BHIM SBI Pay - Personal Banking

BHIM SBI Pay

BHIM SBI Pay

- BHIM SBI Pay

- Installation & Registration Process

- Creation of VPA(Virtual Payment Address)

- Linking of Account

- Beneficiary Management

- PIN Management & Security

- Sending and Receiving Money

- UPI -PayNow Cross border remittances

- Online Shopping/Bill Payments

- Complaints

- Disabling/Enabling of UPI services in your accounts

- Charges & Rewards

- Merchant QR

- UPI - Third Party App Providers

BHIM SBI Pay

“BHIM SBI Pay” (UPI App of SBI) is a payment solution that allows account holders of all Banks participating in UPI to send money, receive money and do online bill payments, recharges, shopping, etc. using their smartphones.

- IMPS facilitate transfer of money from Sender to Receiver and the transaction is initiated by the Sender.

- UPI facilitates transfer of money using both Push & Pull mechanism where the transaction can be initiated by Sender as well as Receiver.

- Multiple Banks account can be linked to a Single APP for money transfer.

- Secured by single click two factor authentication.

- BHIM SBI Pay provides the flexibility of making payments at your convenience 24X7 on all 365 days of the year.

- You can transfer funds using your BHIM SBI Pay app to your friend/relative by knowing only their Virtual Payment Address (VPA).

- The receiver of the money need not disclose his account number, IFSC code or any other such Banking details.

- You can also do online bill payments, recharges and shopping, etc. using your smartphones.

Yes, you can use more than one UPI application on the same mobile and link same as well as different accounts in both the UPI apps.

BHIM SBI Pay is available on Android and iOS phones.

No, you cannot link a mobile wallet to BHIM SBI Pay/UPI. Only bank accounts can be added.

Installation & Registration Process

- Go to Google Playstore/ Apple Appstore as the case be.

- Download the latest version of BHIM SBI Pay.

- Click on the install/open button and complete the steps for Registration.

- Please ensure that you have linked your mobile number with your bank account.

Yes, a customer needs to register with BHIM SBI Pay after downloading it in his/her mobile and link his/her accounts for remitting funds using UPI.

- After registration, user needs to click on "I am a Merchant" tab on the main screen.

- Fill the details as asked for, submit and confirm acceptance.

- User is now a Merchant.

Creation of VPA(Virtual Payment Address)

"Virtual Payment Address" is a virtual ID which is unique. For example, name or number or a combination of numbers and characters followed by @sbi that you can choose for yourself, like, ramesh@sbi or 7051448888@sbi.

Your account is linked to a VPA. So, you can pay/receive money using your VPA instead of sharing bank account details.

- On App start up, confirmation message for SMS to be sent for registration will be displayed.

- On clicking YES, registration page is displayed. Provide the information asked for on the page e.g., First Name, Last Name, Email, Security Question, Security Answer, etc.

- Set your preferred VPA or choose from the suggested VPA and Submit.

Linking of Account

- You have to select the Bank of your choice (where you have your account) from the list of Banks displayed.

- On completion of above details, click on “Next” button. Select the required Account from the list of accounts displayed to link and Click Register.

Yes, Maximum 5 bank accounts can be linked to the same virtual address (VPA)

You can have a single VPA or multiple VPAs as per your choice. In case of multiple accounts linked to single VPA, the default account can be changed using “Account Management” tab in the app using the option “Set as Default Account”.

- Login to BHIM SBI Pay App

- Select option My Accounts in main menu.

- Select Account from linked accounts available.

- Click Set ‘As Default Account’ button to set the selected account as default account. This account will be termed as “Primary Account”

Yes, you can do transactions in your ‘XYZ’ bank account using BHIM SBI Pay. In this case the XYZ banks needs to be on NPCI UPI platform directly or through a Sponsor Bank.

- Not necessary. A single VPA can be created and linked to multiple accounts. One of the account will be default account. The default account can be changed at any time. The money will be paid/received from/in the default account.

- The VPA can be toggled between the various accounts by setting a preferred account under “My Accounts”.

- You also have the option to create separate VPA for each account.

- Yes, you can use multiple UPI apps in single mobile phone.

- For using different UPI apps, you need to download these apps and complete registration process of the respective apps.

- You can also use the same “name” in all VPAs, but the handle (name@handle) will always be different for all apps. (Ex: name@sbi, name@upi, name@hdfc, etc)

Beneficiary Management

- No, registration of Beneficiary is not required for transferring funds through BHIM SBI Pay.

