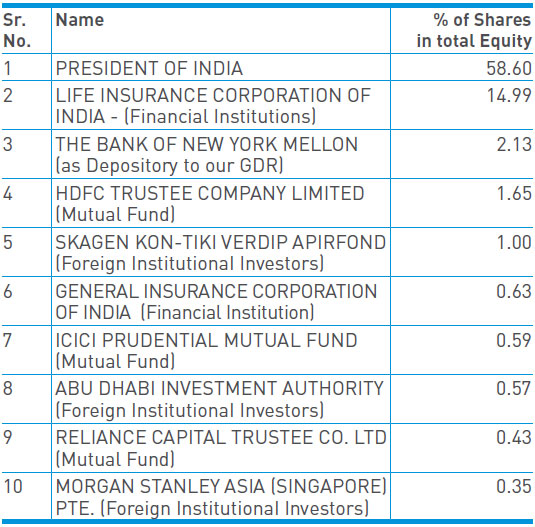

Top Ten Shareholders

-

Annexures I to VOpen or Close

Brief Resumes of the Non-Executive Directors on the Board as on 31st March 2014

Shri S. Venkatachalam

(Date of Birth: 8th November 1944)

Shri S. Venkatachalam is a Director re-elected by the Shareholders u/s 19(c) of SBI Act, w.e.f. 25th June 2011, for three years. He is a fellow member of the Institute of Chartered Accountants of India and was employed with Citi Group and Citibank NA India Organisation in the Senior Management Cadre for a period of 31 years in various capacities.Shri D. Sundaram

(Date of Birth: 16th April 1953)

Shri D. Sundaram, is a Director re-elected by the Shareholders u/s 19(c) of SBI Act, w.e.f 25th June 2011, for a period of three years. He is Vice Chairman and Managing Director of TVS Capital Funds Limited. He is a professionally qualified Accountant (FICWA) and carries a rich experience in the area of Finance and Accounting. He held many important positions in Hindustan Unilever Ltd. (HUL) group as Vice-Chairmann & CFO, Corporate Accountant, Commercial Manager and Treasurer, Finance Member, TOMCO Integration Team, and Finance Director, Brooke Bond Lipton India Ltd. He had also held various positions in Unilever Ltd., London as Commercial Officer for Africa and Middle East and Senior Vice President – Finance, Central and Middle East Group.Shri Parthasarathy Iyengar

(Date of Birth : 2nd June 1961)

Shri Parthasarathy Iyengar is a Director elected by the Shareholders u/s 19(c) of SBI Act, w.e.f. 25th June 2011, for three years. Shri Iyengar holds Post graduate degrees in Engineering and Management (Management Information Systems) from USA. He has more than 25 years of experience in the field of Information Technology in US and India. He is Vice President and Distinguished Analyst in Gartner, a world renowned IT research and advisory services entity and currently its Regional Research Director in India.Shri Thomas Mathew

(Date of Birth : 20th February 1951)

Shri Thomas Mathew is a Director elected by the Shareholders u/s 19(c) of SBI Act, w.e.f. 13th January 2013. Shri Mathew is a Fellow Member of the Institute of Chartered Accountants and has experience of more than 35 years in statutory/ internal audit of Domestic and multinational companies.Shri Jyoti Bhushan Mohapatra

(Date of Birth : 23rd September 1957)

Shri Jyoti Bhushan Mohapatra is a Workmen Employee director u/s 19(ca) of SBI Act, nominated by the Central Government, w.e.f. 21st November 2011.Shri S.K. Mukherjee

(Date of Birth :27th November 1955)

Shri S.K. Mukherjee is an Officer Employee director u/s 19(cb) of SBI Act, nominated by the Central Government, w.e.f. 4th October 2012.Dr. Rajiv Kumar

(Date of Birth : 6th July 1951)

Dr. Rajiv Kumar is a Director re-nominated by the Central Government u/s 19(d) of SBI Act, w.e.f. 6th August 2012, for a period of three years. Dr. Kumar holds a D.Phil from Oxford University, a renowned Economist, with earlier stints in FICCI (Director General), ICRIER (Chief Executive Officer) and with Asian Development bank. Dr. Kumar is currently a Senior Fellow at Centre for Policy Research, New Delhi.Shri Deepak I. Amin

(Date of Birth: 20th April 1966)

