Leading the digital transformation journey:

TECHNOLOGY

Technology has always been a key strategic pillar of our business model particularly in the last decade. Long before the outbreak of the pandemic-led crisis, we have been continuously focussing on enhancing our digital platforms to cater to the increasing aspirations of our customers. Much before the COVID-19 crisis, almost 88.1% of our customer transactions were happening digitally. Now that the crisis has proved the operational resilience of our platform, we are not resting on our laurels and continue to invest in our digital capabilities, to run our business more efficiently and serve our customers better.

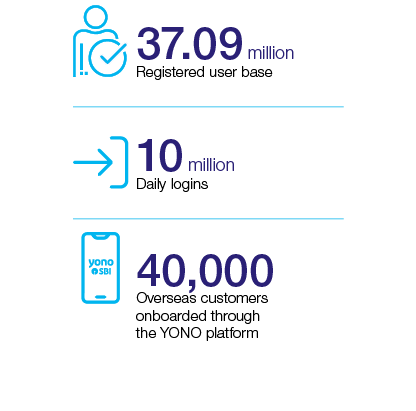

As the world transitions into the new normal, technology has become an essential factor in our productivity and efficiency. Over the years, we have closely engaged with our customers to cater to their broad range of banking needs. As technology took the front seat, customers started to seek services that did not require them to travel, particularly for their routine banking needs. This evolving landscape of customer preferences led us to build YONO, which is today driving much of our business. This path-breaking and industry leading digital platform has crossed 70.5 million downloads, with a registered user base of 37.09 million and averages daily logins of around 10 million.

Launched in 2019, YONO Krishi possesses features such as Agri gold loan, YONO Mandi and YONO Mitra. The application caters to the banking needs of farmers. To handle high volume and low ticket loans in the Agri business optimally through a digital strategy, we are exploring opportunities to enter into partnerships with selected Agri-techs who have differentiated business model that will help in facilitating the transformation of the Agri supply chain to improve farm production opportunities for the farmers with the use of digital tools such as Artificial Intelligence (AI), BlockChain, IoT (Internet of Things) and ML-powered capabilities.

Further, we have also launched YONO Business for corporate customers, which is designed to provide a world-class, user-friendly platform for transaction banking as well as for the trade finance business. Earlier, there were five customer interfaces viz. Corporate Internet Banking (CINB), Cash Management Product (CMP), e-Trade, e-Forex and Supply Chain Finance (SCF), which now have been merged into a single platform named “YONO Business”. Through this, we aim to offer seamless services while catering to the varied needs of our corporate clientele.

We have also extended YONO to our overseas offices as well. YONO has been successfully launched in the UK, Mauritius, Maldives, Bangladesh, Sri Lanka and Canada. As of 31.03.2021, over 40,000 overseas customers have been onboarded on the YONO platform. We are on course to launch YONO in Singapore, Bahrain, South Africa, and the USA by the end of FY2022.

Apart from YONO, we are expanding our digital offerings in other areas through the online loan application and tracking facility for MSME borrowers; introduction of Customer Relationship Management (CRM) for customer engagement; contactless lending platform; Project Vivek; and Pre-Approved Business Loan, amongst others.