- You need any one of VPA/Account+IFSC Code/ Aadhaar Number/QR code of the beneficiary.

- These details can be stored for future use so that every time you need not have to enter the beneficiary details.

- In case of Virtual ID transaction (VPA) & QR Code mode, the beneficiary needs to register with UPI and in turn will have a Virtual ID (VAP) or QR code.

- But in case of Account +IFSC the beneficiary need not be registered for UPI.

Yes, the beneficiary/receiver must have a bank account for transferring money. Amount is directly credited to the account.

- You can refer BHIM SBI Pay App to your contacts & friends through various modes like SMS, WhatsApp, email, Share to phone, Facebook, etc.

- For sending invitation, login to BHIM SBI Pay App, go to main menu and select ‘Invite’ tab.

- Select type of message from the various option shown to send the invitation register for SBI Pay App to the contacts/friends.

- The user receiving the invite can download and install the BHIM BI Pay app from the link provided in your message.

PIN Management & Security

- App PIN is required to open the App. On registration screen after creation of VPA you will be asked to create an App PIN, which is required for opening the BHIM SBI Pay App every time.

- At the lower part in the screen select security question and give its answer, which can be used for recovering the App PIN in case you forget.

- Accept the terms and conditions by clicking the tick mark.

- In case you forgets the UPI PIN of an Account, you needs to re-generate new PIN under Account Management

- Select an account from linked in My Accounts and click on Reset UPI PIN option. Give the details of Debit (ATM) Card in the screen and create a new PIN using the OTP in the next screen.

- If you forgets the BHIM SBI Pay login PIN then you can choose the “Forgot password” option provided in the login screen, enter the email id and answer the secret question to reset your login password.

- In case you forget the security answer, you can re-create App PIN.

- You have to enter the complete email ID or mobile number as per your selection.

- An OTP will sent to your Email or alternate mobile number to enable you to re-create App PIN.

- Therefore, please always keep your email ID and alternate mobile number updated in your profile.

- In case of mobile loss, you need to simply block your mobile number, by contacting your mobile service provider.

- No transaction can be initiated without knowing your App PIN and UPI PIN.

- The transactions are further protected by device binding (linked to mobile handset). If the same SIM is used in a different mobile device, the user has to re-register.

- Never share your App PIN or UPI PIN with anyone.

- In case, both your mobile handset and SIM is changed, you need to re-register for BHIM SBI Pay as a new user by creating new VPA.

- In case of change in SIM card (new mobile number), you can use the same application.

- You will be prompted to update your mobile number automatically by making you to enter the old mobile number and entering the answer to the secret question set during registration.

- You can continue using the same application and same Virtual ID(VPA).

- In case you changes your mobile phone, then on downloading the app, it will ask to 'verify your device'.

- There you need to give answer to secret question. On entering the correct answer you can continue with old virtual ID.

- BHIM SBI Pay app has 2 levels of authentication. During login the application is secured by a Login password.

- In any transaction through UPI, UPI PIN of the Account would be required which needs to be fed through the mobile at the time of transaction, making your BHIM SBI Pay safe and secured.

You have to login to BHIM SBI Pay app and go main menu and use the De-Register option to de-register the UPI facility.

Sending and Receiving Money

- For first transaction after setting/resetting UPI PIN maximum amount will be Rs.5,000/- and cumulative amount in a day will be Rs.5,000/- for the first 24 hours.

- After 24 hours per transaction and per day limit is Rs.1, 00,000/- in BHIM SBI Pay, at present.

- You can do a maximum number of 10 transactions in 24 hours per account within the Rs.1,00,000/- limit

The different options available for transferring funds using BHIM SBI Pay are :

- Transfer through VPA/UPI ID

- Account Number + IFSC

- Scanning QR Code

- Login to BHIM SBI Pay App

- Select option ‘Pay’

- Select any of the payment options like VPA or Account and IFSC or QR Code.

- Enter other required details

- Select Debit Account from the linked accounts and Click on ‘Tick’ mark.

- Enter UPI PIN to authorize transaction.

- Click on ‘Tick’ mark to complete payment.

- Collect Request is for collecting money from you. If you receive a Collect Request, be mindful that money will be debited/paid from your account.

- Never ever approve/authorize a ‘Collect’ request from an unknown person.