Shri Deepak Amin is a Director nominated by the Central Government u/s 19(d) of SBI Act, w.e.f. 24th January 2012, for a period of three years. Shri Amin holds a B.Tech. in Computer Science from IIT Bombay and M.S. in Computer Science from University of Rhode Island, USA. Shri Amin was the co-founder and CEO of Covelix, Inc, a Seattle and India based international software consulting (acquired by Emtec Inc). Prior to this, Shri Amin was the founder and CEO of vJungle, Inc, a web services software infrastructure company, which was acquired by Streamserve, Inc. Shri Amin also worked at Microsoft for many years as a lead engineer in Microsoft Windows Networking teams and was a senior engineer in the original Internet Explorer browser team at Microsoft, USA. Shri Amin is on the Technology Advisory Board of Grameen Foundation of Nobel Laureate Dr. Muhammad Yunus providing scalable financial and technology solutions for improving financial inclusion of the world's poorest women.Shri Harichandra Bahadur Singh

(Date of Birth : 16th September 1963)

Shri Harichandra Bahadur Singh is a Director nominated by the Central Government u/s 19(d) of SBI Act, w.e.f. 24th September 2012, for a period of three years. Shri Singh has exposure to Agriculture, Rural Economy & SME business. He was Director on Punjab & Sind Bank during the period 24.12.2008 to 08.12.2010.Shri Tribhuwan Nath Chaturvedi

(Date of Birth : 15th January 1959)

Shri Tribhuwan Nath Chaturvedi is a Director nominated by the Central Government u/s 19(d) of the SBI Act, w.e.f. 29th August 2013, for a period of three years. Shri Chaturvedi is a Practising Chartered Accountant and Senior Partner in T N Chaturvedi & Co., Chartered Accountants, New Delhi. Shri Chaturvedi has wide experience and expertise in the area of Finance & Accounts, Taxation and Corporate Laws. Shri Chaturvedi earlier served as Shareholder Director on the Board of Punjab National Bank for a period of three years (27th December 2008 to 26th December 2011).Shri Rajiv Takru

(Date of Birth : 26th September 1955)

Shri Rajiv Takru is a Director u/s 19(e) of SBI Act, nominated by the Central Government, w.e.f. 4th February 2013. Shri Rajiv Takru is Secretary, Financial Services, Ministry of Finance, Govt. of India.Dr. Urjit R. Patel

(Date of Birth : 28th October, 1963)

Dr. Urjit R. Patel is a Director u/s 19(f) of SBI Act, nominated by the Central Government, w.e.f. 6th February 2013. Dr. Urjit R. Patel is Deputy Governor, Reserve Bank of India.ANNEXURE II

