If the rising adoption of online and mobile banking in millennials is any indication, it is likely that the brick-and-mortar banking will have less relevance to the younger generation. The cashless economy is driving digital transformation faster than ever, with more banking organisations adopting digital banking. At SBI, we are highly cognisant of this trend, and we are leading the digital transformation drive to serve an increasingly digital India.

With our size, scale, and growth within the banking industry, we believe that we are in a much better position than most to survive and thrive in the digital age.

Today, digital technologies are unleashing innovations by enabling firms to build entirely new capabilities to become efficient, predictive, and future-ready. The impact of digital technologies is transformative and pervasive, and no part of the banking will be left untouched. Digital business ecosystems are changing banking.

Using technology, we have enhanced our ability to sense, think and act, and augment decision-making process.

What’s more? We are using technology to capture deeper insights to address customer’s pain points at various points of contact.

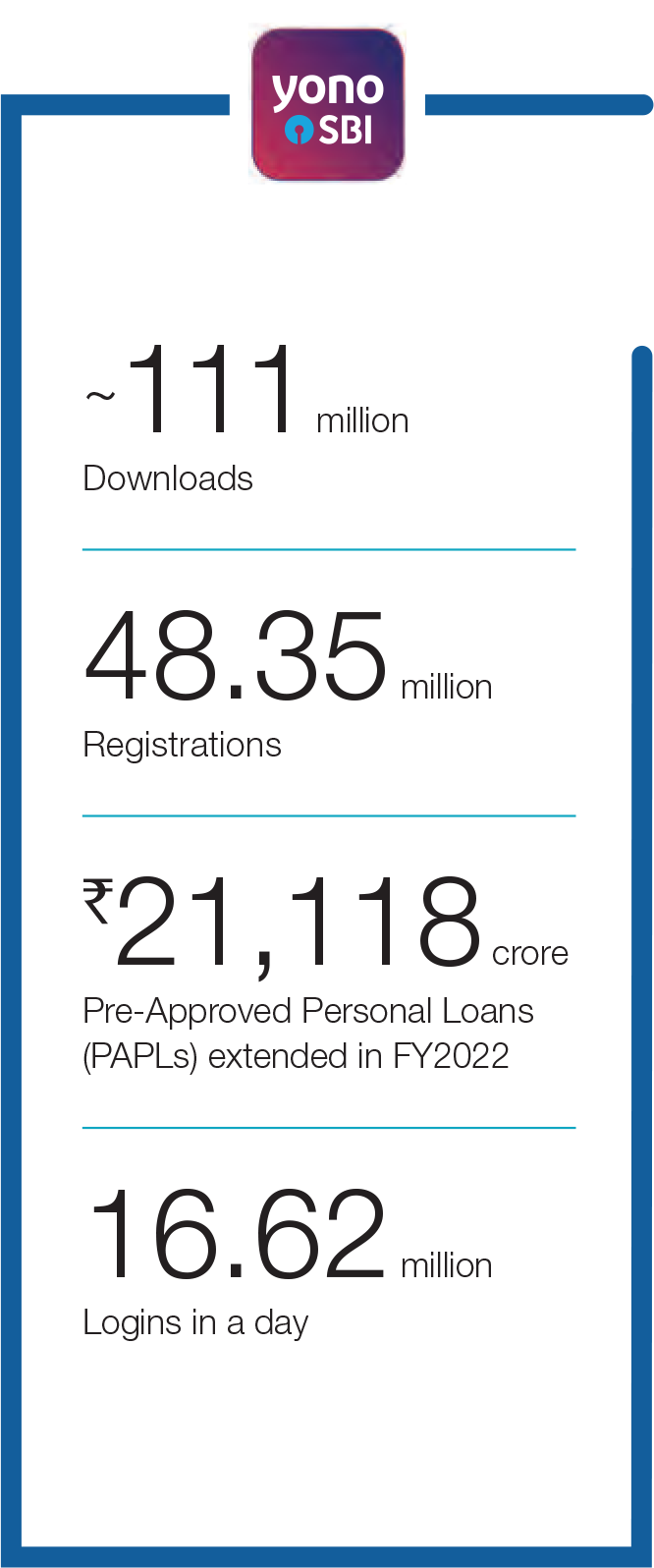

This is unifying all our systems for an enhanced customer experience. As a result, our customers can do more in lesser time. Our flagship all-encompassing digital platform, YONO, is testimony to our prowess in delivering cutting-edge digital services to millions of customers.

YONO is an integrated proposition serving banking and beyond needs of the customer - with innovative banking offerings such as YONO Cash, Yono Business, YONO Quick Pay, Pre-Approved Personal Loans and lifestyle and shopping options from 111 merchant partners.

Customers are increasingly choosing to bank with us online and YONO is seamlessly connecting us with them. As of 31st March 2022, YONO has set a record with 111.74 million downloads, 26K new digital Savings Bank accounts per day and 48.35 million registered users.

These numbers are telling indicators of the potential digital banking holds for SBI.