- Login to BHIM SBI Pay App

- Select option ‘Collect’.

- Enter Virtual Address of the Payer/ Sender

- Enter other required details

- Select Credit Account from the linked accounts and Click on ‘Tick’ mark to initiate Collect. Collect Request will be sent to the Payer as SMS and notification.

- Once Payer approves your Collect request, Money will be credited to your selected account.

The timeline to approve a collect request by default is 30 minutes. However, you can set time limit up to 45 days while generating the collect request.

- You will get a notification when anybody initiates a collect request on you.

- Click on the notification or Login to BHIM SBI Pay App

- Click on the notification ‘Bell Button’ at Right Hand Top

- Select required Collect request from pending items.

- Click Approve/Reject/SPAM as per your wish.

- Enter UPI PIN for Approving the request. Money will be debited from your account & sent to beneficiary’s account instantly.

- If you do not want to make the payment of the collect request received you can ‘Reject’ the request.

- If you are receiving frequent collect request from an unknown person or fraudster you can mark the VPA of the sender as ‘Spam’ instead of ‘Reject’.

- If 5 UPI users have marked a VPA of the sender of collect request that VPA will be blocked by the UPI system and he would not be able to do any UPI transaction in future. This is to prevent any unwarranted attempts by any person to collect money from another person.

No.

No.

- From My Accounts, Set Preferred Account for Transactions so that the default account is displayed in the dropdown during every transaction.

- User can also select any other debit account during the “Pay” transaction by selecting from the dropdown menu option “Pay From”.

- Login to BHIM SBI Pay App

- Select option ‘History’ to see recent transactions. Transaction status will be displayed as – Pending/Success/Failed/Reject/Expired depending on the type of transaction.

- Click on the particular transactions to know the details.

- You can see your transaction from ‘Transaction History’ option also in main menu

- Login to BHIM SBI Pay App

- Select option ‘Pay’ and then go to Pay to VPA option.

- Enter VPA as “sbicard.16digit card number@sbi” and search VPA. For example, if your card number is 1234567890123456 enter VPA as sbicard.1234567890123456@sbi

- Once VPA validated enter the amount to pay and authorize the payment.

- You can apply Initial Public Offerings (IPOs) using mandate facility in BHIM SBI Pay.

- For applying to IPO, you should mention your VPA as a payment option in ASBA application form.

- The intermediary/broker while lodging IPO application will put your VPA and will create a mandate for the applicable amount. The mandate request will come to your mobile as a notification for execution.

- Login to BHIM SBI Pay App, go to mandate menu and execute the mandate received for IPO. The required amount will be blocked in your account.

- If shares allotted to you, the applicable amount will be debited automatically from your account and balance amount blocked, if any, will be released. On non-allotment blocked amount will be released in the account.

- The limit for IPO application for public issue using UPI is Rs.2 Lakhs per transaction. There is no restriction for you on the number of public issues that can be applied simultaneously using the same UPI ID/ VPA.