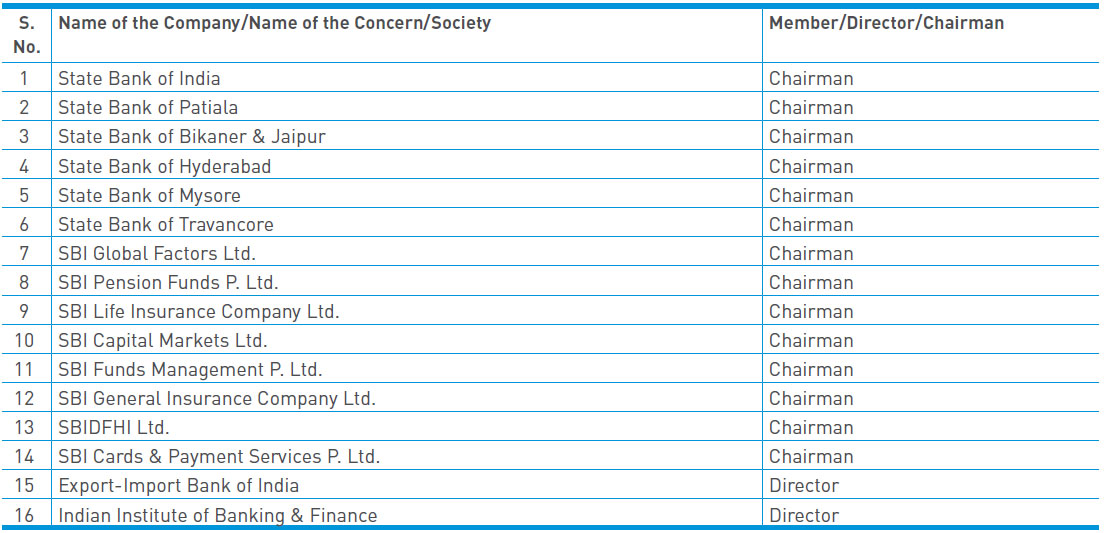

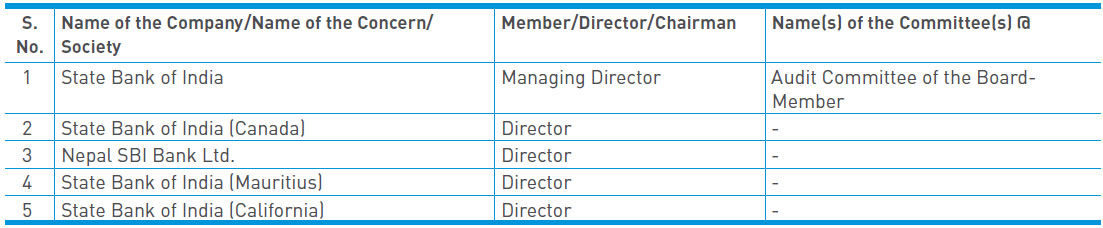

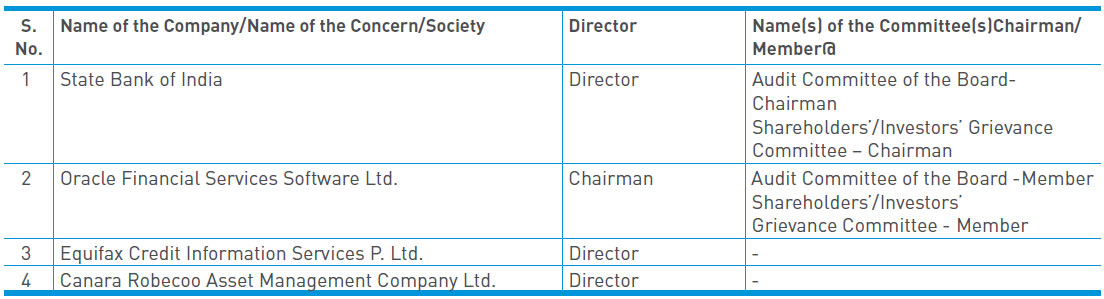

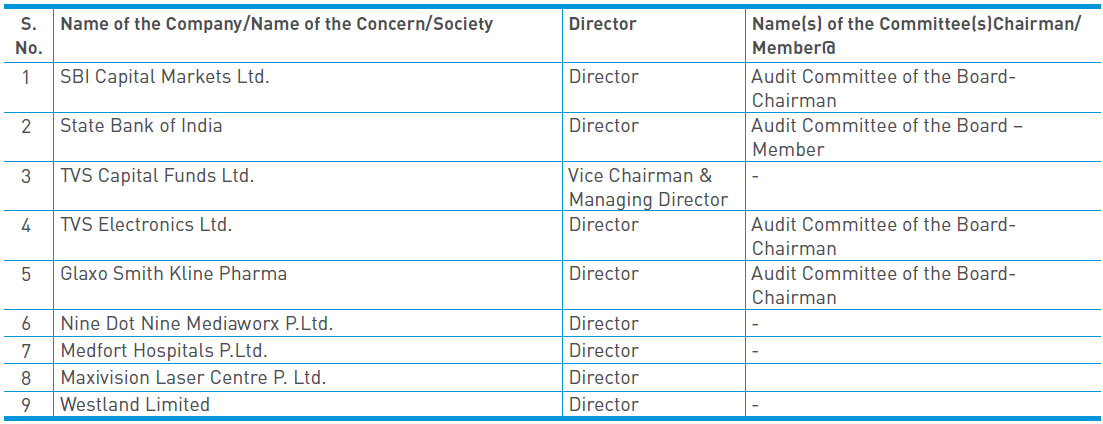

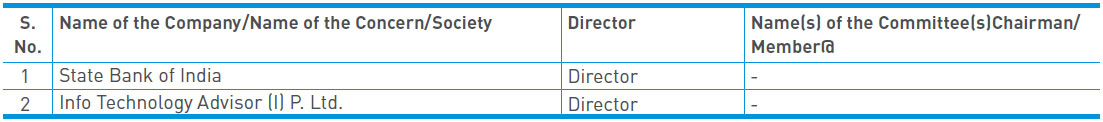

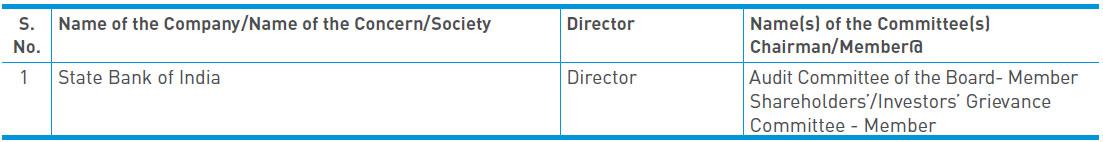

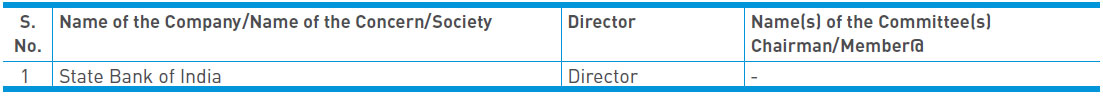

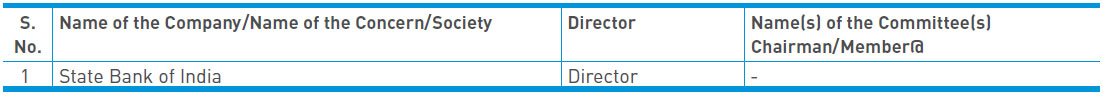

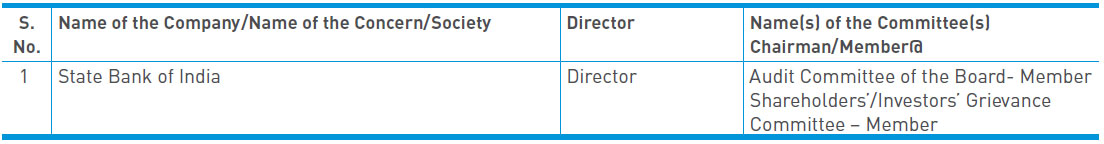

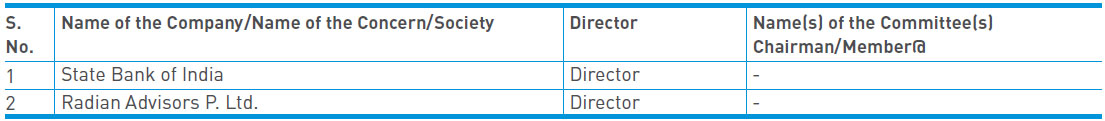

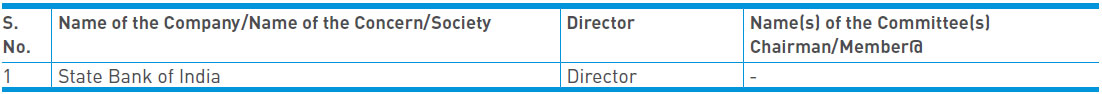

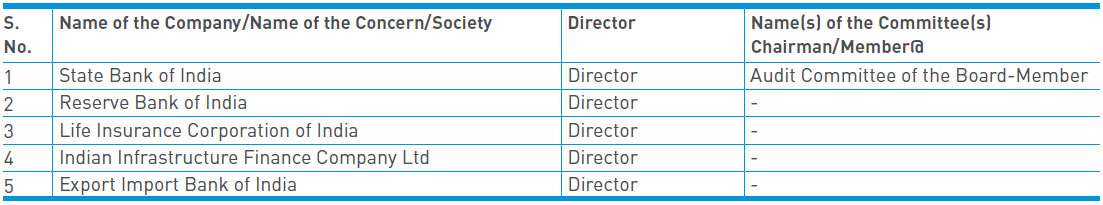

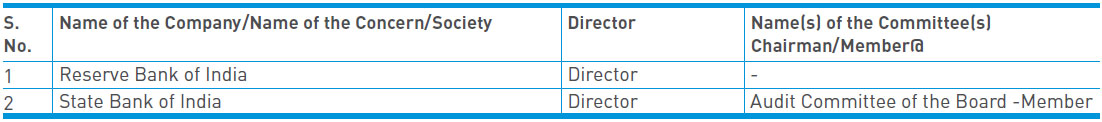

Details of Memberships/Chairmanships held by the Directors on the Boards/Board-level Committees of the Bank @/ Other Companies as on 31.03.2014

@ Only Memberships/Chairmanships of Audit Committee and Shareholders'/Investors' Grievance Committee are reckoned in due compliance with para I (C) (ii) Clause 49 of the Listing Agreement with Stock Exchange.