UPI -PayNow Cross border remittances

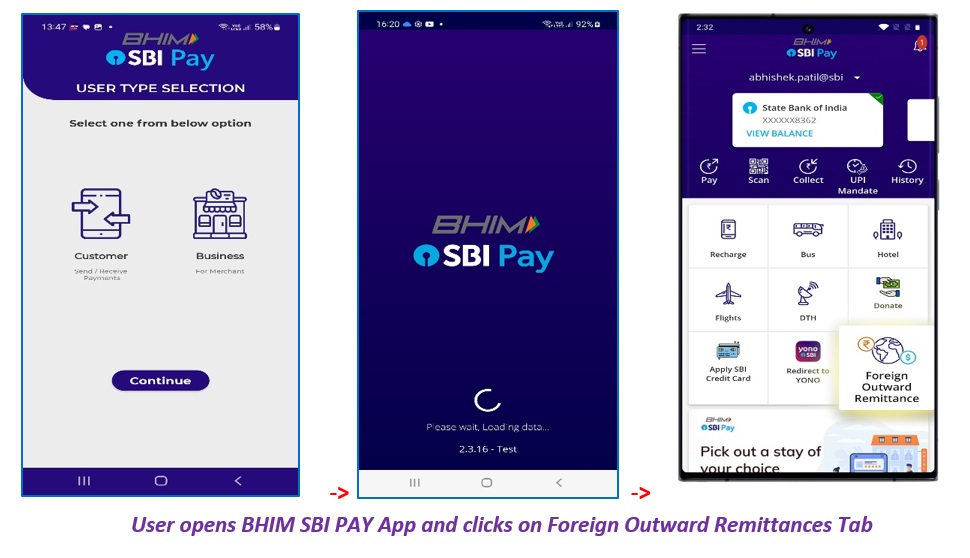

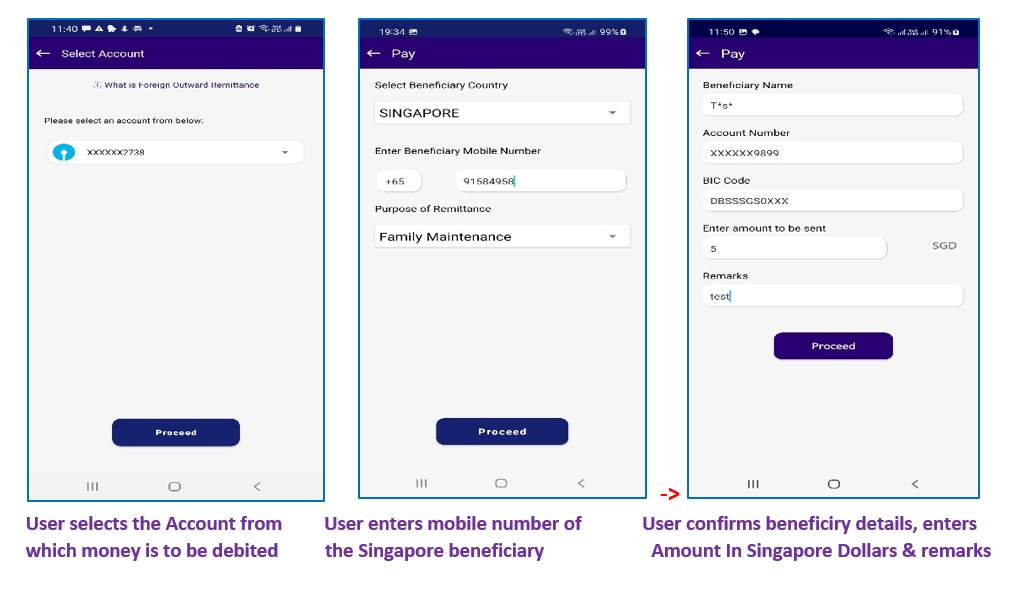

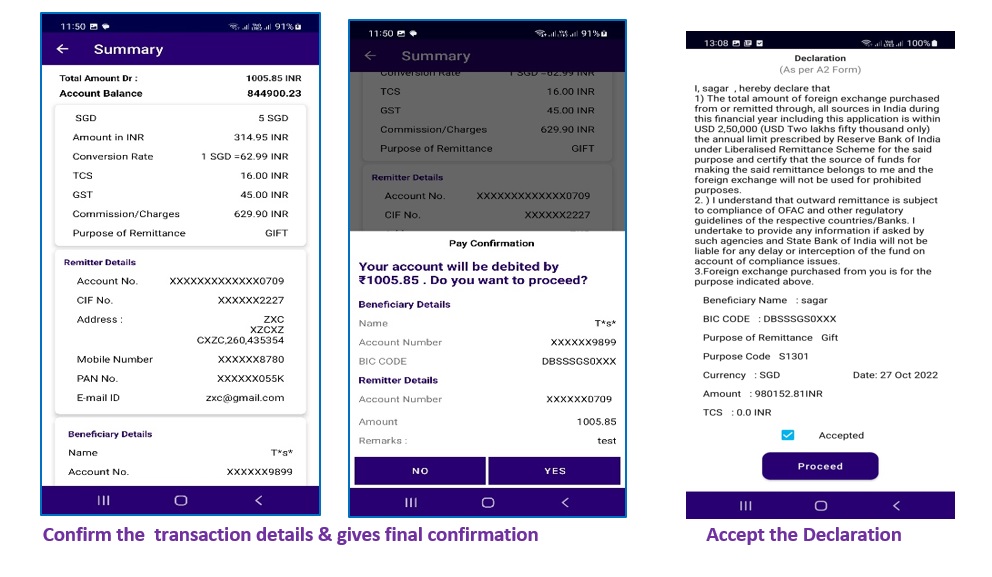

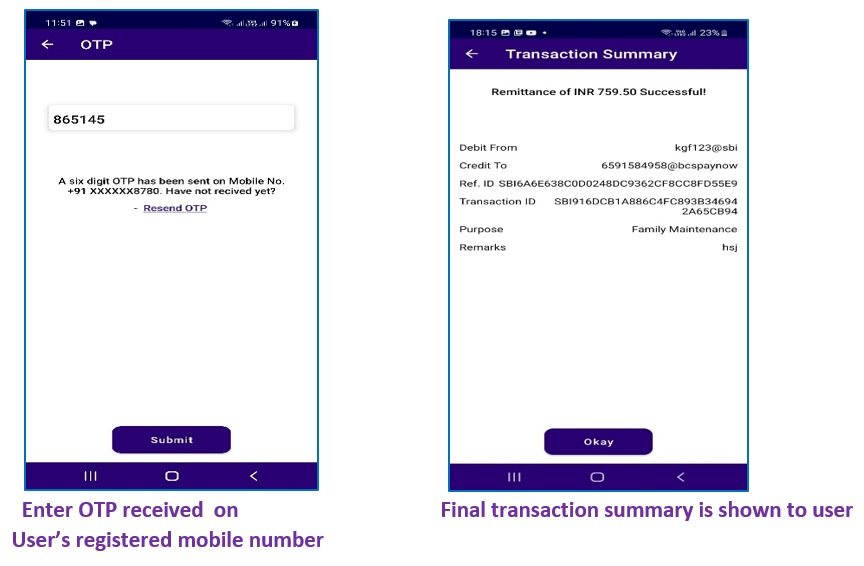

User has to log into BHIM SBI Pay application. Click on ‘Foreign Outward Remittances’ tab.

User has to share his UPI ID (@sbi) with the Singapore contact. The remitter from Singapore will enter the Amount and VPA in his/her App and submit the transaction. The beneficiary user will be able to see the transaction credit in his/her BHIM SBI Pay app (under Transaction history menu).

Click on the Hamburger menu. The outward transactions sent by the user can be viewed under FOR transaction history option. The inward transactions received by user can be viewed under Transaction history option.

This feature is enabled for retail customers only i.e. Savings Bank and NRE Accounts Non -personnel and NRO accounts are not enabled.

Yes. Users can also enable/disable the inward remittance feature from the “My Accounts Section”(Hamburger menu).

Maximum limit of remittance per day– upto 1,000 SGD.

Presently the feature is available for only SBI Account holders using BHIM SBI Pay app.

Two purpose codes are allowed i.e Family Maintenance and Gifting.

Online Shopping/Bill Payments

- Users can login to the App by giving their app PIN. After login at lower portion of the home screen you will see various option like Recharge, Food, Bill Payment, Local Offers, DTH, etc. Click on the required service and proceed to do the shopping or payments in easy steps.

- Login to the App by giving your app PIN. After login at lower portion of the home screen you will see links for Flight, Bus and Hotel among the various links available. Click on the required service and proceed to complete the online booking instantly and confirm by making payment in easy steps.

Complaints

- Login to BHIM SBI Pay

- Click on History to view all recent transactions

- Select the transaction and Click Raise Dispute button

- Select Dispute type, enter Remark.

- Click Submit

- If there is any other query or complaint you can also write to support.upi@sbi.co.in

- UPI provides for reversal mechanism for technical declines.

- The amount would be transferred back to your account on T+2 days after the beneficiary bank verifies at their end and advises to the remitter bank.

- If the amount does not credited back to your account in 2 days, you can raise a dispute for the specific transaction through the App from the menu ‘History’.

- No, once the payment is authorised, you cannot stop the transaction.

- You have to contact the beneficiary through your Bank to get a refund.

- Give a request to your branch for raising charge back on the beneficiary’s Bank.

- In this case, recovery of money from the beneficiary will be done purely on ‘Good Faith’ basis by the beneficiary bank on getting debit authority or approval from their customer.

- You can raise your grievance or check status of BHIM SBI Pay transaction through the UPI App of the participating banks and also send an email to support.upi@sbi.co.in

- You can register your complaints and seek clarifications also on the following Toll Free numbers viz. 1800112211 & 18004253800

Disabling/Enabling of UPI services in your accounts

Yes. In case you did not want to continue to use UPI facility in your account, you can stop the facility by contacting your home branch and giving a written request.