ANNEXURE IIA

Total Number of Memberships/Chairmanships held by the Directors on the Boards/Board-level Committees of the Bank@/Other Companies as on 31.03.2014

(@Only Memberships/Chairmanships of Audit Committee and Shareholders'/Investors' Grievance Committee are reckoned)

1. Smt. Arundhati Bhattacharya

2. Shri Hemant G. Contractor

3. Shri A. Krishna Kumar

4. Shri S. Vishvanathan

5. Shri P. Pradeep Kumar

6. Shri S. Venkatachalam

7. Shri D. Sundaram

8. Shri Parthasarathy Iyengar

9. Shri Thomas Mathew

10. Shri Jyoti Bhushan Mohapatra

11. Shri S.K.Mukherjee

12. Dr. Rajiv Kumar

13. Shri Deepak I. Amin

14. Shri Harichandra Bahadur Singh

15. Shri Tribhuwan Nath Chaturvedi

16. Shri Rajiv Takru

17. Dr. Urjit R. Patel

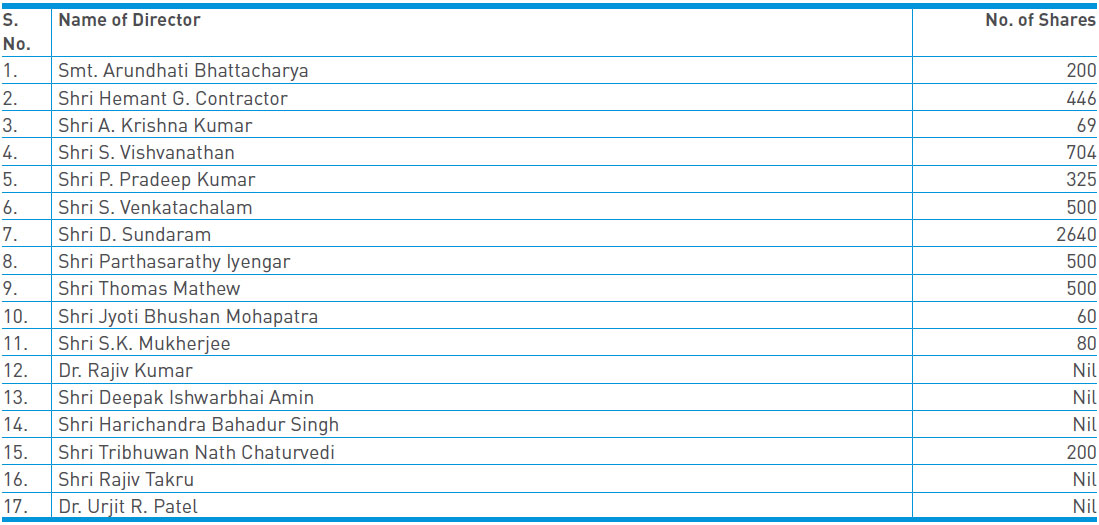

ANNEXURE III

Details of shareholding as on 31.03.2014 of the Directors on the Bank's Central Board

ANNEXURE IV

Details of Sitting Fees paid to Directors for attending Meetings of the Central Board and Board-Level Committees during 2013-14

ANNEXURE V

Declaration

Affirmation of Compliance with The Bank's Code of Conduct (2013-14)

I declare that all Board Members and Senior Management have affirmed compliance with the Bank's Code of Conduct for the Financial Year 2013-14.

Arundhati Bhattacharya Date: 12th April 2014 Chairman

S.VENKATRAM & CO.

Chartered Accountants

AUDITORS' CERTIFICATE ON

CORPORATE GOVERNANCETo the Shareholders of

State Bank of India

We have examined the compliance of conditions of Corporate Governance by STATE BANK OF INDIA ("the Bank"), for the year ended 31stMarch, 2014, as stipulated in Clause 49 of the Listing Agreement of the Bank with the Stock Exchanges in India.

The compliance of the conditions of Corporate Governance is the responsibility of the Management. Our examination was carried out in accordance with the Guidance Note on Certification of Corporate Governance, issued by the Institute of Chartered Accountants of India, and was limited to procedures and implementation thereof, adopted by the Bank for ensuring the compliance of the conditions of Corporate Governance. It is neither an audit nor an expression of opinion on the financial statements of the Bank.

In our opinion and to the best of our information and according to the explanations given to us, we certify that the Bank has, in all material aspects, complied with the conditions of Corporate Governance as stipulated in the above mentioned Listing Agreement.

We state that no investor grievance is pending for a period exceeding one month against the Bank as per the records maintained by the Shareholders'/ Investors' Grievance Committee.

We further state that such compliance is neither an assurance as to the future viability of the Bank nor the efficiency or effectiveness with which the Management has conducted the affairs of the Bank.

For S.Venkatram & Co.,

Chartered Accountants

(G.Narayanaswamy)

Partner M.No.002161

FRN No. 004656 S

Place: Kolkata

Date: 23rd May 2014