Charges & Rewards

- Presently, no charges are levied for BHIM SBI Pay transactions. Charges are subject to revision from time to time. Any change in this matter will be published on Bank’s website www.bank.sbi.

- Available Rewards and offers from the various merchant partners will be shown in screen after login.

Merchant QR

With BHIM SBI Pay – QR code, now accept payments from your customers instantly without any worries.

Go digital and grow your business without incurring any additional costs. Provide your customers the convenience of making payments using their smartphones by simply scanning the BHIM SBI Pay – QR code. Customers can use any UPI app to make payments for purchase of goods or services from you.

Merchants having existing SB/CC/CA account with SBI can approach their Home Branch or any nearest Branch of SBI to get their BHIM SBI Pay - QR code instantly.

Here are some major benefits of availing BHIM SBI Pay – QR for your business:

- Get your BHIM SBI Pay – QR instantly at zero additional cost

- Avoid daily hassles of handling cash

- All customer payments get instantly credited to your linked Bank accounts

- Get detailed statement of your daily transactions and save time on end-of-day reconciliations

- No need to visit your Branch on a daily basis for cash deposits into your current account

- Provide customers the convenience of paying through their smartphones using any of the BHIM UPI enabled apps like: BHIM SBI Pay, Google Pay, PhonePe, Paytm etc.

All of the above benefits at ZERO additional costs, without even you having a smartphone.

Toh Lagao QR Badhao Vyapaar!

What’s more?

Get rewarded for getting your BHIM SBI Pay – QR and accepting payments from customers.Earn upto Rs. 8000 cashbacks for accepting payments on BHIM SBI Pay QR –

Basic reward:

| Incentive | Condition |

|---|---|

| Rs. 40 | Accept payments of Rs. 100 or more from at least 2 unique customers through BHIM SBI Pay – QR |

Superstar rewards:

| Incentive | Condition |

|---|---|

| Rs. 1000 | Accept payments from at least 300 unique customers using the BHIM SBI Pay - QR |

| Rs. 5000 | Accept payments from at least 500 unique customers using the BHIM SBI Pay - QR |

| Rs. 8000 | Accept payments from at least 1000 unique customers using the BHIM SBI Pay - QR |

Offer Terms and Conditions:

- Merchants who apply and avail of the BHIM SBI Pay - QR during the campaign period will be considered eligible for cashback rewards.

- The BHIM SBI Pay - QR code should be prominently displayed at the Merchant site for accepting payments.

- Customers can pay by scanning the BHIM SBI Pay - QR code using any BHIM UPI based apps like BHIM SBI Pay, BHIM, Google Pay, PhonePe etc.

- To earn incentives, the following conditions are to be fulfilled:

For the Basic reward:

- Minimum transaction amount per transaction of Rs.25 or more and

- Cumulative transaction amount of Rs. 100 or more from 2 different customers

- Minimum transaction amount per transaction of Rs.25 or more

- All the transactions done during the campaign period (1st Mar-31st Mar’20) will only be considered for calculation of rewards.

- A Customer transaction will be considered unique based on either of the following:

For the Basic reward:- Debit Account No

- VPA/UPI Id

- Customer Mobile Numbe

- The reward/incentive will be credited to the merchant’s linked Bank account with SBI within 30 days after the campaign period.

- SBI reserves the right to discontinue or modify any of the terms applicable to this offer without any prior intimation

- SBI reserves the sole right to decide on whether a purchase transaction meets the eligibility criteria of this offer. All decisions in respect of the offer will be at the discretion of SBI and the same shall be final and binding

- By participating in this offer, the Customers shall be deemed to have accepted all the aforementioned terms and conditions in totality

Last Updated On : Thursday, 23-03-2023

Interest Rates

2.70% p.a.

less than Rs.10 Cr. w.e.f 15.10.22

3.00% p.a.

Rs.10 Cr. and above w.e.f 15.10.22

2.70% p.a.

Balance below Rs. 10 crs

3.00% p.a.

Balance Rs. 10 crores and above

Digital Landing Page

Criteria

- Features

- Eligibility

- Terms and Conditions

Interest Rates

2.70% p.a.

less than Rs.10 Cr. w.e.f 15.10.22

3.00% p.a.

Rs.10 Cr. and above w.e.f 15.10.22

2.70% p.a.

Balance below Rs. 10 crs

3.00% p.a.

Balance Rs. 10 crores and above